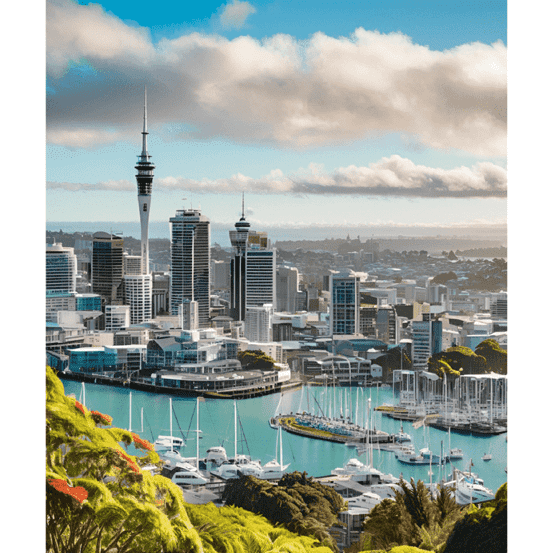

New Zealand Housing Market Needs Summer Surge for Recovery

ANZ Bank warns that New Zealand's stagnant housing market requires a summer sales boost to clear listings and support price recovery by 2025.

New Zealand's housing market, currently languishing in a state of stagnation, is poised for a critical summer sales surge if it is to alleviate the burgeoning backlog of listings and facilitate a meaningful recovery in property prices by 2025, as posited by ANZ Bank. According to CoreLogic's recent report from Wellington, house prices experienced a decline of 0.5% in October compared to September, marking the eighth consecutive month of price depreciation.

The inventory of homes available for sale has reached a decade-high, while transaction volumes remain tepid, resulting in protracted selling timelines, as highlighted in a separate ANZ report. It is anticipated that house prices will stabilize as the year concludes, paving the way for a gradual recovery throughout 2025. However, a sustained uptick in property values will necessitate a significant increase in sales volumes to effectively clear the existing backlog in the market.

The current economic landscape is characterized by stalled growth and rising unemployment, factors that have understandably rendered potential buyers hesitant to engage in borrowing, despite the ongoing decline in prices. The Reserve Bank of New Zealand (RBNZ) has embarked on an aggressive monetary easing strategy, having reduced the Official Cash Rate by 75 basis points since August, with economists projecting an additional 50-point cut in the near future. This shift has begun to lower home-loan interest rates, albeit the pace of decline in house prices has only recently begun to decelerate, suggesting a potential floor for property values may be on the horizon.

While there is a burgeoning sense of optimism, it is important to note that rising sentiment may take time to manifest in tangible data. Although advertised mortgage interest rates have decreased, they remain relatively elevated, compounded by lenders applying a so-called test rate that exceeds the advertised rates when evaluating new customers. As reported by the RBNZ, the test rate hovered around 8% in October, in stark contrast to the approximately 6% rate for a one-year fixed mortgage.

Furthermore, a notable lack of investor interest has dampened demand within the market, as the RBNZ indicated, even as a steady influx of newly constructed homes continues to enter the fray. Industry insiders have reported a potential oversupply of townhouses in Auckland, New Zealand's largest city, where new builds constituted roughly 25% of all listings in October, according to the central bank's findings. As the market navigates these complexities, the interplay of supply, demand, and economic indicators will undoubtedly shape the trajectory of New Zealand's housing landscape in the coming years.

New Zealand Housing Market Needs Summer Surge for Recovery

Greece Real Estate Market: Rise of Serviced Apartments

Explore the growing demand for serviced apartments in central Athens, where integrated hospitality services attract savvy investors in the Greece real estate market.

Explore the growing demand for serviced apartments in central Athens, where integrated hospitality services attract savvy investors in the Greece real estate market.

Read moreHome Prices Hit by Climate Change, J.P. Morgan Warns

J.P. Morgan analysts reveal a negative link between climate risk and home price appreciation. Explore the emerging trends and their impact.

J.P. Morgan analysts reveal a negative link between climate risk and home price appreciation. Explore the emerging trends and their impact.

Read moreRenting in Spain: Prices Finally Decline

The cost of renting in Spain trends downwards, averaging €13/m². Discover insights on this shift after years of steep increases.

The cost of renting in Spain trends downwards, averaging €13/m². Discover insights on this shift after years of steep increases.

Read moreRise of Cash Purchases Outside London: A New Trend

Explore the growing trend of cash purchases outside London and its implications for the property market and economic landscape.

Explore the growing trend of cash purchases outside London and its implications for the property market and economic landscape.

Read moreCanada Real Estate Market: Rents Drop for First Time in over 3 years

For the first time in over three years, average asking rents in Canada fell 1.2% in October, reaching $2,152, according to Rentals.ca.

For the first time in over three years, average asking rents in Canada fell 1.2% in October, reaching $2,152, according to Rentals.ca.

Read moreFewer Than 2% of Dutch Homes Sold to International Buyers

Analyze the decline in international purchases of Dutch houses, revealing key factors influencing this trend and its effects on the housing market.

Analyze the decline in international purchases of Dutch houses, revealing key factors influencing this trend and its effects on the housing market.

Read moreDonald Trump’s Victory May Boost London Property Demand

Knight Frank analyzes how Donald Trump’s election win could increase demand for prime London properties. Discover the potential market shifts.

Knight Frank analyzes how Donald Trump’s election win could increase demand for prime London properties. Discover the potential market shifts.

Read moreGerman Investors Fuel Growth in Greek Real Estate Market

Discover how German-speaking house buyers are revitalizing Greece's realty market, driving demand and investment in stunning properties.

Discover how German-speaking house buyers are revitalizing Greece\'s realty market, driving demand and investment in stunning properties.

Read moreLisbon: 11th City for Rising Luxury House Prices

Lisbon's luxury housing prices increased by 5.6%, outpacing Madrid, Seoul, and Zurich, marking it as a key player in the global real estate market.

Lisbon\'s luxury housing prices increased by 5.6%, outpacing Madrid, Seoul, and Zurich, marking it as a key player in the global real estate market.

Read more