[FINANCIAL MANAGEMENT] 6 RULES TO PREVENT FINANCIAL CRISIS

Not everyone has the conditions to be equipped with knowledge about money early on. The lack of attention to cash flow leads to many cases of passive exposure to risk and at the same time difficult to achieve financial freedom later.

- 1- Not knowing your own financial situation

- 2- Spending money on unnecessary things

- 3- Living on debt and credit cards

- 4- Investment without calculation

- 5- Lacking of emergency fund

- 6- Not preparing for retirement

However, you can still learn and change to have a better chance of creating a stronger economy. Below are some mistakes young people often make.

1- Not knowing your own financial situation

According to Money Under 30, regularly checking our financial situation helps us to adjust our lifestyle and be more proactive in money matters.

6 questions to check your financial health according to Investopedia:

- How do you prepare for contingencies?

- Take the total assets owned minus the amount owed, how much do you have?

- Have you achieved what you need in life and what you want?

- What debts do you have that are considered high interest rates?

- Are you actively saving for retirement?

- Do you have enough insurance to cover health and life risk

2- Spending money on unnecessary things

Many people who go to work often fall into a state of empty pocket when the new payment period has not yet come, even though there is no significant expenditure.

In fact, small amounts of money such as coffee, clothes, eating out, watching movies online, etc., when combined, will affect your pocket.

The best way to protect your finances is to have a specific monthly spending budget, excluding sundries.

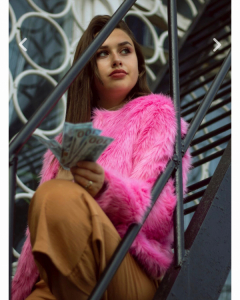

Financial Management: 6 rules to prevent financial crisis / ph: pexels

How to make a basic budget according to Nerd Wallet:

- Spending 50% of income on essential living expenses

- Using 30% of income for hobbies and entertainment activities

- Retaining 20% of income for debt repayment and savings

3- Living on debt and credit cards

If you often use your credit card to pay for things you can't afford, the advice is not to maintain this habit.

In some cases, credit card interest charges an additional cost for the item. This means you have to pay a higher amount than it actually is.

Moreover, taking this month's income to pay the previous month's credit, and then continuing to spend it with the card creates a vicious cycle.

Instead, you should only spend the money you have, and use your credit card for the purpose of building a good credit history, setting the stage for needed loans in the future, Credit Simple suggests.

4- Investment without calculation

Investing in emotions, not understanding the market thoroughly, easily leads to failure and waste of money.

Once losing money, not everyone has enough capital and patience to start over.

Therefore, being careful in investment is the top factor for you to gradually learn from small mistakes.

To be proactive in investment decisions, you need to understand yourself and financial products well enough to build an appropriate strategy and portfolio.

Each person will have a different financial capacity and risk perception.

5- Lacking of emergency fund

An emergency fund is money amount you can use to meet unexpected expenses, like medical care, living expenses during unemployment or home repairs,..

Many people ignore this provision because they think that life is stable, the above problems rarely happen or if they do, they will always have a way to manage.

However, you will think again when you know that the fund also acts as a protective net for your savings, helping you to continue towards your financial goals despite the uncertainties.

For example, if you are unfortunately unemployed, you can use your emergency fund to cover it, instead of touching your savings to buy a house.

6- Not preparing for retirement

Most personal finance-related advice is geared towards building a pension fund for life in old age.

Choosing a financial plan for retirement depends on each person's point of view. But there is a fact that the more assets you have accumulated, the easier it is to pay for problems such as health care, travel, ... when you stop working.

There are many ways to prepare for retirement. The simplest is to start from a young age, transfer a fixed part of money every month into a retirement account. Besides, you can consult with financial advisors to arrange specific plans.

[FINANCIAL MANAGEMENT] 6 RULES TO PREVENT FINANCIAL CRISIS

Top 6 Money Habits of Self-Made Millionaires

Here are Top 6 Money Habits of Self-Made Millionaires that you should know.

