Mergers and Acquisitions Surge Among UK and European Banks

Explore the rising trend of mergers and acquisitions in UK and European banks amid low interest rates and financial pressures in the coming year.

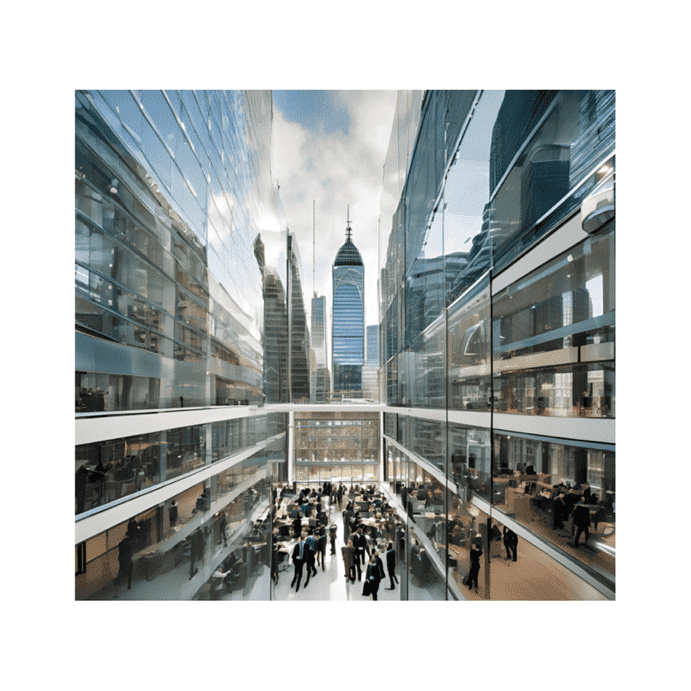

In a landscape increasingly characterized by economic pressures, the banking sector in the UK and Europe is poised for a notable uptick in mergers and acquisitions, as elucidated in the latest report from the esteemed law firm White & Case. This anticipated surge is largely a response to a confluence of factors, including persistently low interest rates, governmental interventions, and the strategic maneuvers of financial sponsors seeking exits from their investments.

As banks endeavor to fortify their balance sheets and streamline operations, a concomitant strategy involves the reduction of headcount and the consolidation of local branches. This approach is not merely a cost-cutting exercise; rather, it reflects a broader imperative to enhance profitability in an increasingly competitive and challenging financial environment.

The report highlights that the past 18 months have already witnessed a significant wave of consolidation within the banking sector, with over 35 domestic bank mergers occurring in the UK and the eurozone in the last year alone. Notably, this figure excludes transactions influenced by the geopolitical ramifications of the ongoing conflict between Russia and Ukraine, which has further complicated the financial landscape.

As banks navigate these turbulent waters, the dual strategies of mergers and operational efficiencies will likely become the order of the day, setting the stage for a transformative period in the financial services sector.

Mergers and Acquisitions Surge Among UK and European Banks

KBC Bank Recovers €800M in Customer Deposits

KBC Bank has regained more customers than lost post-Belgian State bonds, adding €800 million in deposits. Discover the details here.

KBC Bank has regained more customers than lost post-Belgian State bonds, adding €800 million in deposits. Discover the details here.

Read moreSantander UK Adjusts Mortgages After Rate Cut

In light of the Bank of England's 0.25% rate reduction to 4.75%, Santander UK announces significant changes to its mortgage offerings.

In light of the Bank of England\'s 0.25% rate reduction to 4.75%, Santander UK announces significant changes to its mortgage offerings.

Read moreUBS Launches Blockchain Pilot for Cross-Border Payments

Swiss bank UBS successfully pilots its blockchain-based UBS Digital Cash, aiming to enhance efficiency in cross-border transactions.

Swiss bank UBS successfully pilots its blockchain-based UBS Digital Cash, aiming to enhance efficiency in cross-border transactions.

Read moreSantander’s Profits Hit €9.309 Billion

Spanish financial group Santander reports €9.309 billion in profits for the first nine months of 2023, a 14% increase from last year.

Spanish financial group Santander reports €9.309 billion in profits for the first nine months of 2023, a 14% increase from last year.

Read moreBNP Paribas Reports Net Income Boost from Corporate Banking

BNP Paribas has recorded a notable increase in net income, fueled by strong performance in its corporate banking sector. Explore the details.

BNP Paribas has recorded a notable increase in net income, fueled by strong performance in its corporate banking sector. Explore the details.

Read moreASR Divests Knab to Bawag Group for €590 Million

ASR's strategic sale of Knab to Bawag Group marks a €590 million deal, with €100 million allocated for share repurchase to boost shareholder value.

ASR\'s strategic sale of Knab to Bawag Group marks a €590 million deal, with €100 million allocated for share repurchase to boost shareholder value.

Read moreUBS’s Asset Management Launches First Tokenized Investment Fund

UBS Asset Management has launched its inaugural tokenized investment fund, highlighting a significant trend in the evolving financial landscape.

UBS Asset Management has launched its inaugural tokenized investment fund, highlighting a significant trend in the evolving financial landscape.

Read moreSwiss National Bank Reports CHF62.5 Billion Profit

The Swiss National Bank (SNB) has generated a remarkable CHF62.5 billion profit in the first nine months of this year, reflecting robust financial performance.

The Swiss National Bank (SNB) has generated a remarkable CHF62.5 billion profit in the first nine months of this year, reflecting robust financial performance.

Read moreProfits Rise at Standard Chartered’s Wealth Arm

Standard Chartered's wealth division reports an 11% profit increase in Q3, fueled by a $1.5 billion investment to enhance services and capabilities.

Standard Chartered\'s wealth division reports an 11% profit increase in Q3, fueled by a $1.5 billion investment to enhance services and capabilities.

Read more