[FINANCIAL MANAGEMENT] 6 FINANCIAL HABITS OF THE WEALTHY

To become rich, using money to make money is not an easy thing. To do that not only have a stable job with a good income source but also know how to spend money wisely. This depends on our money habits. Let's check what are financial habits of the wealthy.

To become rich, using money to make money is not an easy thing. To do that not only have a stable job with a good income source but also know how to spend money wisely. This depends on our money habits. Let's check what are financial habits of the wealthy.

1- Savings

Actually saving is not depend on how much money you earn. Owning a savings account is the most powerful proof that you are whom knows how to spend and use money wisely. This is also the first good financial habit that helps you get profit from your money.

2- Not shopping unconsciously

Unconsciously shoppings always do more harm than good. It has a direct effect on your financial security, easily pushing you into financial difficult situation. The wealthy know exactly when and how to spend money on shopping.

3- Take use of free time to earn more money

If you just want to live on a monthly salary, you cannot become rich.

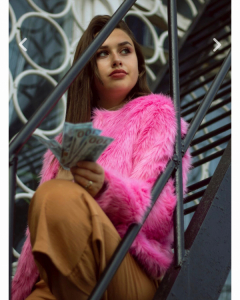

6 Financial Habits of The Wealthy / ph: pexels

6 Financial Habits of The Wealthy / ph: pexels

People with a wealth mindset will have a lot more different incomes to accumulate gradually. To do so, in addition to 8 hours of a working day, they accept to exchange their free time to earn more money with different jobs.

4- Daily spending record

Recording your daily spending is a very beneficial financial habit. This helps you keep a close eye on where your money has been poured, whether it is wasted or not. At the same time, it will also serve as a reminder, helping you get out of shopping cravings and spending money for things beyond your ability.

5- Passion in investing

It can’t be denial that one of best way to use money to make money

is investing. People with wealth mindset always know how to seize opportunities to earn more money, owning many different investments. They are reckless, risky in investment and business. They understand well that taking risks is the first step to become rich.

6- Stay away from debt

The wealthy always find a way to stay away from loans, if they fall into debt, they also plan to pay, get rid of that burden immediately.

The financial habits of the wealthy are savings and investing to multiple their money over time.

[FINANCIAL MANAGEMENT] 6 FINANCIAL HABITS OF THE WEALTHY

Top 6 Money Habits of Self-Made Millionaires

Here are Top 6 Money Habits of Self-Made Millionaires that you should know.

Here are Top 6 Money Habits of Self-Made Millionaires that you should know.

Read more

10 Money Rules to face economic recession

Have you ever wondered what your financial situation will be like in a year, even just a few months? In the current context, it is unavoidable to worry about the risk of an economic recession. However, it is important that you start preparing now so that in the event of a recession in the next 6-12 months, you will be in the best position with the money amount you have.

Have you ever wondered what your financial situation will be like in a year, even just a few months? In the current context, it is unavoidable to worry about the risk of an economic recession. However, it is important that you start preparing now so that in the event of a recession in the next 6-12 months, you will be in the best position with the money amount you have.

Read more8 Money Saving Tips When Buying A House

Although housing prices have increased many times compared to the past time, you can still buy a house if you know how to save money smartly. Owning a dream home is no longer a far-away wish when we know how to make an effective financial plan. Below 8 Effective Money Saving Tips When Buying A House.

Although housing prices have increased many times compared to the past time, you can still buy a house if you know how to save money smartly. Owning a dream home is no longer a far-away wish when we know how to make an effective financial plan. Below 8 Effective Money Saving Tips When Buying A House.

Read more7 Billionaire Spending Habits help build Wealth

Fortune magazine published the results of a study showing that up to 54% of billionaires want to continue working at retirement age, and 60% of those with a net worth of more than $15 million don't even have a retire plan.

Fortune magazine published the results of a study showing that up to 54% of billionaires want to continue working at retirement age, and 60% of those with a net worth of more than $15 million don\'t even have a retire plan.

Read moreMost common habits of The World’s 4 Richest groups

Research "Rich Habits" by Tom Corley shows that there are 4 groups of wealthy people, including savers - investors, people who are eager to advance at work, high skilled professionals and the dreamers.

One of the common wealthy habits of the world's richest people is saving and investing their savings.

Research "Rich Habits" by Tom Corley shows that there are 4 groups of wealthy people, including savers - investors, people who are eager to advance at work, high skilled professionals and the dreamers.

One of the common wealthy habits of the world\'s richest people is saving and investing their savings.

Read more4 Financial mistakes young people often make

The path to financial independence is often not easy. For young people, focusing on retirement or saving for the future is often not a top priority.

But they can lose a lot of money if they make the wrong financial decisions. Here are 4 common financial mistakes that young people often make.

The path to financial independence is often not easy. For young people, focusing on retirement or saving for the future is often not a top priority.

But they can lose a lot of money if they make the wrong financial decisions. Here are 4 common financial mistakes that young people often make.

Read more4 Things to know when Getting a House Mortgage

A home loan is a suitable option if you need a large sum of money. To manage finances intelligently and avoid falling into a debt spiral, you should pay attention to a safe loan threshold, interest costs to pay, loan term,..

A home loan is a suitable option if you need a large sum of money. To manage finances intelligently and avoid falling into a debt spiral, you should pay attention to a safe loan threshold, interest costs to pay, loan term,..

Read more4 Investing Tips for Your 20s

There are investments that, as long as you are willing to put in money, time and effort, will definitely bring a worthy return. Here are 4 investments that you should make at the age of 20-30, According to Tim Denning, an Australian blogger.

There are investments that, as long as you are willing to put in money, time and effort, will definitely bring a worthy return. Here are 4 investments that you should make at the age of 20-30, According to Tim Denning, an Australian blogger.

Read moreHow to Save Money with Low Income fast: 5 Tips

If you have a low income, you need to make a concentrated effort to save money. While this is not always easy, it can be worthwhile in the long run. To help people with low income to save money, financial experts have shared 5 tips as below.

If you have a low income, you need to make a concentrated effort to save money. While this is not always easy, it can be worthwhile in the long run. To help people with low income to save money, financial experts have shared 5 tips as below.

Read more