Topics: Canadian

Canada Real Estate Market Update: September Surge

Discover the latest trends in Canada's real estate market, with significant sales increases in Montreal and Toronto this September.

Discover the latest trends in Canada\'s real estate market, with significant sales increases in Montreal and Toronto this September.

Read moreCanadian real estate investment trusts: A Bright Future for Investors

Canadian real estate investment trusts (REITs) are rebounding post-pandemic, with promising returns projected in the coming years. Explore the evolving landscape and investment potential.

Canadian real estate investment trusts (REITs) are rebounding post-pandemic, with promising returns projected in the coming years. Explore the evolving landscape and investment potential.

Read moreDesmarais-Backed Canadian Mortgage Firm Nesto Acquires Lender CMLS

Canadian online mortgage company Nesto Inc., backed by Montreal's Desmarais family, has acquired real estate financier CMLS Group, boosting its mortgages under administration to over C$60 billion.

Canadian online mortgage company Nesto Inc., backed by Montreal\'s Desmarais family, has acquired real estate financier CMLS Group, boosting its mortgages under administration to over C$60 billion.

Read moreCanada’s Housing Market Weakens in May Amid Anticipation of Bank of Canada Interest Rate Cut

The benchmark price of a home in Canada fell 0.2% in May to $714,300, with prices down 2.4% from last year. Will the upcoming interest rate cut provide relief for buyers?

The benchmark price of a home in Canada fell 0.2% in May to $714,300, with prices down 2.4% from last year. Will the upcoming interest rate cut provide relief for buyers?

Read more27% of Canadian Renters Ready to Buy | Royal LePage Study

Discover the latest findings from the Royal LePage study, revealing that 27% of Canadian renters are ready to overcome financial hurdles and purchase a property within the next two years.

Discover the latest findings from the Royal LePage study, revealing that 27% of Canadian renters are ready to overcome financial hurdles and purchase a property within the next two years.

Read moreBank of Canada Rate Cut Sparks Housing Market Revival

CREA predicts the end of a slow month as interest rates drop, potentially boosting the housing market. Read more on the latest rate cut impact.

CREA predicts the end of a slow month as interest rates drop, potentially boosting the housing market. Read more on the latest rate cut impact.

Read moreNational Bank Acquires Canadian Western Bank in $5 Billion Deal

National Bank's purchase of Canadian Western Bank for $5 billion solidifies its position in the market, valuing the Edmonton-based lender at approximately $5 billion.

National Bank\'s purchase of Canadian Western Bank for $5 billion solidifies its position in the market, valuing the Edmonton-based lender at approximately $5 billion.

Read morePurpose-Built Rentals: The Future of Commercial Real Estate?

Discover the future of commercial real estate with purpose-built rentals as highlighted in the latest Re/Max report. Explore how landlords are shifting towards this trend for increased density and profitability.

Discover the future of commercial real estate with purpose-built rentals as highlighted in the latest Re/Max report. Explore how landlords are shifting towards this trend for increased density and profitability.

Read moreCanada: Montreal Home Sales Increase as Prices Surge

The Montreal real estate market sees a rise in home sales, with prices on the upswing. Find out more about the latest trends in the region.

The Montreal real estate market sees a rise in home sales, with prices on the upswing. Find out more about the latest trends in the region.

Read moreCanada’s Average Asking Rental Price Hits Record High

A recent report reveals that the average asking rental price in Canada has reached an all-time high, impacting tenants nationwide.

A recent report reveals that the average asking rental price in Canada has reached an all-time high, impacting tenants nationwide.

Read moreCanadian Housing Market Struggles Amid Bank of Canada Rate Hikes

With 44% of mortgages up for renewal, experts recommend short-term fixed rates for stability. Compare options online for potential savings.

With 44% of mortgages up for renewal, experts recommend short-term fixed rates for stability. Compare options online for potential savings.

Read moreMortgage Discounts Fail to Lure Borrowers Away from Shorter-Terms

CMHC reports slowest growth in residential mortgage debt in over two decades as rate cuts approach. Borrowers remain cautious.

CMHC reports slowest growth in residential mortgage debt in over two decades as rate cuts approach. Borrowers remain cautious.

Read moreCanadians Eyeing Moves to Affordable Housing Cities

Discover why Canadians in major cities like Toronto, Montreal, and Vancouver are considering relocating for more affordable housing options.

Discover why Canadians in major cities like Toronto, Montreal, and Vancouver are considering relocating for more affordable housing options.

