A Comparative Analysis of Real Estate Investing in Canada vs USA

Discover the differences in legal considerations, tax implications, financing options, market trends, risks, and benefits of real estate investing in Canada vs USA.

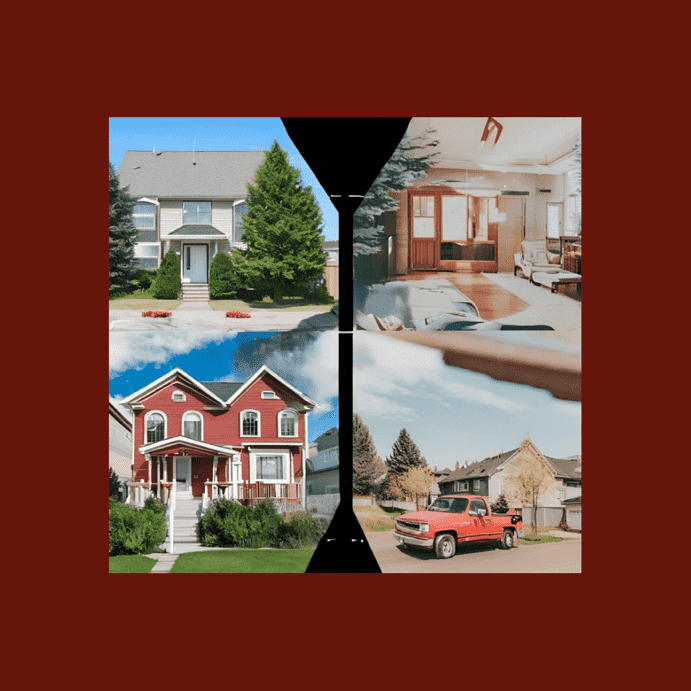

Real estate investing is a popular way for individuals to build wealth and secure their financial future. When it comes to real estate investing, Canada and the USA are two of the most attractive markets in the world. Both countries offer unique opportunities and challenges for investors looking to enter the real estate market. In this article, we will compare real estate investing in Canada vs USA, focusing on key aspects such as legal considerations, tax implications, financing options, market trends, risks, and benefits.

Understanding about to Real Estate Investing

Real estate investing involves purchasing, owning, managing, renting, or selling real estate for profit. It is a long-term investment strategy that can provide steady income and potential capital appreciation over time. Real estate investors can generate income through rental properties, property appreciation, and real estate development projects.

Overview of Real Estate Markets in Canada and the USA

Canada and the USA have robust real estate markets that attract investors from around the world. In Canada, major cities like Toronto, Vancouver, and Montreal are known for their strong real estate markets and high property values. The USA, on the other hand, has diverse real estate markets, with cities like New York, Los Angeles, and Miami offering a wide range of investment opportunities.

Legal Aspects of Real Estate Investing in Canada

In Canada, real estate investing is governed by provincial laws and regulations. Investors must adhere to zoning laws, building codes, and property tax regulations when purchasing or developing real estate. Foreign investors may face additional restrictions and taxes when investing in Canadian real estate.

Legal Aspects of Real Estate Investing in the USA

In the USA, real estate laws vary by state, with each state having its own regulations governing property transactions. Investors must be aware of local laws regarding property ownership, landlord-tenant relationships, and real estate contracts. Foreign investors may also face restrictions and taxes when investing in US real estate.

Tax Implications in Canada

In Canada, real estate investors are subject to capital gains tax on the sale of investment properties. Rental income is also taxed at the investor's marginal tax rate. However, there are tax incentives available for real estate investors, such as the principal residence exemption and tax deductions for rental property expenses.

Tax Implications in the USA

In the USA, real estate investors are subject to capital gains tax on the sale of investment properties. Rental income is taxed at the investor's marginal tax rate, with additional taxes imposed on rental income from non-resident investors. Tax deductions are available for real estate expenses, such as mortgage interest, property taxes, and depreciation.

Financing Options in Canada

In Canada, real estate investors can obtain financing from banks, credit unions, and private lenders. Mortgage rates are relatively low, making it easier for investors to finance real estate purchases. Investors can also use leverage to increase their purchasing power and maximize their returns.

Financing Options in the USA

In the USA, real estate investors have access to a wide range of financing options, including conventional mortgages, FHA loans, and hard money loans. Interest rates are competitive, and investors can take advantage of government-backed loan programs to finance their real estate investments. Leverage is commonly used by investors to increase their buying power and generate higher returns.

Market Trends in Canada

In Canada, real estate markets have experienced steady growth in recent years, with property values increasing in major cities and urban centers. Demand for rental properties remains strong, driven by population growth and immigration. However, some markets are experiencing affordability challenges, with high property prices and limited inventory.

