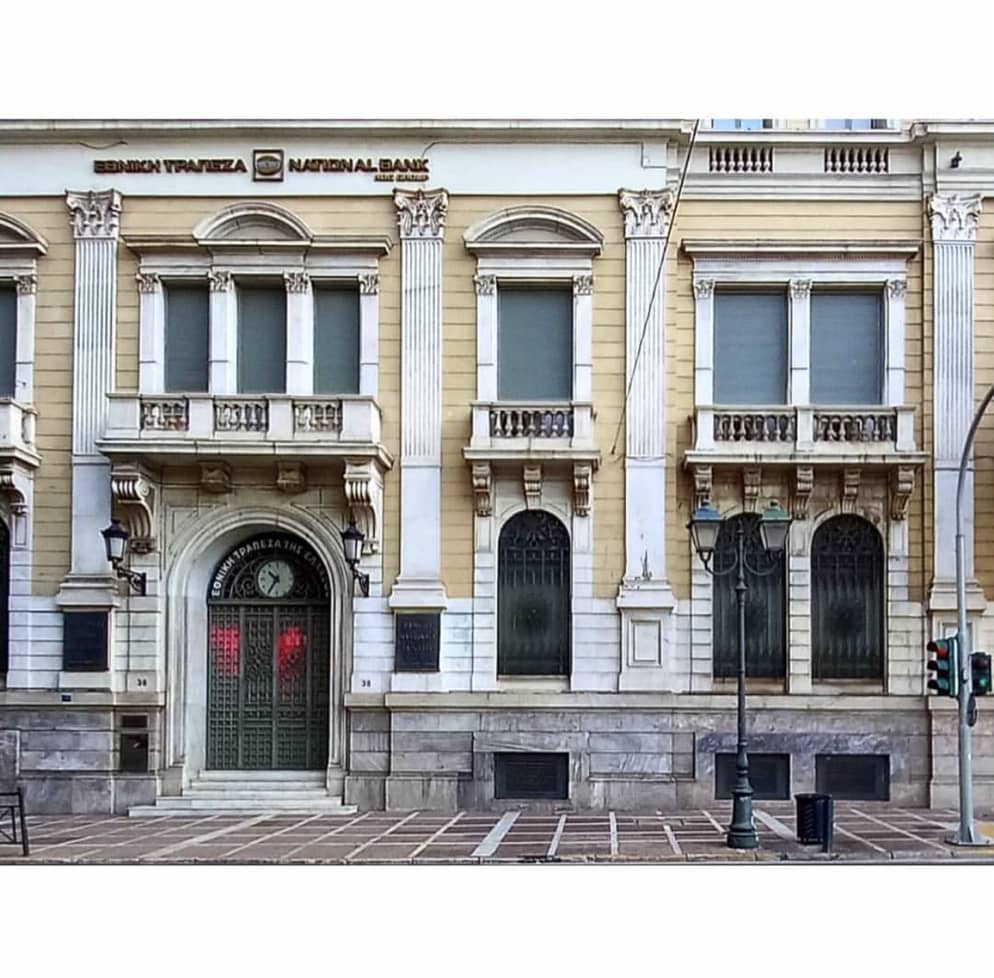

National Bank of Greece Partners with Qualco to Enter Real Estate Market

National Bank of Greece (NBG) teams up with Qualco to launch a platform for property search and financing, transforming the real estate landscape.

In a strategic maneuver that intertwines finance with real estate, the National Bank of Greece (NBG) is poised to make its foray into the real estate brokerage sector, courtesy of a collaboration with the technology provider Qualco. This partnership, which will manifest as a joint venture—wherein Qualco will command a 51% stake while National Bank of Greece (NBG) retains 49%—aims to establish a comprehensive platform. This platform will empower prospective buyers to not only search for properties but also facilitate financing options through NBG, should the need arise.

The ambitious initiative, aptly named Uniko, aspires to transcend the conventional boundaries of property sourcing. It seeks to aggregate listings not solely from the bank’s inventory but also from a myriad of external sources, leveraging strategic partnerships with real estate agents to enhance the breadth of available options. Among the myriad advantages that Uniko promises to deliver is a robust framework of technical and legal support, ensuring that properties are transaction-ready upon acquisition.

