Revealing the Harsh Reality of Florida Residents Amidst the Housing Crisis

In recent times, the housing crisis has been an increasing concern for a majority of Florida residents. According to a poll conducted by market research firm Redfield & Wilton Strategies, a staggering 76% of Florida residents believe that current home prices in the state are "too high." This sentiment highlights the growing anguish experienced by many Floridians as they struggle to find affordable housing options.

In recent times, the housing crisis has been an increasing concern for a majority of Florida residents. According to a poll conducted by market research firm Redfield & Wilton Strategies, a staggering 76% of Florida residents believe that current home prices in the state are "too high." This sentiment highlights the growing anguish experienced by many Floridians as they struggle to find affordable housing options.

The latest data provided by Zillow Real Estate reveals that as of June 30th, the median value of a home in Florida stands at $390,856. This figure indicates a 1.6% increase from the previous year. In comparison, the national average for median home values is $348,853, which is an astounding 10% lower than that of Florida. The significant disparity in home prices between Florida and the rest of the nation only amplifies the residents' concern.

One of the primary factors driving the soaring housing prices in Florida is the historically low mortgage rates witnessed during the pandemic. As prospective homeowners seek to take advantage of favorable borrowing conditions, the demand for housing has surged. Consequently, this increased demand has led to a shortage of available housing options, driving up prices even further.

According to Norada Real Estate Investments, a real estate investment firm, Florida's home values have shot up by a staggering 80% over the past five years. The state's sustained supply shortages, coupled with the continuous influx of people relocating to the area, have contributed to this drastic increase. Sadly, this upward trend in home values has resulted in Florida being home to some of the most expensive neighborhoods in the United States.

For instance, the neighborhoods of Palm Island, Port Royal, and Golden Beach have median home values of $8,018,344, $15,569, and $7,228,892, respectively, according to Zillow Company. These exorbitant prices pose significant challenges for aspiring homeowners, exacerbating the housing crisis in the region.

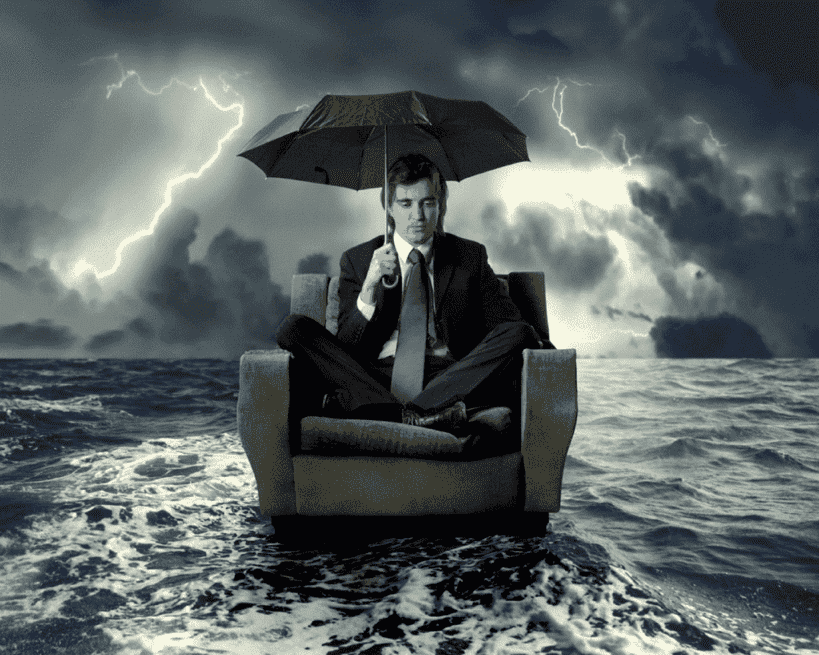

However, the concerns surrounding high home prices are not the only challenge Florida residents face. The state is now grappling with an insurance crisis. Several major insurers have recently withdrawn their services from Florida, including agricultural insurance. The primary driver behind this exodus is the increased risk of extreme weather events in the state.

