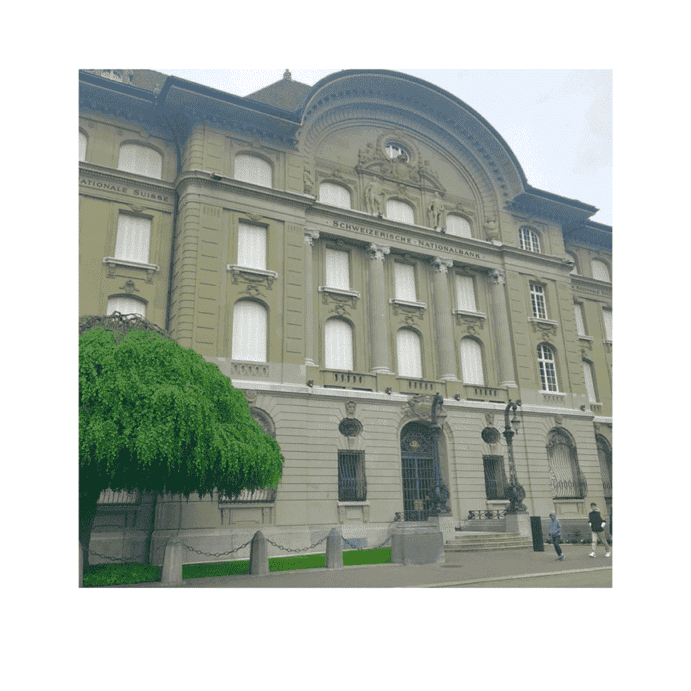

Swiss National Bank Interest Rate Cuts Halve 10-Year Mortgage Costs

Discover how the Swiss National Bank (SNB)'s rate cuts have significantly reduced 10-year fixed mortgage costs, as revealed by Comparis.

Interest rate reductions orchestrated by the Swiss National Bank (SNB) have effectively halved the financial burden associated with servicing 10-year fixed-rate mortgages, a significant shift from the peaks observed in 2022, as reported by the online comparison platform Comparis. In the third quarter, the average rates for ten-year fixed mortgages, as calculated by Comparis, fell within the range of 1.5% to 2.0%, while Saron-based loans hovered between 1.6% and 2.0%. This relatively attractive rate environment has sparked robust demand; a striking 72% of respondents who recently secured home loans opted for a ten-year fixed-rate mortgage, a marked increase from the 40-50% range noted in the preceding two quarters. Conversely, the share of medium-term mortgages—specifically those spanning four to six years—plummeted to 14%, a halving over the span of just three months. Furthermore, three-year mortgages, including those tied to the Saron rate, dwindled to a mere 7%, down from a more substantial 20% previously.

The downward trajectory of indicative ten-year mortgage rates has remained steadfast since June. By the conclusion of the third quarter, these rates settled at 1.81%, reflecting a decrease of 0.33 percentage points since the end of June. For five-year rates, Comparis reported a figure of 1.68%, which represents a reduction of 0.36 percentage points over the same three-month period. At the dawn of January, these indicative rates were notably higher, standing at 2.26% and 2.13%, respectively. Additionally, the yield on ten-year Swiss government bonds was recorded at 0.41% at the end of September, marking a decline of 0.25 percentage points since the year's commencement.

In September, the Swiss National Bank (SNB) executed a key interest rate cut of 0.25 percentage points, bringing the rate down to 1%, marking the third consecutive reduction of this magnitude. This trend of monetary easing is not isolated to Switzerland; major central banks globally are also adopting similar strategies. The US Federal Reserve, for instance, made headlines by slashing its rate by 0.50 points, now targeting a range of 4.75-5%. Meanwhile, the European Central Bank has set its key rate at 3.5%, following a modest 0.25% cut. In this intricate dance of monetary policy, one can only wonder: are we witnessing a global trend towards lower rates, or merely a temporary reprieve in the face of economic uncertainty?

Swiss National Bank Interest Rate Cuts Halve 10-Year Mortgage Costs

KBC Bank Recovers €800M in Customer Deposits

KBC Bank has regained more customers than lost post-Belgian State bonds, adding €800 million in deposits. Discover the details here.

KBC Bank has regained more customers than lost post-Belgian State bonds, adding €800 million in deposits. Discover the details here.

Read moreSantander UK Adjusts Mortgages After Rate Cut

In light of the Bank of England's 0.25% rate reduction to 4.75%, Santander UK announces significant changes to its mortgage offerings.

In light of the Bank of England\'s 0.25% rate reduction to 4.75%, Santander UK announces significant changes to its mortgage offerings.

Read moreUBS Launches Blockchain Pilot for Cross-Border Payments

Swiss bank UBS successfully pilots its blockchain-based UBS Digital Cash, aiming to enhance efficiency in cross-border transactions.

Swiss bank UBS successfully pilots its blockchain-based UBS Digital Cash, aiming to enhance efficiency in cross-border transactions.

Read moreSantander’s Profits Hit €9.309 Billion

Spanish financial group Santander reports €9.309 billion in profits for the first nine months of 2023, a 14% increase from last year.

Spanish financial group Santander reports €9.309 billion in profits for the first nine months of 2023, a 14% increase from last year.

Read moreBNP Paribas Reports Net Income Boost from Corporate Banking

BNP Paribas has recorded a notable increase in net income, fueled by strong performance in its corporate banking sector. Explore the details.

BNP Paribas has recorded a notable increase in net income, fueled by strong performance in its corporate banking sector. Explore the details.

Read moreASR Divests Knab to Bawag Group for €590 Million

ASR's strategic sale of Knab to Bawag Group marks a €590 million deal, with €100 million allocated for share repurchase to boost shareholder value.

ASR\'s strategic sale of Knab to Bawag Group marks a €590 million deal, with €100 million allocated for share repurchase to boost shareholder value.

Read moreUBS’s Asset Management Launches First Tokenized Investment Fund

UBS Asset Management has launched its inaugural tokenized investment fund, highlighting a significant trend in the evolving financial landscape.

UBS Asset Management has launched its inaugural tokenized investment fund, highlighting a significant trend in the evolving financial landscape.

Read moreSwiss National Bank Reports CHF62.5 Billion Profit

The Swiss National Bank (SNB) has generated a remarkable CHF62.5 billion profit in the first nine months of this year, reflecting robust financial performance.

The Swiss National Bank (SNB) has generated a remarkable CHF62.5 billion profit in the first nine months of this year, reflecting robust financial performance.

Read moreProfits Rise at Standard Chartered’s Wealth Arm

Standard Chartered's wealth division reports an 11% profit increase in Q3, fueled by a $1.5 billion investment to enhance services and capabilities.

Standard Chartered\'s wealth division reports an 11% profit increase in Q3, fueled by a $1.5 billion investment to enhance services and capabilities.

Read more