Societe Generale Sells 57.93% Stake in Guinea Unit

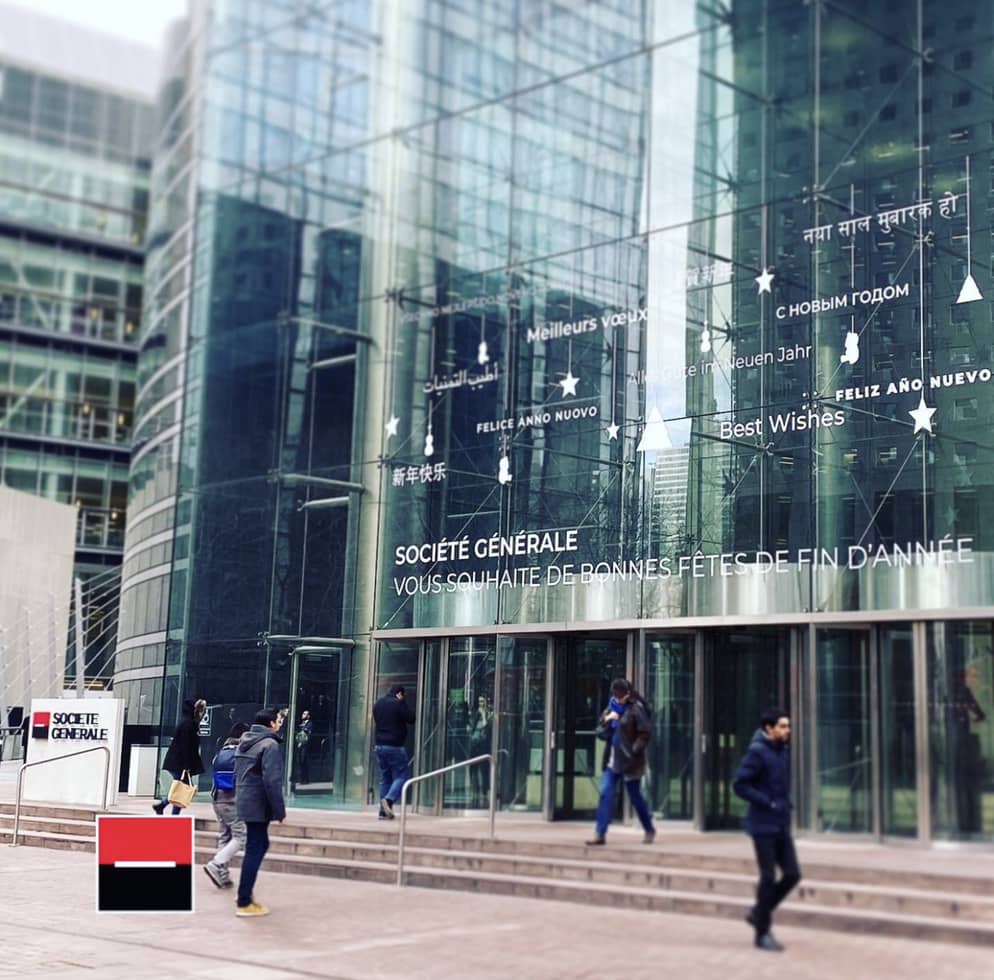

French bank Societe Generale announces a deal with Atlantic Financial Group to sell a majority stake in its Guinean operations, enhancing strategic focus.

In a significant strategic maneuver, Société Générale (SOGN.PA) announced on Friday its agreement with Atlantic Financial Group to divest a substantial 57.93% stake in its Guinean subsidiary. This move is part of Chief Executive Slawomir Krupa's broader initiative to enhance profitability and bolster capital reserves through rigorous cost-cutting measures and the divestiture of non-core assets, thereby optimizing the bank's overall performance metrics.

Earlier in August, the financial institution disclosed its intentions to offload its UK and Swiss private banking divisions for a staggering sum of approximately $1 billion. Furthermore, in April, Société Générale revealed a deal to relinquish its professional equipment financing segment for €1.1 billion (equivalent to $1.23 billion) and its stakes in Moroccan units for €745 million.

While the bank has opted to keep the financial specifics of the Guinean unit's sale under wraps, it did indicate in a formal statement that this transaction is anticipated to yield a positive impact of around 2 basis points on its Common Equity Tier 1 (CET1) ratio upon completion, which is projected to occur by the end of the first quarter of 2025.

In a world where financial institutions are often likened to ships navigating turbulent seas, one might say that Société Générale is trimming its sails and charting a course toward clearer waters, albeit with a few waves still to navigate.

Societe Generale Sells 57.93% Stake in Guinea Unit

ASR Divests Knab to Bawag Group for €590 Million

ASR's strategic sale of Knab to Bawag Group marks a €590 million deal, with €100 million allocated for share repurchase to boost shareholder value.

ASR\'s strategic sale of Knab to Bawag Group marks a €590 million deal, with €100 million allocated for share repurchase to boost shareholder value.

Read moreUBS’s Asset Management Launches First Tokenized Investment Fund

UBS Asset Management has launched its inaugural tokenized investment fund, highlighting a significant trend in the evolving financial landscape.

UBS Asset Management has launched its inaugural tokenized investment fund, highlighting a significant trend in the evolving financial landscape.

Read moreSwiss National Bank Reports CHF62.5 Billion Profit

The Swiss National Bank (SNB) has generated a remarkable CHF62.5 billion profit in the first nine months of this year, reflecting robust financial performance.

The Swiss National Bank (SNB) has generated a remarkable CHF62.5 billion profit in the first nine months of this year, reflecting robust financial performance.

Read moreProfits Rise at Standard Chartered’s Wealth Arm

Standard Chartered's wealth division reports an 11% profit increase in Q3, fueled by a $1.5 billion investment to enhance services and capabilities.

Standard Chartered\'s wealth division reports an 11% profit increase in Q3, fueled by a $1.5 billion investment to enhance services and capabilities.

Read moreNatWest’s Coutts Sees Profit Surge to £90 Million

NatWest Group's Coutts reports a significant profit increase to £90M in Q3 2024, highlighting strong income growth and strategic financial management.

NatWest Group\'s Coutts reports a significant profit increase to £90M in Q3 2024, highlighting strong income growth and strategic financial management.

Read moreUBS Achieves Billion-Franc Profit, Exceeds Expectations

Swiss bank UBS reports a billion-franc profit in Q3 2024, surpassing market expectations while advancing the Credit Suisse integration efforts.

Swiss bank UBS reports a billion-franc profit in Q3 2024, surpassing market expectations while advancing the Credit Suisse integration efforts.

Read moreOnline Lending Market Declines in Switzerland

Explore the reasons behind the shrinking online lending market in Switzerland and its impact on borrowers and financial institutions.

Explore the reasons behind the shrinking online lending market in Switzerland and its impact on borrowers and financial institutions.

Read moreSantander Launches Digital Bank in the U.S.

Santander launches Openbank in the U.S. to enhance growth, focusing on deposit generation to support its auto lending strategy. Explore the details.

Santander launches Openbank in the U.S. to enhance growth, focusing on deposit generation to support its auto lending strategy. Explore the details.

Read moreAtlantic Union Bank Acquires Sandy Spring for $1.6B

Atlantic Union Bank's $1.6B deal expands its presence in the D.C. area, adding 53 branches and doubling its wealth management services.

Atlantic Union Bank\'s $1.6B deal expands its presence in the D.C. area, adding 53 branches and doubling its wealth management services.

Read more