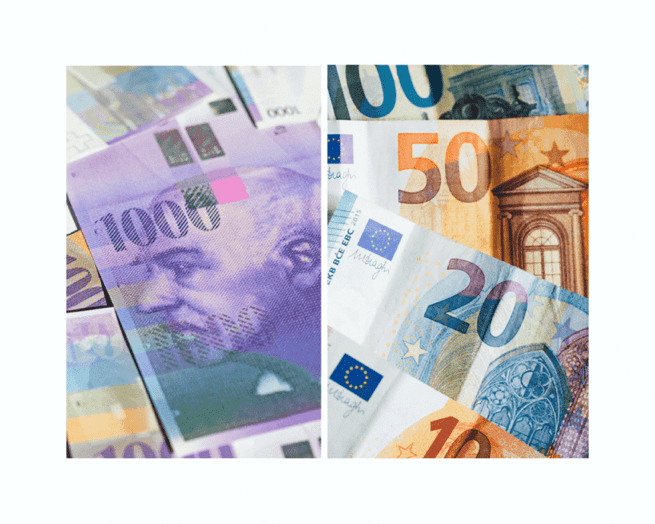

Swiss Franc Surges Against Euro

The Swiss franc has surged to its highest level against the euro since January 2015, as the euro experienced a significant drop due to market expectations of early interest rate cuts from the European Central Bank.

The euro fell to 0.9404 francs against the Swiss franc, marking its lowest level since the Swiss National Bank ended its minimum exchange rate policy in January 2015. This significant drop was attributed to market expectations of early interest rate cuts from the European Central Bank, following dovish commentary and weak economic data.

The euro experienced a significant drop against the Swiss franc, reaching its lowest point in almost nine years on Thursday. This decline was attributed to market expectations of early interest rate cuts from the European Central Bank, following dovish commentary and weak economic data. At 1122 GMT, the euro fell to 0.9404 francs against the franc, marking its lowest level since the Swiss National Bank ended its minimum exchange rate policy in January 2015.

This development has raised concerns among investors and economists, as it reflects the growing pessimism surrounding the Eurozone economy. The prospect of interest rate cuts from the European Central Bank has contributed to the downward pressure on the euro, as investors seek safer assets such as the Swiss franc.

The weakening of the euro against the Swiss franc has significant implications for trade and investment within the Eurozone. A weaker euro makes Eurozone exports more competitive in international markets, potentially boosting the region's export-driven economy. However, it also makes imports more expensive, which could lead to higher inflation and reduced purchasing power for Eurozone consumers.

The euro's decline to its lowest level against the Swiss franc in nearly nine years underscores the challenges facing the Eurozone economy. The prospect of early interest rate cuts from the European Central Bank has added to the downward pressure on the euro, raising concerns among investors and economists about the region's economic outlook.

Swiss Franc Surges Against Euro

KBC Bank Recovers €800M in Customer Deposits

KBC Bank has regained more customers than lost post-Belgian State bonds, adding €800 million in deposits. Discover the details here.

KBC Bank has regained more customers than lost post-Belgian State bonds, adding €800 million in deposits. Discover the details here.

Read moreSantander UK Adjusts Mortgages After Rate Cut

In light of the Bank of England's 0.25% rate reduction to 4.75%, Santander UK announces significant changes to its mortgage offerings.

In light of the Bank of England\'s 0.25% rate reduction to 4.75%, Santander UK announces significant changes to its mortgage offerings.

Read moreUBS Launches Blockchain Pilot for Cross-Border Payments

Swiss bank UBS successfully pilots its blockchain-based UBS Digital Cash, aiming to enhance efficiency in cross-border transactions.

Swiss bank UBS successfully pilots its blockchain-based UBS Digital Cash, aiming to enhance efficiency in cross-border transactions.

Read moreSantander’s Profits Hit €9.309 Billion

Spanish financial group Santander reports €9.309 billion in profits for the first nine months of 2023, a 14% increase from last year.

Spanish financial group Santander reports €9.309 billion in profits for the first nine months of 2023, a 14% increase from last year.

Read moreBNP Paribas Reports Net Income Boost from Corporate Banking

BNP Paribas has recorded a notable increase in net income, fueled by strong performance in its corporate banking sector. Explore the details.

BNP Paribas has recorded a notable increase in net income, fueled by strong performance in its corporate banking sector. Explore the details.

Read moreASR Divests Knab to Bawag Group for €590 Million

ASR's strategic sale of Knab to Bawag Group marks a €590 million deal, with €100 million allocated for share repurchase to boost shareholder value.

ASR\'s strategic sale of Knab to Bawag Group marks a €590 million deal, with €100 million allocated for share repurchase to boost shareholder value.

Read moreUBS’s Asset Management Launches First Tokenized Investment Fund

UBS Asset Management has launched its inaugural tokenized investment fund, highlighting a significant trend in the evolving financial landscape.

UBS Asset Management has launched its inaugural tokenized investment fund, highlighting a significant trend in the evolving financial landscape.

Read moreSwiss National Bank Reports CHF62.5 Billion Profit

The Swiss National Bank (SNB) has generated a remarkable CHF62.5 billion profit in the first nine months of this year, reflecting robust financial performance.

The Swiss National Bank (SNB) has generated a remarkable CHF62.5 billion profit in the first nine months of this year, reflecting robust financial performance.

Read moreProfits Rise at Standard Chartered’s Wealth Arm

Standard Chartered's wealth division reports an 11% profit increase in Q3, fueled by a $1.5 billion investment to enhance services and capabilities.

Standard Chartered\'s wealth division reports an 11% profit increase in Q3, fueled by a $1.5 billion investment to enhance services and capabilities.

Read more