Chinese Wealth Sparks Australian Property Boom

In a cascading trend that is reshaping Australia's real estate market, wealthy Chinese buyers are fueling a surge in high-end property purchases.

In a cascading trend that is reshaping Australia's real estate market, wealthy Chinese buyers are fueling a surge in high-end property purchases. The landscape of exclusive suburbs in Australia, such as Sydney's Vaucluse and Bellevue Hill, Melbourne's Toorak and Brighton, and even markets in London and Singapore, are witnessing a frenzy of property acquisitions driven by the rising affluence of Chinese Australians and China's wealthy individuals seeking overseas investments.

The phenomena of Chinese wealth pouring into the Australian property market is not confined to this specific region. Vancouver, a city that experienced a similar property boom, serves as a perfect parallel. The appeal for Chinese buyers extends far beyond Australia's borders, creating a global trend that shouldn't be ignored.

It is worth noting that the Australian government has been actively encouraging foreign investments in its real estate sector. In fact, government approvals for foreign property investments have skyrocketed by 40% in the previous quarter compared to the same period last year. While this surge in foreign investment brings economic benefits to the country, there are growing concerns regarding its impact on property prices, especially in the high-end segment. Many locals are increasingly worried about the affordability and accessibility of housing in their own cities.

One key issue that has emerged is the involvement of anonymous investment trusts based in Singapore in property transactions. The lack of transparency surrounding these deals has raised red flags, as authorities question the potential for money laundering activities. As the Chinese influence on the Australian property market persists, finding a delicate balance between attracting foreign investment and safeguarding a fair and sustainable housing market for all Australians becomes paramount.

In conclusion, the Australian real estate market is undergoing a remarkable transformation fueled by the wealth of Chinese buyers. This phenomenon is not unique to Australia but extends to exclusive suburbs around the world, marking a global trend. While the government actively encourages foreign investment, concerns regarding rising property prices, housing affordability, and anonymous transactions require close attention. Striking a balance between foreign investment and ensuring a fair housing market for Australians remains a pressing challenge.

Chinese Wealth Sparks Australian Property Boom

UK Landlords Sell Fast Amid Capital Gains Tax Fears

Record 18% of homes for sale in September were rentals, as landlords rush to offload properties before potential tax hikes.

Record 18% of homes for sale in September were rentals, as landlords rush to offload properties before potential tax hikes.

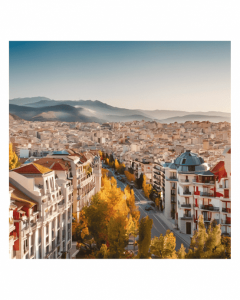

Read moreLuxury Home Prices Surge 9.6% in Alicante, Spain

Discover how Alicante's luxury real estate market led Spain with a remarkable 9.6% price increase in the past year. Explore the trends now!

Discover how Alicante\'s luxury real estate market led Spain with a remarkable 9.6% price increase in the past year. Explore the trends now!

Read morePrince Harry & Meghan Markle Purchase Home in Portugal

Prince Harry and Meghan Markle have officially bought a house in Portugal, as reported by the Daily Mail, signaling their new life abroad.

Prince Harry and Meghan Markle have officially bought a house in Portugal, as reported by the Daily Mail, signaling their new life abroad.

Read moreGreece’s Holiday Homes: A New Trend for Senior Executives

Discover why businesspeople aged 50+ are investing in newly built holiday homes in Greece for personal use and short-term rentals.

Discover why businesspeople aged 50+ are investing in newly built holiday homes in Greece for personal use and short-term rentals.

Read moreUK Real Estate Trends: Buy-to-Let Landlords Thrive

Discover how 60% of buy-to-let (BTL) landlords remain optimistic amid market challenges, anticipating strong rental yields and capital growth.

Discover how 60% of buy-to-let (BTL) landlords remain optimistic amid market challenges, anticipating strong rental yields and capital growth.

Read moreUK Pension Fund Acquires 3,000 Homes from Blackstone for £405 Million

Blackstone sells 3,000 homes to a UK pension fund for £405 million, marking a pivotal moment in the real estate market. This strategic move raises questions about future investments and market trends.

Blackstone sells 3,000 homes to a UK pension fund for £405 million, marking a pivotal moment in the real estate market. This strategic move raises questions about future investments and market trends.

Read morePortugal Real Estate Investment Thrives Post-Golden Visa

Despite the end of golden visas, FDI in Portugal's real estate surged to €892.8 million, reflecting a 30% increase in Q2. Discover the trends.

Despite the end of golden visas, FDI in Portugal\'s real estate surged to €892.8 million, reflecting a 30% increase in Q2. Discover the trends.

Read moreWhy Spain and Canada Emerge as Best countries for Foreign Real Estate Investment

The Global Property Market has seen a surge in interest for Spain and Canada as best countries for foreign real estate investment. This blog post delves into the factors driving this trend and what makes these countries so attractive for relocation.

The Global Property Market has seen a surge in interest for Spain and Canada as best countries for foreign real estate investment. This blog post delves into the factors driving this trend and what makes these countries so attractive for relocation.

Read moreCyprus Real Estate Investment: 2024 Market Insights

Explore Cyprus real estate investment trends in 2024, with a 7.42% price surge. Discover key statistics driving this thriving market.

Explore Cyprus real estate investment trends in 2024, with a 7.42% price surge. Discover key statistics driving this thriving market.

Read more