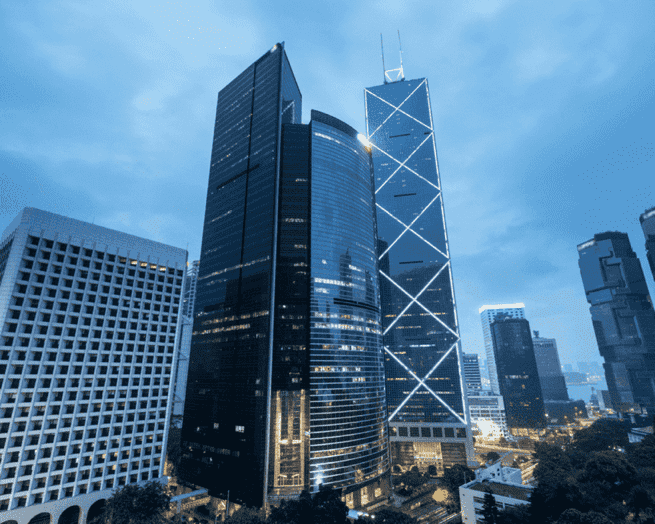

Projection: U.S. Commercial Lending to Decline by 38% in 2023

The Mortgage Bankers Association (MBA) predicts that total U.S. commercial and multifamily mortgage borrowing and lending will plummet by 38 percent this year, reaching a total of $504 billion.

The impact of these market conditions has been particularly evident in multifamily lending, which is a crucial component of the overall commercial lending sector. According to the MBA, multifamily lending, which is inclusive of the total figures, is expected to witness a steep decline to $299 billion in 2023. This drop represents a 38 percent decrease from the previous year's total of $480 billion. However, experts anticipate a rebound in borrowing and lending activities in 2024, with a projected total of $856 billion in commercial real estate lending, including $452 billion specifically in multifamily lending.

The key driver for this anticipated decline in U.S. commercial lending is the higher interest rates that borrowers are facing. As rates increase, businesses and individuals alike become more cautious about taking on debt, subsequently impacting the demand for commercial loans. Additionally, economic uncertainty further exacerbates the situation, as businesses tend to restrain investments and expansion plans until the economic climate stabilizes.

Despite these challenges, there is hope for the industry. Lenders and borrowers alike must adapt their strategies to meet the changing circumstances and seize the opportunities brought about by these shifting tides. Understanding market trends, improving loan products, and providing tailored lending solutions can help both lenders and borrowers navigate through this challenging period.

Projection: U.S. Commercial Lending to Decline by 38% in 2023

Greece Real Estate Market: Rise of Serviced Apartments

Explore the growing demand for serviced apartments in central Athens, where integrated hospitality services attract savvy investors in the Greece real estate market.

Explore the growing demand for serviced apartments in central Athens, where integrated hospitality services attract savvy investors in the Greece real estate market.

Read moreHome Prices Hit by Climate Change, J.P. Morgan Warns

J.P. Morgan analysts reveal a negative link between climate risk and home price appreciation. Explore the emerging trends and their impact.

J.P. Morgan analysts reveal a negative link between climate risk and home price appreciation. Explore the emerging trends and their impact.

Read moreRenting in Spain: Prices Finally Decline

The cost of renting in Spain trends downwards, averaging €13/m². Discover insights on this shift after years of steep increases.

The cost of renting in Spain trends downwards, averaging €13/m². Discover insights on this shift after years of steep increases.

Read moreRise of Cash Purchases Outside London: A New Trend

Explore the growing trend of cash purchases outside London and its implications for the property market and economic landscape.

Explore the growing trend of cash purchases outside London and its implications for the property market and economic landscape.

Read moreCanada Real Estate Market: Rents Drop for First Time in over 3 years

For the first time in over three years, average asking rents in Canada fell 1.2% in October, reaching $2,152, according to Rentals.ca.

For the first time in over three years, average asking rents in Canada fell 1.2% in October, reaching $2,152, according to Rentals.ca.

Read moreFewer Than 2% of Dutch Homes Sold to International Buyers

Analyze the decline in international purchases of Dutch houses, revealing key factors influencing this trend and its effects on the housing market.

Analyze the decline in international purchases of Dutch houses, revealing key factors influencing this trend and its effects on the housing market.

Read moreDonald Trump’s Victory May Boost London Property Demand

Knight Frank analyzes how Donald Trump’s election win could increase demand for prime London properties. Discover the potential market shifts.

Knight Frank analyzes how Donald Trump’s election win could increase demand for prime London properties. Discover the potential market shifts.

Read moreGerman Investors Fuel Growth in Greek Real Estate Market

Discover how German-speaking house buyers are revitalizing Greece's realty market, driving demand and investment in stunning properties.

Discover how German-speaking house buyers are revitalizing Greece\'s realty market, driving demand and investment in stunning properties.

Read moreLisbon: 11th City for Rising Luxury House Prices

Lisbon's luxury housing prices increased by 5.6%, outpacing Madrid, Seoul, and Zurich, marking it as a key player in the global real estate market.

Lisbon\'s luxury housing prices increased by 5.6%, outpacing Madrid, Seoul, and Zurich, marking it as a key player in the global real estate market.

Read more