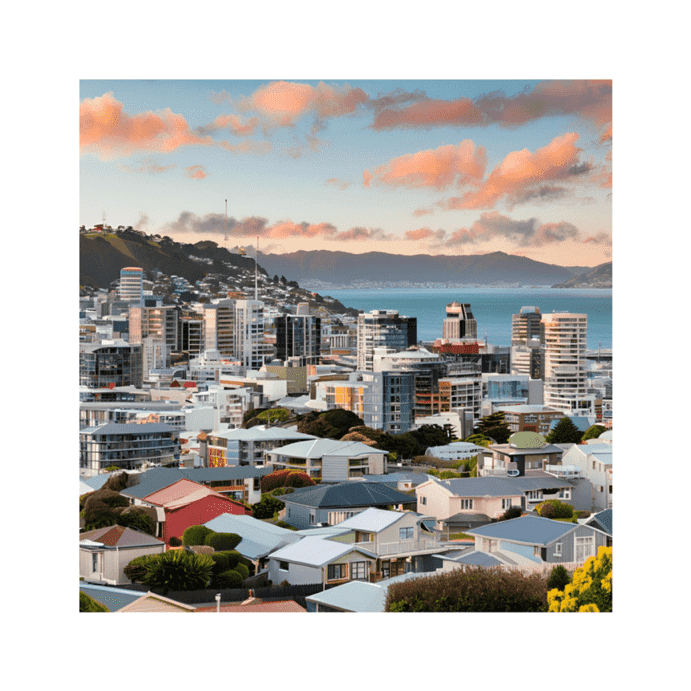

New Zealand Real Estate: Rentals Surge as Prices Drop

Explore the latest trends in the New Zealand real estate market, where rental listings soar amid declining property prices.

Explore the latest trends in the New Zealand real estate market, where rental listings soar amid declining property prices.

As the colder winter months settle in, New Zealand real estate market is witnessing a notable shift, with rental prices experiencing a decline for the second consecutive month. According to the latest Rental Price Index released by Trade Me, the national median weekly rent has decreased by 0.8 percent, dropping from $645 in June to $640 in July. This marks a significant moment, as it is the first time in over two years that back-to-back declines in rental prices have been recorded.

Gavin Lloyd, Trade Me Property’s Customer Director, commented on the implications of this decrease, stating that while any reduction in rental costs is beneficial for tenants, the impact may be limited given the numerous increases that have occurred over the past year. The current market dynamics suggest that the easing of rental prices may not fully alleviate the financial strain that many renters have faced.

Supply Outpaces Demand

The recent decline in rental prices can be attributed to a surge in supply that has outstripped demand. In July, rental listings on Trade Me reached their highest level since the platform began recording data in 2019. This surge represents an 11 percent increase compared to June and a staggering 46 percent increase year-on-year.

Regions contributing significantly to this high supply include Gisborne, which saw a remarkable 124 percent increase in listings year-on-year, followed by the West Coast at 68 percent, Hawke’s Bay at 63 percent, Auckland at 62 percent, and the Bay of Plenty at 59 percent.

Despite a 4 percent improvement in demand compared to the previous month, it remains 27 percent lower than the same time last year, indicating that while more properties are available, fewer people are looking to rent.

A Tale of Two Islands

The rental landscape in New Zealand presents a stark contrast between the North and South Islands. The North Island continues to be more expensive for renters, with the top three most costly regions being Auckland at $680 per week, Bay of Plenty at $670, and Wellington at $650. However, the year-on-year increases in these areas are relatively modest compared to those observed in the South Island.

In contrast, the Otago region has experienced the most significant year-on-year rent increase, soaring by 15.9 percent to reach $620 per week. Other regions in the South Island have also seen notable increases, including Waikato at 7.3 percent, Southland at 6.7 percent, Nelson/Tasman at 5.7 percent, and Marlborough at 4.5 percent.

Record Highs in Christchurch

Despite the overall decline in rental prices, Christchurch has demonstrated resilience in its rental market. The city has recorded new highs for both townhouses and larger properties. Between June and July, the rental prices for properties with five or more bedrooms surged by 12.1 percent, reaching a record high of $1,110 per week. Similarly, townhouses in Ōtautahi have seen a price increase of 3.7 percent, now commanding $560 per week. Additionally, units have also experienced a rise of over 10 percent during the same period.

The New Zealand rental market is currently undergoing a significant transformation, characterized by a decline in rental prices for the first time in over two years. This shift is largely driven by an increase in supply that has outpaced demand, particularly in regions such as Gisborne and Christchurch. While the North Island remains more expensive for renters, the South Island is witnessing substantial year-on-year increases in rental prices. As the market continues to evolve, it remains to be seen how these trends will impact both tenants and landlords in the coming months.

New Zealand Real Estate: Rentals Surge as Prices Drop

Greece Real Estate Market: Rise of Serviced Apartments

Explore the growing demand for serviced apartments in central Athens, where integrated hospitality services attract savvy investors in the Greece real estate market.

Explore the growing demand for serviced apartments in central Athens, where integrated hospitality services attract savvy investors in the Greece real estate market.

Read moreHome Prices Hit by Climate Change, J.P. Morgan Warns

J.P. Morgan analysts reveal a negative link between climate risk and home price appreciation. Explore the emerging trends and their impact.

J.P. Morgan analysts reveal a negative link between climate risk and home price appreciation. Explore the emerging trends and their impact.

Read moreRenting in Spain: Prices Finally Decline

The cost of renting in Spain trends downwards, averaging €13/m². Discover insights on this shift after years of steep increases.

The cost of renting in Spain trends downwards, averaging €13/m². Discover insights on this shift after years of steep increases.

Read moreRise of Cash Purchases Outside London: A New Trend

Explore the growing trend of cash purchases outside London and its implications for the property market and economic landscape.

Explore the growing trend of cash purchases outside London and its implications for the property market and economic landscape.

Read moreCanada Real Estate Market: Rents Drop for First Time in over 3 years

For the first time in over three years, average asking rents in Canada fell 1.2% in October, reaching $2,152, according to Rentals.ca.

For the first time in over three years, average asking rents in Canada fell 1.2% in October, reaching $2,152, according to Rentals.ca.

Read moreFewer Than 2% of Dutch Homes Sold to International Buyers

Analyze the decline in international purchases of Dutch houses, revealing key factors influencing this trend and its effects on the housing market.

Analyze the decline in international purchases of Dutch houses, revealing key factors influencing this trend and its effects on the housing market.

Read moreDonald Trump’s Victory May Boost London Property Demand

Knight Frank analyzes how Donald Trump’s election win could increase demand for prime London properties. Discover the potential market shifts.

Knight Frank analyzes how Donald Trump’s election win could increase demand for prime London properties. Discover the potential market shifts.

Read moreGerman Investors Fuel Growth in Greek Real Estate Market

Discover how German-speaking house buyers are revitalizing Greece's realty market, driving demand and investment in stunning properties.

Discover how German-speaking house buyers are revitalizing Greece\'s realty market, driving demand and investment in stunning properties.

Read moreLisbon: 11th City for Rising Luxury House Prices

Lisbon's luxury housing prices increased by 5.6%, outpacing Madrid, Seoul, and Zurich, marking it as a key player in the global real estate market.

Lisbon\'s luxury housing prices increased by 5.6%, outpacing Madrid, Seoul, and Zurich, marking it as a key player in the global real estate market.

Read more