Read moreFinancial Risks Loom for Homeowners: Bank Regulator in Canada Alert

The Office of the Superintendent of Financial Institutions (OSFI) issues a warning about potential financial risks for homeowners with pandemic-era mortgages.

The Office of the Superintendent of Financial Institutions (OSFI) issues a warning about potential financial risks for homeowners with pandemic-era mortgages.

Read moreCanadian Rent Prices Increase 9.3% in April: Urbanation and Rentals.ca Report

The latest report by Urbanation and Rentals.ca reveals that Canadian rent prices increased by 9.3% in April, with Ontario being the only province to see a decline.

The latest report by Urbanation and Rentals.ca reveals that Canadian rent prices increased by 9.3% in April, with Ontario being the only province to see a decline.

Read moreRising Canadian Cottage Prices in 2024: ReMax Predicts 6.8% Increase

ReMax predicts a 6.8% increase in cottage prices in 2024, with owners in no rush to sell. Stay informed on the rising cottage market trends.

ReMax predicts a 6.8% increase in cottage prices in 2024, with owners in no rush to sell. Stay informed on the rising cottage market trends.

Read moreHomebuyers Delaying Purchases for Rate Cuts: BMO Canada Survey

Majority of Canadians delaying home purchases to wait for interest rate cuts, according to a BMO survey. Find out more about the impact on the housing market.

Majority of Canadians delaying home purchases to wait for interest rate cuts, according to a BMO survey. Find out more about the impact on the housing market.

Read moreCanada Home Prices Set to Rise 4.9% in 2024 as Sales Surge

According to the latest report from CREA, Canada's housing market is expected to see a 4.9% increase in home prices next year, fueled by a recent uptick in sales.

According to the latest report from CREA, Canada\'s housing market is expected to see a 4.9% increase in home prices next year, fueled by a recent uptick in sales.

Read moreEconomist Warns of Unaffordable Market Conditions for Canadian Home Buyers

Discover the challenges faced by prospective homebuyers in Canada due to high interest rates and soaring prices, as highlighted by an economist.

Discover the challenges faced by prospective homebuyers in Canada due to high interest rates and soaring prices, as highlighted by an economist.

Read moreCanadian Lenders Tackle Risk of Ultra-Long Mortgages | Financial System Alert

Discover how Canadian lenders are addressing the risk posed by ultra-long mortgages amidst the pandemic. Learn more about the measures being taken to safeguard the financial system. Take action now.

Discover how Canadian lenders are addressing the risk posed by ultra-long mortgages amidst the pandemic. Learn more about the measures being taken to safeguard the financial system. Take action now.

Read moreCanada Housing Market Trends: Surge in First-Time Homebuyers Revealed

Uncover the latest findings on the housing market, with a notable rise in first-time homebuyers according to a recent survey by LowestRates.ca.

Uncover the latest findings on the housing market, with a notable rise in first-time homebuyers according to a recent survey by LowestRates.ca.

Read moreTPG Inc. in Discussions to Acquire Canadian Apartment Properties REIT's Manufactured Housing Business

TPG Inc., a major US investor, is in talks to purchase CAPREIT's manufactured housing business, aiming to tap into Canada's competitive real estate market.

TPG Inc., a major US investor, is in talks to purchase CAPREIT\'s manufactured housing business, aiming to tap into Canada\'s competitive real estate market.

Read moreCanadians Overpaying Billions in Bank Fees, Report Finds

A recent report from consultancy North Economics has shed light on the excessive bank fees that Canadians are facing, revealing that they are overpaying by billions of dollars each year. The report compared fees at the Canadian Big Five banks — RBC, TD, BMO, CIBC, and Scotiabank — with those in the U.K. and Australia, showing a significant disparity in costs.

A recent report from consultancy North Economics has shed light on the excessive bank fees that Canadians are facing, revealing that they are overpaying by billions of dollars each year. The report compared fees at the Canadian Big Five banks — RBC, TD, BMO, CIBC, and Scotiabank — with those in the U.K. and Australia, showing a significant disparity in costs.

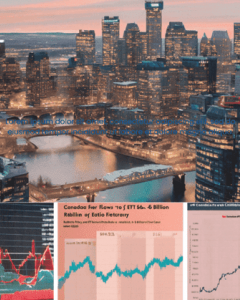

Read moreCanadian ETFs See Record Inflows of $6 Billion in February

National Bank's report reveals highest level of inflows in 11 months, surpassing $400 billion in total assets. Last peak seen in March 2023 amid major economic shifts.

National Bank\'s report reveals highest level of inflows in 11 months, surpassing $400 billion in total assets. Last peak seen in March 2023 amid major economic shifts.

Read more