FINANCIAL MANAGEMENT: 5 TIPS FOR SPENDING MONEY WISELY

Regardless of income, saving money depends entirely on how each person spends. People who are good at saving are those who know how to plan their expenses effectively and take advantage of each resource in the house.

Here are 5 secrets of spending money that Japan's most effective savings families never share.

1- Not go shopping every day

2- Not deciding what to buy when going to the store

3- Not buy things you like in bulk

4- Use a family notebook

5- Become a member of the secondhand market

3- Not buy things you like in bulk

4- Use a family notebook

5- Become a member of the secondhand market

5- Become a member of the secondhand market

Regardless of income, saving money depends entirely on how each person spends. People who are good at saving are those who know how to plan their expenses effectively and take advantage of each resource in the house.

Here are 5 secrets of spending money that Japan's most effective savings families never share.

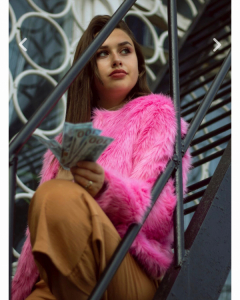

5 Tips for Spending Money Wisely / ph: pexels

5 Tips for Spending Money Wisely / ph: pexels

1- Not go shopping every day

Even if a person intends to save, going to the market or shopping every day poses the risk of having to spend more money. People who are good at savings tend to shopping less right from the start and but instead decide in advance when to spend their money, like weekends. This habit will also help reduce food loss effectively.

2- Not deciding what to buy when going to the store

When entering a store, maybe cheap items will make a person feel to have a good deal but in reality, that is not the case. Making a shopping list and buying only the essentials is the best way to save money. When listing from the most in-demand item down, at a certain point, the spender will find that his budget is no longer enough, so he will buy it next time.

This list-making method can be applied to anything from everyday necessities like food to clothing and household items.

3- Not buy things you like in bulk

Many online shopping deals often offer a discount on bulk purchases. However, with some items, consumers may have a loss, especially luxury items such as alcohol, cigarettes or sweets because they will be inventory in the house and the buyer will have to consume them more. Then, when used to it, that person will wait for the next discount to buy more, in large quantities and regularly.

4- Use a family notebook

The Japanese have a very good way of both managing spending and controlling what has already been bought in the family handbook. In fact, it's an extension of making a list of things to spend, specifically listing what you have in your home right now and how it is used.

For example, in a refrigerator, if a person has good control of the amount of food he has in it, there will never be a problem of rotting food that has not been used or there are items left in there for too long. leading to reduced nutrition and no longer delicious.

5- Become a member of the secondhand market

In Japan, due to a very strict waste classification system, if household items are no longer in use, people must contact waste companies for disposal. This will cost a lot depending on the size of the item, possibly up to several hundred thousand yen.

Therefore, many Japanese people often choose to call second-hand stores to resell if they want to change their furniture. The selling price is usually not high, even much cheaper than their use value (many are still in good use because the Japanese don't use the items until they're damaged, but usually have a shelf life, 7 years at most). However, such a resale at least makes a profit, and is still better than having to pay extra for the cleaning units to come and take away the items.

FINANCIAL MANAGEMENT: 5 TIPS FOR SPENDING MONEY WISELY

Top 6 Money Habits of Self-Made Millionaires

Here are Top 6 Money Habits of Self-Made Millionaires that you should know.

Here are Top 6 Money Habits of Self-Made Millionaires that you should know.

Read more

10 Money Rules to face economic recession

Have you ever wondered what your financial situation will be like in a year, even just a few months? In the current context, it is unavoidable to worry about the risk of an economic recession. However, it is important that you start preparing now so that in the event of a recession in the next 6-12 months, you will be in the best position with the money amount you have.

Have you ever wondered what your financial situation will be like in a year, even just a few months? In the current context, it is unavoidable to worry about the risk of an economic recession. However, it is important that you start preparing now so that in the event of a recession in the next 6-12 months, you will be in the best position with the money amount you have.

Read more8 Money Saving Tips When Buying A House

Although housing prices have increased many times compared to the past time, you can still buy a house if you know how to save money smartly. Owning a dream home is no longer a far-away wish when we know how to make an effective financial plan. Below 8 Effective Money Saving Tips When Buying A House.

Although housing prices have increased many times compared to the past time, you can still buy a house if you know how to save money smartly. Owning a dream home is no longer a far-away wish when we know how to make an effective financial plan. Below 8 Effective Money Saving Tips When Buying A House.

Read more7 Billionaire Spending Habits help build Wealth

Fortune magazine published the results of a study showing that up to 54% of billionaires want to continue working at retirement age, and 60% of those with a net worth of more than $15 million don't even have a retire plan.

Fortune magazine published the results of a study showing that up to 54% of billionaires want to continue working at retirement age, and 60% of those with a net worth of more than $15 million don\'t even have a retire plan.

Read moreMost common habits of The World’s 4 Richest groups

Research "Rich Habits" by Tom Corley shows that there are 4 groups of wealthy people, including savers - investors, people who are eager to advance at work, high skilled professionals and the dreamers.

One of the common wealthy habits of the world's richest people is saving and investing their savings.

Research "Rich Habits" by Tom Corley shows that there are 4 groups of wealthy people, including savers - investors, people who are eager to advance at work, high skilled professionals and the dreamers.

One of the common wealthy habits of the world\'s richest people is saving and investing their savings.

Read more4 Financial mistakes young people often make

The path to financial independence is often not easy. For young people, focusing on retirement or saving for the future is often not a top priority.

But they can lose a lot of money if they make the wrong financial decisions. Here are 4 common financial mistakes that young people often make.

The path to financial independence is often not easy. For young people, focusing on retirement or saving for the future is often not a top priority.

But they can lose a lot of money if they make the wrong financial decisions. Here are 4 common financial mistakes that young people often make.

Read more4 Things to know when Getting a House Mortgage

A home loan is a suitable option if you need a large sum of money. To manage finances intelligently and avoid falling into a debt spiral, you should pay attention to a safe loan threshold, interest costs to pay, loan term,..

A home loan is a suitable option if you need a large sum of money. To manage finances intelligently and avoid falling into a debt spiral, you should pay attention to a safe loan threshold, interest costs to pay, loan term,..

Read more4 Investing Tips for Your 20s

There are investments that, as long as you are willing to put in money, time and effort, will definitely bring a worthy return. Here are 4 investments that you should make at the age of 20-30, According to Tim Denning, an Australian blogger.

There are investments that, as long as you are willing to put in money, time and effort, will definitely bring a worthy return. Here are 4 investments that you should make at the age of 20-30, According to Tim Denning, an Australian blogger.

Read moreHow to Save Money with Low Income fast: 5 Tips

If you have a low income, you need to make a concentrated effort to save money. While this is not always easy, it can be worthwhile in the long run. To help people with low income to save money, financial experts have shared 5 tips as below.

If you have a low income, you need to make a concentrated effort to save money. While this is not always easy, it can be worthwhile in the long run. To help people with low income to save money, financial experts have shared 5 tips as below.

Read more