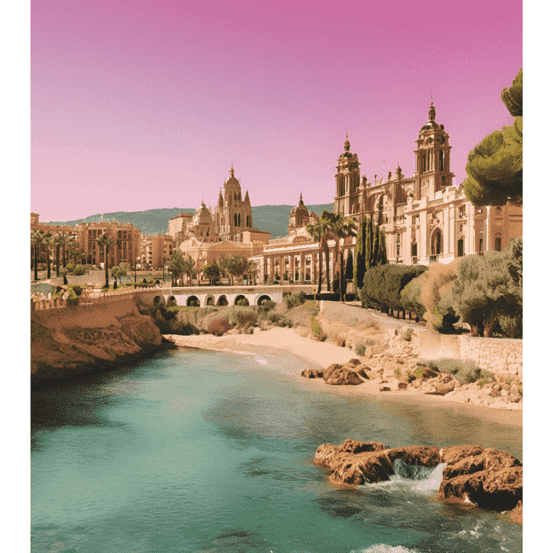

Spain Real Estate Market Soars 9.6%. Is It a Bubble?

Spain real estate market grows 9.6% annually, surpassing 2007 peaks. Discover the trends and data behind this remarkable surge.

Spain real estate market is currently experiencing a remarkable renaissance, characterized by unprecedented growth that has left many analysts both astounded and intrigued. According to the latest data from Idealista, the market has surged by an impressive 9.6% year-on-year and a staggering 16.62% since January 2023 alone. This meteoric rise has propelled property values to heights not witnessed since the infamous housing bubble of 2007.

As it stands, the average cost of a home in Spain has reached €2,209 per square meter, marking a 4.4% increase from the previous peak of €2,115 in June 2007. However, this trajectory is not without its historical context; following the 2007 peak, prices plummeted to €1,890 by February 2010, a decline exacerbated by the eurozone crisis that plunged the nation into economic turmoil. Yet, since hitting a nadir of €1,491 in September 2016, Spain’s housing market has embarked on a remarkable recovery, gaining significant momentum in early 2023.

In the bustling metropolis of Madrid, house prices have skyrocketed by 18.8% over the past year, reaching an eye-watering €4,830 per square meter. Barcelona, not to be outdone, has seen its prices rise by 10.8%, now averaging €4,597 per square meter. San Sebastián claims the title of the most expensive city overall, with prices soaring to €5,631 per square meter, while Zamora offers a more palatable entry point at €1,171.

Interestingly, the city of Valencia, previously beleaguered by economic strife, has recorded the highest price increase at a remarkable 20%. This is closely followed by Málaga (19.6%), Santander (18.1%), and Alicante (16.7%). Among the provinces, a notable trend emerges: all but four have seen price increases, with the Canary Islands—specifically Santa Cruz de Tenerife and Las Palmas—experiencing the most significant rises at 16.4% and 16%, respectively. Other notable growth regions include the Community of Madrid (15.4%), the Balearic Islands (14.8%), and the Region of Murcia (14.9%).

Conversely, prospective homebuyers may wish to steer clear of Ourense (-3.2%), Córdoba (-2.5%), Badajoz (-1.1%), and Ciudad Real (-0.7%), where prices are on a downward trajectory. The Balearic Islands continue to hold the title of the most expensive autonomous region, with an average price of €4,663 per square meter, followed by the Community of Madrid (€3,638), the Basque Country (€3,015), the Canary Islands (€2,767), and Catalonia (€2,443). For those on the hunt for bargains, Castilla-La Mancha (€937), Extremadura (€977), and Castilla y León (€1,199) present more affordable options.

The Spain real estate market is not merely recovering; it is thriving, with a complexity of factors driving this resurgence. As the landscape evolves, one can only wonder how sustainable this growth will be and what implications it holds for the future of housing in Spain.

Spain Real Estate Market Soars 9.6%. Is It a Bubble?

Greece Real Estate Market: Rise of Serviced Apartments

Explore the growing demand for serviced apartments in central Athens, where integrated hospitality services attract savvy investors in the Greece real estate market.

Explore the growing demand for serviced apartments in central Athens, where integrated hospitality services attract savvy investors in the Greece real estate market.

Read moreHome Prices Hit by Climate Change, J.P. Morgan Warns

J.P. Morgan analysts reveal a negative link between climate risk and home price appreciation. Explore the emerging trends and their impact.

J.P. Morgan analysts reveal a negative link between climate risk and home price appreciation. Explore the emerging trends and their impact.

Read moreRenting in Spain: Prices Finally Decline

The cost of renting in Spain trends downwards, averaging €13/m². Discover insights on this shift after years of steep increases.

The cost of renting in Spain trends downwards, averaging €13/m². Discover insights on this shift after years of steep increases.

Read moreRise of Cash Purchases Outside London: A New Trend

Explore the growing trend of cash purchases outside London and its implications for the property market and economic landscape.

Explore the growing trend of cash purchases outside London and its implications for the property market and economic landscape.

Read moreCanada Real Estate Market: Rents Drop for First Time in over 3 years

For the first time in over three years, average asking rents in Canada fell 1.2% in October, reaching $2,152, according to Rentals.ca.

For the first time in over three years, average asking rents in Canada fell 1.2% in October, reaching $2,152, according to Rentals.ca.

Read moreFewer Than 2% of Dutch Homes Sold to International Buyers

Analyze the decline in international purchases of Dutch houses, revealing key factors influencing this trend and its effects on the housing market.

Analyze the decline in international purchases of Dutch houses, revealing key factors influencing this trend and its effects on the housing market.

Read moreDonald Trump’s Victory May Boost London Property Demand

Knight Frank analyzes how Donald Trump’s election win could increase demand for prime London properties. Discover the potential market shifts.

Knight Frank analyzes how Donald Trump’s election win could increase demand for prime London properties. Discover the potential market shifts.

Read moreGerman Investors Fuel Growth in Greek Real Estate Market

Discover how German-speaking house buyers are revitalizing Greece's realty market, driving demand and investment in stunning properties.

Discover how German-speaking house buyers are revitalizing Greece\'s realty market, driving demand and investment in stunning properties.

Read moreLisbon: 11th City for Rising Luxury House Prices

Lisbon's luxury housing prices increased by 5.6%, outpacing Madrid, Seoul, and Zurich, marking it as a key player in the global real estate market.

Lisbon\'s luxury housing prices increased by 5.6%, outpacing Madrid, Seoul, and Zurich, marking it as a key player in the global real estate market.

Read more