Moreover, the platform is designed to cater to buyers who have already pinpointed their desired properties, offering them essential financing and consulting services. This strategic pivot is indicative of National Bank of Greece (NBG)'s broader objective to augment its presence in the mortgage market, thereby solidifying its foothold in a competitive landscape.

From the perspective of National Bank of Greece (NBG), this venture represents a calculated diversification of revenue streams, harnessing the synergies between the bank's comprehensive banking capabilities and Qualco's technological prowess. The financial commitment to this venture is substantial, with an estimated total investment of €11.5 million—of which National Bank of Greece (NBG)'s contribution amounts to €5.6 million. The platform is anticipated to launch by the year's end, promising to revolutionize the real estate acquisition process.

It is noteworthy that National Bank of Greece (NBG) is not venturing into this arena unprepared; the bank has already established its own platforms for the sale of properties acquired through auctions. Additionally, it has forged collaborations with property management firms to address legal and technical challenges, as well as maintenance issues. The bank's existing RealEstateOnline.gr platform has demonstrated efficacy, generating €76 million from the sale of 445 properties in 2023, with an additional €36 million accrued in the first half of 2024 from 346 properties sold.

National Bank of Greece (NBG)'s foray into the real estate brokerage sector through its collaboration with Qualco is a multifaceted strategy that promises to enhance its market share while providing a seamless experience for property buyers. As the platform gears up for launch, the implications for both the bank and the broader real estate market are poised to be significant.

National Bank of Greece Partners with Qualco to Enter Real Estate Market

KBC Bank Recovers €800M in Customer Deposits

KBC Bank has regained more customers than lost post-Belgian State bonds, adding €800 million in deposits. Discover the details here.

KBC Bank has regained more customers than lost post-Belgian State bonds, adding €800 million in deposits. Discover the details here.

Read moreSantander UK Adjusts Mortgages After Rate Cut

In light of the Bank of England's 0.25% rate reduction to 4.75%, Santander UK announces significant changes to its mortgage offerings.

In light of the Bank of England\'s 0.25% rate reduction to 4.75%, Santander UK announces significant changes to its mortgage offerings.

Read moreUBS Launches Blockchain Pilot for Cross-Border Payments

Swiss bank UBS successfully pilots its blockchain-based UBS Digital Cash, aiming to enhance efficiency in cross-border transactions.

Swiss bank UBS successfully pilots its blockchain-based UBS Digital Cash, aiming to enhance efficiency in cross-border transactions.

Read moreSantander’s Profits Hit €9.309 Billion

Spanish financial group Santander reports €9.309 billion in profits for the first nine months of 2023, a 14% increase from last year.

Spanish financial group Santander reports €9.309 billion in profits for the first nine months of 2023, a 14% increase from last year.

Read moreBNP Paribas Reports Net Income Boost from Corporate Banking

BNP Paribas has recorded a notable increase in net income, fueled by strong performance in its corporate banking sector. Explore the details.

BNP Paribas has recorded a notable increase in net income, fueled by strong performance in its corporate banking sector. Explore the details.

Read moreASR Divests Knab to Bawag Group for €590 Million

ASR's strategic sale of Knab to Bawag Group marks a €590 million deal, with €100 million allocated for share repurchase to boost shareholder value.

ASR\'s strategic sale of Knab to Bawag Group marks a €590 million deal, with €100 million allocated for share repurchase to boost shareholder value.

Read moreUBS’s Asset Management Launches First Tokenized Investment Fund

UBS Asset Management has launched its inaugural tokenized investment fund, highlighting a significant trend in the evolving financial landscape.

UBS Asset Management has launched its inaugural tokenized investment fund, highlighting a significant trend in the evolving financial landscape.

Read moreSwiss National Bank Reports CHF62.5 Billion Profit

The Swiss National Bank (SNB) has generated a remarkable CHF62.5 billion profit in the first nine months of this year, reflecting robust financial performance.

The Swiss National Bank (SNB) has generated a remarkable CHF62.5 billion profit in the first nine months of this year, reflecting robust financial performance.

Read moreProfits Rise at Standard Chartered’s Wealth Arm

Standard Chartered's wealth division reports an 11% profit increase in Q3, fueled by a $1.5 billion investment to enhance services and capabilities.

Standard Chartered\'s wealth division reports an 11% profit increase in Q3, fueled by a $1.5 billion investment to enhance services and capabilities.

Read more