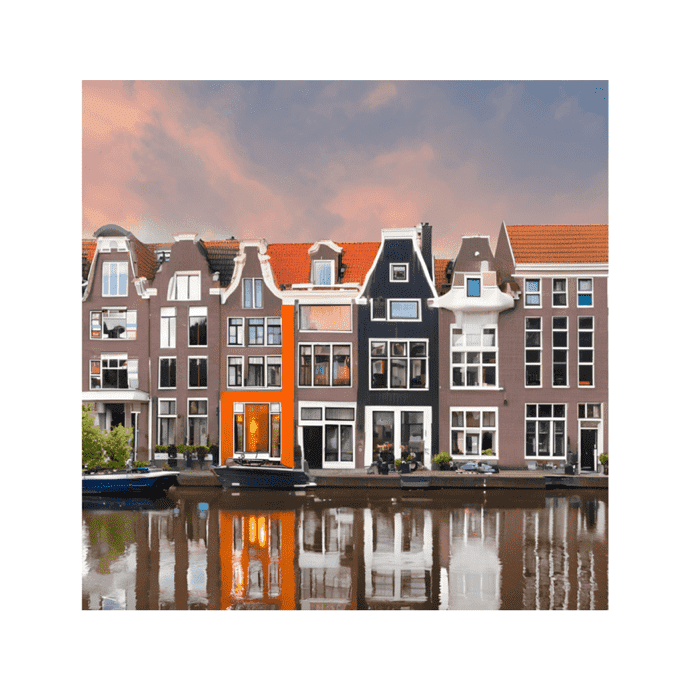

Dutch Home Prices to Rise 14% by End 2026; De Nederlandsche Bank Predicts No Recession

De Nederlandsche Bank forecasts a 6% increase in Dutch home prices this year, with a steady 4% rise in the next two years. No more fear of recession for the Dutch economy.

Dutch home prices are expected to rise by 14% by the end of 2026, according to a new estimate by De Nederlandsche Bank (DNB). This forecast comes after home prices reached a new record level in April, with the central bank projecting a 6% increase in prices this year and around 4% per year in the following two years. This upward adjustment is more than double what was estimated six months ago, driven by a decline in investments in housing construction, lower mortgage interest rates, and rising incomes.

Dutch first-time buyers are benefiting from falling prices, with nearly 40% of households having sufficient income to finance an average-priced home of 452,000 euros. The tight Dutch housing market has led to increased demand, pushing prices higher. DNB emphasizes the need for more housing construction to alleviate the tight market conditions.

DNB also stated that the fear of a recession is no longer a concern, with the Dutch economy expected to grow by 0.5% this year and 1.3% in the next two years. This more optimistic outlook is attributed to the revival of world trade, government and consumer spending, and wage increases. However, the budget deficit is projected to increase under the new coalition's plans, exceeding the EU standard of 3% in the coming years.

The DNB expects the deficit to reach 3.3% of the gross domestic product (GDP) in 2025, higher than the current plans and above the EU standard. The new Cabinet's plans are expected to result in a lower deficit in the later years, with the budget deficit projected to be 3.1% in 2028. The outgoing Cabinet was heading for a deficit of 3.7% in 2028, highlighting the differences in fiscal policies between the two administrations.

The Dutch housing market is experiencing continued price growth, driven by factors such as low mortgage rates and rising incomes. The economy is expected to grow steadily in the coming years, with the government's spending plans impacting the budget deficit. It remains to be seen how the new coalition will navigate these economic challenges in the years ahead.

Dutch Home Prices to Rise 14% by End 2026; De Nederlandsche Bank Predicts No Recession

Greece Real Estate Market: Rise of Serviced Apartments

Explore the growing demand for serviced apartments in central Athens, where integrated hospitality services attract savvy investors in the Greece real estate market.

Explore the growing demand for serviced apartments in central Athens, where integrated hospitality services attract savvy investors in the Greece real estate market.

Read moreHome Prices Hit by Climate Change, J.P. Morgan Warns

J.P. Morgan analysts reveal a negative link between climate risk and home price appreciation. Explore the emerging trends and their impact.

J.P. Morgan analysts reveal a negative link between climate risk and home price appreciation. Explore the emerging trends and their impact.

Read moreRenting in Spain: Prices Finally Decline

The cost of renting in Spain trends downwards, averaging €13/m². Discover insights on this shift after years of steep increases.

The cost of renting in Spain trends downwards, averaging €13/m². Discover insights on this shift after years of steep increases.

Read moreRise of Cash Purchases Outside London: A New Trend

Explore the growing trend of cash purchases outside London and its implications for the property market and economic landscape.

Explore the growing trend of cash purchases outside London and its implications for the property market and economic landscape.

Read moreCanada Real Estate Market: Rents Drop for First Time in over 3 years

For the first time in over three years, average asking rents in Canada fell 1.2% in October, reaching $2,152, according to Rentals.ca.

For the first time in over three years, average asking rents in Canada fell 1.2% in October, reaching $2,152, according to Rentals.ca.

Read moreFewer Than 2% of Dutch Homes Sold to International Buyers

Analyze the decline in international purchases of Dutch houses, revealing key factors influencing this trend and its effects on the housing market.

Analyze the decline in international purchases of Dutch houses, revealing key factors influencing this trend and its effects on the housing market.

Read moreDonald Trump’s Victory May Boost London Property Demand

Knight Frank analyzes how Donald Trump’s election win could increase demand for prime London properties. Discover the potential market shifts.

Knight Frank analyzes how Donald Trump’s election win could increase demand for prime London properties. Discover the potential market shifts.

Read moreGerman Investors Fuel Growth in Greek Real Estate Market

Discover how German-speaking house buyers are revitalizing Greece's realty market, driving demand and investment in stunning properties.

Discover how German-speaking house buyers are revitalizing Greece\'s realty market, driving demand and investment in stunning properties.

Read moreLisbon: 11th City for Rising Luxury House Prices

Lisbon's luxury housing prices increased by 5.6%, outpacing Madrid, Seoul, and Zurich, marking it as a key player in the global real estate market.

Lisbon\'s luxury housing prices increased by 5.6%, outpacing Madrid, Seoul, and Zurich, marking it as a key player in the global real estate market.

Read more