With insurance companies pulling out, Floridians now have limited options for insurance coverage, which is expected to drive up insurance costs significantly. This, in turn, will further escalate the overall cost of homeownership in the state. The rise in insurance premiums and ensuing financial stress could potentially result in increased home sales or mortgage defaults.

Revealing the Harsh Reality of Florida Residents Amidst the Housing Crisis

Growing Trend: Seniors Preferring to Age in Home, CMHC Report Finds

Aging in place is becoming increasingly popular among Canadian seniors, as revealed by the CMHC report. Find out why more seniors are choosing to stay put in their homes.

Aging in place is becoming increasingly popular among Canadian seniors, as revealed by the CMHC report. Find out why more seniors are choosing to stay put in their homes.

Read moreShocking Truth: Canadians Trapped in a Vortex of Personal Finance Stress

Recent survey data from Edward Jones Canada suggests that most Canadians are struggling with finances, and it’s impacting their quality of life.

Recent survey data from Edward Jones Canada suggests that most Canadians are struggling with finances, and it’s impacting their quality of life.

Read moreMortgage Payments Increasing: What Should You Do?

Facing higher monthly payments due to mortgage payments increasing? Canadian homeowners must decide between renewal or refinancing of their home loan. Find out what you should do.

Facing higher monthly payments due to mortgage payments increasing? Canadian homeowners must decide between renewal or refinancing of their home loan. Find out what you should do.

Read moreIncome Gap Widens: Americans Must Earn $40,000 Above Average to Buy a Home in 2023

According to new data from Redfin, Americans must now earn $40,000 above average to afford a home in 2023. This represents a significant increase in the income gap and highlights the challenges faced by potential homebuyers.

According to new data from Redfin, Americans must now earn $40,000 above average to afford a home in 2023. This represents a significant increase in the income gap and highlights the challenges faced by potential homebuyers.

Read moreWarning: The Disturbing Rise of 'Living for the Moment' Culture in US society

Discover the alarming trend of the 'Living for the Moment' culture in US society. Explore how extravagant spending impacts the economy despite financial uncertainties. Read more to understand the implications.

Discover the alarming trend of the \'Living for the Moment\' culture in US society. Explore how extravagant spending impacts the economy despite financial uncertainties. Read more to understand the implications.

Read moreRising Trend of Converted Vehicles: A Solution to UK's Housing Crisis

Discover the rising trend of converted vehicles as a creative solution to the UK's housing crisis. Explore how DIY home projects, such as transforming horseboxes, lorries, and buses, offer independence and cost-saving benefits amidst a shortage of affordable housing options.

Discover the rising trend of converted vehicles as a creative solution to the UK\'s housing crisis. Explore how DIY home projects, such as transforming horseboxes, lorries, and buses, offer independence and cost-saving benefits amidst a shortage of affordable housing options.

Read moreRevealing UK Supermarkets' Shocking New Security Measures for Shoppers

Find out about the shocking new security measures in UK supermarkets, including receipt requirements and bag checks. Will this become the new norm for grocery shopping? Stay informed.

Find out about the shocking new security measures in UK supermarkets, including receipt requirements and bag checks. Will this become the new norm for grocery shopping? Stay informed.

Read moreHousing Affordability Crisis: Interest Rates Soar Above 7%, American Millennials Struggle to Buy Homes

As interest rates reach their highest levels in 21 years, housing affordability plummets for Millennials. The American dream of home ownership becomes increasingly out of reach, impacting wealth creation and financial stability.

As interest rates reach their highest levels in 21 years, housing affordability plummets for Millennials. The American dream of home ownership becomes increasingly out of reach, impacting wealth creation and financial stability.

Read moreCanadian Homeowners in a Financial Dilemma: Renting vs. Owning Amid Rising Interest Rates

Delve into the financial dilemma faced by Canadian homeowners amidst the Bank of Canada's decision to maintain elevated interest rates. Explore the potential implications, such as increased rental demand and higher rents, exacerbating affordability concerns. Stay informed with our comprehensive analysis.

Delve into the financial dilemma faced by Canadian homeowners amidst the Bank of Canada\'s decision to maintain elevated interest rates. Explore the potential implications, such as increased rental demand and higher rents, exacerbating affordability concerns. Stay informed with our comprehensive analysis.

Read more