[FINANCIAL MANAGEMENT] HOW TO DEAL WITH FINANCIAL STRESS AND ANXIETY: 5 WAYS

You have to change jobs, temporarily unemployed or fired due to the epidemic, and you are extremely headache with your financial situation.

The pandemic has been affecting all of us. For those who stay at home for a month or even a few months is not easy, in addition, you also have to deal with your own financial situation.

Moreover, for better disease prevention, we also rarely go out to meet friends, relatives,... All of this can lead to both emotional and financial stress, especially if you're worried about mounting debt and managing your spending at this time.

But don’t be too worry, there are ways to manage your financial stress with these 6 ways and put your mind at ease.

1- Focus on what you can control

Feelings of insecurity and stress can arise when you feel anxious or frustrated. During a pandemic, this can lead to financial stress.

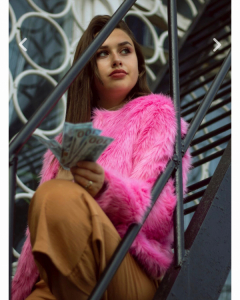

How To Deal With Financial Stress And Anxiety? / ph: pexels

How To Deal With Financial Stress And Anxiety? / ph: pexels

However, here's an important thing to keep in mind: you may feel stressed from not being in control of your situation. While there are many things that you cannot control, just focus on what you can.

2- Priority payment

If your money amount is tight and you can't afford everything, start prioritizing your payments to make sure you're covering the essentials first.

To keep things organized, list your bills and monthly payments in order of importance. This way, you'll know what to pay up front, and then write down any payments you can postpone. Move those things lower on your priority list so you can pay the necessary bills first.

3- Make more money

If you are worried about your finances, you are not alone. One thing you can do is explore opportunities to make more money at this time. Manual jobs such as shipper, taxi drivers, hourly maid... will not require too many skills.

There are also plenty of ways you can start a full hustle life at home. While you may need to take some online courses to learn some new skills, with a little creativity and ingenuity you can start making money as a virtual assistant, tutor, teacher, yoga teacher, translation, writing...

4- Save some money if you can

Maybe you've wanted to save money in the past but have never taken it seriously. So, now is the perfect time to develop healthy savings habits if you still have an income. This can also help you take control of your finances.

5- Take care of yourself

Practicing self-care can be a great way to manage financial stress during difficult times.

For starters, try to exercise every day, even if you're only walking for 20 minutes or brisk walking.

Also, eating healthy foods can help you feel more energetic.

So choose healthy foods at affordable prices, such as fresh products, lean protein, and foods high in fiber like brown rice and other whole grains.

Sleep is also important for your health. To help you sleep better, try developing an evening routine to help you relax during the day.

The best way to manage financial stress during difficult times is to assess your situation and make a plan. So, use these 5 suggestions to help you handle your financial stress then come up with a financial plan that's right for you.

[FINANCIAL MANAGEMENT] HOW TO DEAL WITH FINANCIAL STRESS AND ANXIETY: 5 WAYS

Top 6 Money Habits of Self-Made Millionaires

Here are Top 6 Money Habits of Self-Made Millionaires that you should know.

Here are Top 6 Money Habits of Self-Made Millionaires that you should know.

Read more

10 Money Rules to face economic recession

Have you ever wondered what your financial situation will be like in a year, even just a few months? In the current context, it is unavoidable to worry about the risk of an economic recession. However, it is important that you start preparing now so that in the event of a recession in the next 6-12 months, you will be in the best position with the money amount you have.

Have you ever wondered what your financial situation will be like in a year, even just a few months? In the current context, it is unavoidable to worry about the risk of an economic recession. However, it is important that you start preparing now so that in the event of a recession in the next 6-12 months, you will be in the best position with the money amount you have.

Read more8 Money Saving Tips When Buying A House

Although housing prices have increased many times compared to the past time, you can still buy a house if you know how to save money smartly. Owning a dream home is no longer a far-away wish when we know how to make an effective financial plan. Below 8 Effective Money Saving Tips When Buying A House.

Although housing prices have increased many times compared to the past time, you can still buy a house if you know how to save money smartly. Owning a dream home is no longer a far-away wish when we know how to make an effective financial plan. Below 8 Effective Money Saving Tips When Buying A House.

Read more7 Billionaire Spending Habits help build Wealth

Fortune magazine published the results of a study showing that up to 54% of billionaires want to continue working at retirement age, and 60% of those with a net worth of more than $15 million don't even have a retire plan.

Fortune magazine published the results of a study showing that up to 54% of billionaires want to continue working at retirement age, and 60% of those with a net worth of more than $15 million don\'t even have a retire plan.

Read moreMost common habits of The World’s 4 Richest groups

Research "Rich Habits" by Tom Corley shows that there are 4 groups of wealthy people, including savers - investors, people who are eager to advance at work, high skilled professionals and the dreamers.

One of the common wealthy habits of the world's richest people is saving and investing their savings.

Research "Rich Habits" by Tom Corley shows that there are 4 groups of wealthy people, including savers - investors, people who are eager to advance at work, high skilled professionals and the dreamers.

One of the common wealthy habits of the world\'s richest people is saving and investing their savings.

Read more4 Financial mistakes young people often make

The path to financial independence is often not easy. For young people, focusing on retirement or saving for the future is often not a top priority.

But they can lose a lot of money if they make the wrong financial decisions. Here are 4 common financial mistakes that young people often make.

The path to financial independence is often not easy. For young people, focusing on retirement or saving for the future is often not a top priority.

But they can lose a lot of money if they make the wrong financial decisions. Here are 4 common financial mistakes that young people often make.

Read more4 Things to know when Getting a House Mortgage

A home loan is a suitable option if you need a large sum of money. To manage finances intelligently and avoid falling into a debt spiral, you should pay attention to a safe loan threshold, interest costs to pay, loan term,..

A home loan is a suitable option if you need a large sum of money. To manage finances intelligently and avoid falling into a debt spiral, you should pay attention to a safe loan threshold, interest costs to pay, loan term,..

Read more4 Investing Tips for Your 20s

There are investments that, as long as you are willing to put in money, time and effort, will definitely bring a worthy return. Here are 4 investments that you should make at the age of 20-30, According to Tim Denning, an Australian blogger.

There are investments that, as long as you are willing to put in money, time and effort, will definitely bring a worthy return. Here are 4 investments that you should make at the age of 20-30, According to Tim Denning, an Australian blogger.

Read moreHow to Save Money with Low Income fast: 5 Tips

If you have a low income, you need to make a concentrated effort to save money. While this is not always easy, it can be worthwhile in the long run. To help people with low income to save money, financial experts have shared 5 tips as below.

If you have a low income, you need to make a concentrated effort to save money. While this is not always easy, it can be worthwhile in the long run. To help people with low income to save money, financial experts have shared 5 tips as below.

Read more