Here are Top 6 Money Habits of Self-Made Millionaires that you should know.

Read more

10 Money Rules to face economic recession

Have you ever wondered what your financial situation will be like in a year, even just a few months? In the current context, it is unavoidable to worry about the risk of an economic recession. However, it is important that you start preparing now so that in the event of a recession in the next 6-12 months, you will be in the best position with the money amount you have.

Have you ever wondered what your financial situation will be like in a year, even just a few months? In the current context, it is unavoidable to worry about the risk of an economic recession. However, it is important that you start preparing now so that in the event of a recession in the next 6-12 months, you will be in the best position with the money amount you have.

Read more8 Money Saving Tips When Buying A House

Although housing prices have increased many times compared to the past time, you can still buy a house if you know how to save money smartly. Owning a dream home is no longer a far-away wish when we know how to make an effective financial plan. Below 8 Effective Money Saving Tips When Buying A House.

Although housing prices have increased many times compared to the past time, you can still buy a house if you know how to save money smartly. Owning a dream home is no longer a far-away wish when we know how to make an effective financial plan. Below 8 Effective Money Saving Tips When Buying A House.

Read more7 Billionaire Spending Habits help build Wealth

Fortune magazine published the results of a study showing that up to 54% of billionaires want to continue working at retirement age, and 60% of those with a net worth of more than $15 million don't even have a retire plan.

Fortune magazine published the results of a study showing that up to 54% of billionaires want to continue working at retirement age, and 60% of those with a net worth of more than $15 million don\'t even have a retire plan.

Read moreMost common habits of The World’s 4 Richest groups

Research "Rich Habits" by Tom Corley shows that there are 4 groups of wealthy people, including savers - investors, people who are eager to advance at work, high skilled professionals and the dreamers.

One of the common wealthy habits of the world's richest people is saving and investing their savings.

Research "Rich Habits" by Tom Corley shows that there are 4 groups of wealthy people, including savers - investors, people who are eager to advance at work, high skilled professionals and the dreamers.

One of the common wealthy habits of the world\'s richest people is saving and investing their savings.

Read more4 Financial mistakes young people often make

The path to financial independence is often not easy. For young people, focusing on retirement or saving for the future is often not a top priority.

But they can lose a lot of money if they make the wrong financial decisions. Here are 4 common financial mistakes that young people often make.

The path to financial independence is often not easy. For young people, focusing on retirement or saving for the future is often not a top priority.

But they can lose a lot of money if they make the wrong financial decisions. Here are 4 common financial mistakes that young people often make.

Read more4 Things to know when Getting a House Mortgage

A home loan is a suitable option if you need a large sum of money. To manage finances intelligently and avoid falling into a debt spiral, you should pay attention to a safe loan threshold, interest costs to pay, loan term,..

A home loan is a suitable option if you need a large sum of money. To manage finances intelligently and avoid falling into a debt spiral, you should pay attention to a safe loan threshold, interest costs to pay, loan term,..

Read more4 Investing Tips for Your 20s

There are investments that, as long as you are willing to put in money, time and effort, will definitely bring a worthy return. Here are 4 investments that you should make at the age of 20-30, According to Tim Denning, an Australian blogger.

There are investments that, as long as you are willing to put in money, time and effort, will definitely bring a worthy return. Here are 4 investments that you should make at the age of 20-30, According to Tim Denning, an Australian blogger.

Read moreHow to Save Money with Low Income fast: 5 Tips

If you have a low income, you need to make a concentrated effort to save money. While this is not always easy, it can be worthwhile in the long run. To help people with low income to save money, financial experts have shared 5 tips as below.

If you have a low income, you need to make a concentrated effort to save money. While this is not always easy, it can be worthwhile in the long run. To help people with low income to save money, financial experts have shared 5 tips as below.

Read more