Market Trends in the USA

In the USA, real estate markets are diverse, with some cities experiencing rapid appreciation and others facing economic challenges. The housing market is influenced by factors such as job growth, population trends, and interest rates. Demand for rental properties is high in many urban areas, creating opportunities for real estate investors to generate passive income.

Risks and Challenges in Canada

Real estate investing in Canada comes with risks, such as market volatility, economic uncertainty, and regulatory changes. Investors may face challenges related to property management, tenant turnover, and maintenance costs. Foreign investors may also encounter currency fluctuations and tax implications when investing in Canadian real estate.

Risks and Challenges in the USA

Real estate investing in the USA is not without risks, including market fluctuations, interest rate changes, and economic downturns. Investors may face challenges related to property vacancies, tenant disputes, and property maintenance. Foreign investors may also encounter legal and tax issues when investing in US real estate.

Benefits of Investing in Canada

Despite the risks, real estate investing in Canada offers several benefits, such as stable property values, rental income potential, and long-term appreciation. Canada has a strong economy, political stability, and a well-regulated real estate market, making it an attractive destination for investors seeking to diversify their portfolios.

Benefits of Investing in the USA

Investing in US real estate also has its advantages, including a diverse range of investment opportunities, high rental yields, and potential for capital appreciation. The USA has a dynamic economy, favorable tax policies, and a transparent legal system, making it a preferred destination for international investors looking to enter the real estate market.

In conclusion, real estate investing in Canada vs USA offers unique opportunities and challenges for investors seeking to build wealth through property ownership. Both countries have strong real estate markets, with diverse investment options and potential for long-term growth. By understanding the legal, tax, and market considerations of each country, investors can make informed decisions and maximize their returns in the real estate market.

FAQs

1. Is it better to invest in Canadian or US real estate?

2. What are the tax implications for foreign investors in Canada?

3. How can I finance a real estate investment in the USA?

4. What are the current market trends in Canadian real estate?

5. What are the risks of investing in US real estate?

A Comparative Analysis of Real Estate Investing in Canada vs USA

Unlocking the Secrets: How to Invest in Commercial Real Estate with Little Money

Discover the smart strategies and expert tips on how to invest in commercial real estate with little money. Start your journey to financial success today.

Discover the smart strategies and expert tips on how to invest in commercial real estate with little money. Start your journey to financial success today.

Read moreIs Buying a Foreclosed Home a Good Idea? Pros and Cons Revealed

Discover the advantages and drawbacks of buying a foreclosed home before making a decision. Make an informed choice.

Discover the advantages and drawbacks of buying a foreclosed home before making a decision. Make an informed choice.

Read moreUnlocking the Secrets: How to Calculate An Investment Property’s Income Generating Potential

Discover how to calculate an investment property's income generating potential and maximize financial success in real estate.

Discover how to calculate an investment property\'s income generating potential and maximize financial success in real estate.

Read moreOceanfront Pet-Friendly Rentals: A Lucrative Rentals Investment Opportunity

Discover the benefits of investing in oceanfront pet-friendly rentals, popular locations, management tips, and marketing strategies.

Discover the benefits of investing in oceanfront pet-friendly rentals, popular locations, management tips, and marketing strategies.

Read moreShould I Buy House Now or Wait? Expert Insights on the Current Housing Market

Discover the latest data from the NAR and Fannie Mae on existing home sales and consumer sentiment to help you make an informed decision on “Should I buy house now or wait?” in today's competitive market.

Discover the latest data from the NAR and Fannie Mae on existing home sales and consumer sentiment to help you make an informed decision on “Should I buy house now or wait?” in today\'s competitive market.

Read moreHow to Use Debt to Build Wealth in Real Estate: A Strategic Guide

Discover the power of leveraging debt to maximize your real estate investments and build long-term wealth. Learn how to use debt to build wealth in real estate strategically.

Discover the power of leveraging debt to maximize your real estate investments and build long-term wealth. Learn how to use debt to build wealth in real estate strategically.

Read moreUnlocking Opportunities: How to Raise Finance for Property Investment

Discover the best strategies for how to raise finance for property investment, from traditional loans to innovative financing options. Maximize your returns today.

Discover the best strategies for how to raise finance for property investment, from traditional loans to innovative financing options. Maximize your returns today.

Read moreBest Value Holiday Homes in Spain: Top Locations & Deals

Looking for the best value holiday homes in Spain? Explore top locations, property types, and deals for affordable holiday homes in Spain.

Looking for the best value holiday homes in Spain? Explore top locations, property types, and deals for affordable holiday homes in Spain.

Read moreHow to Grow Rental Property Business: 6 Steps

Learn how to grow rental property business successfully with these essential steps. Start investing in rental properties today!

Learn how to grow rental property business successfully with these essential steps. Start investing in rental properties today!

Read more