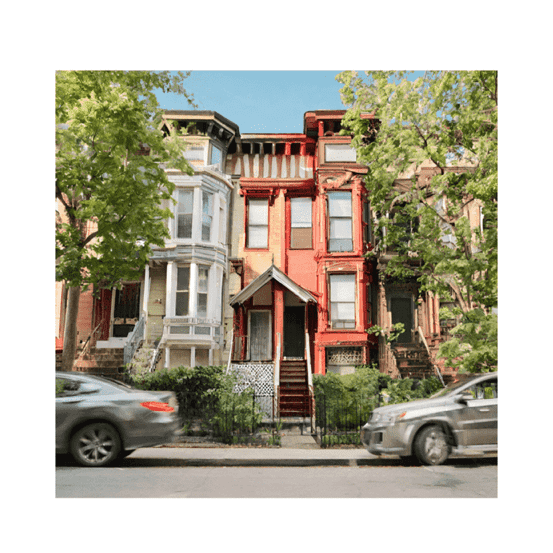

Renting vs. Buying: New Report Reveals Cheaper Rental Options in US Major Cities

Discover the latest findings from Realtor.com on the cost gap between renting and owning in big cities. Is renting the more affordable option?

The latest rental data from Realtor.com paints a grim picture for potential homebuyers, highlighting the growing unaffordability of the US housing market. According to researchers at Realtor.com, it is now more cost-effective to rent rather than own a home in all of the top 50 metro areas in the United States. This marks a significant shift from a year ago when renting was cheaper in only 45 of the 50 markets analyzed.

The rising costs of homeownership can be attributed to a combination of factors, including high demand, low inventory, and increased borrowing rates in the for-sale market. On the other hand, rental prices have started to decrease as developers introduce new rental housing options in major cities.

In February, the cost of purchasing a starter home in the top 50 metros was $1,027 higher than renting, representing a 60.1% difference. This is a stark contrast to the $865 difference observed in February 2023, indicating a $162 increase in monthly savings from renting compared to the previous year.

Some of the metro areas with the largest disparities between renting and owning costsinclude popular pandemic destinations like Austin, Seattle, and various markets in the Southwest and West Coast regions. In Austin and Seattle, for instance, the cost of buying a home is more than double the cost of renting.

The top 10 metros with the greatest savings from renting versus buying are as follows:

1. Austin-Round Rock-Georgetown, TX – $2,165 monthly rent savings (141.5% difference)

2. Seattle-Tacoma-Bellevue, WA – $2,422 savings (121.1%)

3. Phoenix-Mesa-Chandler, AZ – $1,528 savings (99.0%)

4. San Francisco-Oakland-Berkeley, CA – $2,689 savings (95.5%)

5. Los Angeles-Long Beach-Anaheim, CA – $2,539 savings (89.7%)

6. San Jose-Sunnyvale-Santa Clara, CA – $2,780 savings (86.7%)

7. Nashville-Davidson-Murfreesboro-Franklin, TN – $1,366 savings (86.0%)

8. Portland-Vancouver-Hillsboro, OR/WA – $1,396 savings (84.4%)

9. Sacramento-Roseville-Folsom, CA – $1,514 savings (82.1%)

10. Houston-The Woodlands-Sugar Land, TX – $1,103 savings (80.0%)

Prospective buyers are advised to carefully weigh the trade-offs between buying and renting, considering factors beyond just price. While renting may offer short-term financial advantages, homeownership provides the potential for long-term housing wealth gains. Individuals should evaluate their long-term housing plans and personal circumstances before making a decision.

The widening gap between renting and owning costs underscores the challenges faced by potential homebuyers in today's US housing market. It is essential for individuals to carefully assess their financial situation and long-term goals before committing to a housing decision.

Renting vs. Buying: New Report Reveals Cheaper Rental Options in US Major Cities

Greece Real Estate Market: Rise of Serviced Apartments

Explore the growing demand for serviced apartments in central Athens, where integrated hospitality services attract savvy investors in the Greece real estate market.

Explore the growing demand for serviced apartments in central Athens, where integrated hospitality services attract savvy investors in the Greece real estate market.

Read moreHome Prices Hit by Climate Change, J.P. Morgan Warns

J.P. Morgan analysts reveal a negative link between climate risk and home price appreciation. Explore the emerging trends and their impact.

J.P. Morgan analysts reveal a negative link between climate risk and home price appreciation. Explore the emerging trends and their impact.

Read moreRenting in Spain: Prices Finally Decline

The cost of renting in Spain trends downwards, averaging €13/m². Discover insights on this shift after years of steep increases.

The cost of renting in Spain trends downwards, averaging €13/m². Discover insights on this shift after years of steep increases.

Read moreRise of Cash Purchases Outside London: A New Trend

Explore the growing trend of cash purchases outside London and its implications for the property market and economic landscape.

Explore the growing trend of cash purchases outside London and its implications for the property market and economic landscape.

Read moreCanada Real Estate Market: Rents Drop for First Time in over 3 years

For the first time in over three years, average asking rents in Canada fell 1.2% in October, reaching $2,152, according to Rentals.ca.

For the first time in over three years, average asking rents in Canada fell 1.2% in October, reaching $2,152, according to Rentals.ca.

Read moreFewer Than 2% of Dutch Homes Sold to International Buyers

Analyze the decline in international purchases of Dutch houses, revealing key factors influencing this trend and its effects on the housing market.

Analyze the decline in international purchases of Dutch houses, revealing key factors influencing this trend and its effects on the housing market.

Read moreDonald Trump’s Victory May Boost London Property Demand

Knight Frank analyzes how Donald Trump’s election win could increase demand for prime London properties. Discover the potential market shifts.

Knight Frank analyzes how Donald Trump’s election win could increase demand for prime London properties. Discover the potential market shifts.

Read moreGerman Investors Fuel Growth in Greek Real Estate Market

Discover how German-speaking house buyers are revitalizing Greece's realty market, driving demand and investment in stunning properties.

Discover how German-speaking house buyers are revitalizing Greece\'s realty market, driving demand and investment in stunning properties.

Read moreLisbon: 11th City for Rising Luxury House Prices

Lisbon's luxury housing prices increased by 5.6%, outpacing Madrid, Seoul, and Zurich, marking it as a key player in the global real estate market.

Lisbon\'s luxury housing prices increased by 5.6%, outpacing Madrid, Seoul, and Zurich, marking it as a key player in the global real estate market.

Read more