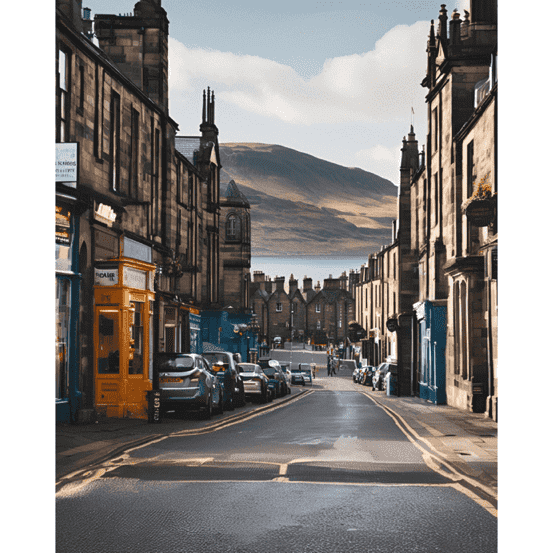

UK: First-Time Buyers in Scotland Defy Market Trends

Despite rising house prices and interest rates, first-time buyers in Scotland are making a comeback. Explore the factors behind this trend

In a rather intriguing turn of events, despite the relentless ascent of house prices and the concomitant rise in interest rates, first-time buyers in Scotland are making a notable resurgence in the housing market, as reported by DJ Alexander Ltd., a prominent lettings and estate agency. The agency's latest data unveils a distinctly optimistic trend that is hard to overlook.

During the first quarter of 2024—the most recent period for which official statistics are available—new mortgage lending to first-time buyers in Scotland exhibited an impressive annual growth rate of 9.6%. This figure stands in stark contrast to the modest 2.2% increase observed among existing homeowners, suggesting that the FTB demographic is not merely dipping its toes but rather diving headfirst into the market.

Moreover, the mean loan-to-value (LTV) ratio for mortgages extended to first-time buyers has surged to 80.9% at the commencement of this year, nearly matching pre-pandemic levels—just a mere 0.6% shy. In contrast, the homeowner market languishes at a 3.5% deficit compared to its pre-pandemic state, raising questions about the resilience of established homeowners versus the buoyancy of new entrants.

Interestingly, Scotland boasted the third lowest level of deposit requirements in the UK last year. While average prices for first-time buyers in Scotland have escalated by 4.7% over the year leading up to July 2024—from £152,983 to £160,213—this increase occurred concurrently with a 6.0% rise in average income. This juxtaposition of rising prices against increasing income levels paints a complex picture of the Scottish housing landscape, one that is both promising and perplexing.

The current dynamics of the housing market in Scotland reveal a fascinating interplay of economic factors, where first-time buyers in Scotland are navigating a landscape fraught with challenges yet emerging with renewed vigor. As we observe these trends, one cannot help but ponder the implications for the broader market and the potential for continued growth amidst the prevailing uncertainties.

UK: First-Time Buyers in Scotland Defy Market Trends

Greece Real Estate Market: Rise of Serviced Apartments

Explore the growing demand for serviced apartments in central Athens, where integrated hospitality services attract savvy investors in the Greece real estate market.

Explore the growing demand for serviced apartments in central Athens, where integrated hospitality services attract savvy investors in the Greece real estate market.

Read moreHome Prices Hit by Climate Change, J.P. Morgan Warns

J.P. Morgan analysts reveal a negative link between climate risk and home price appreciation. Explore the emerging trends and their impact.

J.P. Morgan analysts reveal a negative link between climate risk and home price appreciation. Explore the emerging trends and their impact.

Read moreRenting in Spain: Prices Finally Decline

The cost of renting in Spain trends downwards, averaging €13/m². Discover insights on this shift after years of steep increases.

The cost of renting in Spain trends downwards, averaging €13/m². Discover insights on this shift after years of steep increases.

Read moreRise of Cash Purchases Outside London: A New Trend

Explore the growing trend of cash purchases outside London and its implications for the property market and economic landscape.

Explore the growing trend of cash purchases outside London and its implications for the property market and economic landscape.

Read moreCanada Real Estate Market: Rents Drop for First Time in over 3 years

For the first time in over three years, average asking rents in Canada fell 1.2% in October, reaching $2,152, according to Rentals.ca.

For the first time in over three years, average asking rents in Canada fell 1.2% in October, reaching $2,152, according to Rentals.ca.

Read moreFewer Than 2% of Dutch Homes Sold to International Buyers

Analyze the decline in international purchases of Dutch houses, revealing key factors influencing this trend and its effects on the housing market.

Analyze the decline in international purchases of Dutch houses, revealing key factors influencing this trend and its effects on the housing market.

Read moreDonald Trump’s Victory May Boost London Property Demand

Knight Frank analyzes how Donald Trump’s election win could increase demand for prime London properties. Discover the potential market shifts.

Knight Frank analyzes how Donald Trump’s election win could increase demand for prime London properties. Discover the potential market shifts.

Read moreGerman Investors Fuel Growth in Greek Real Estate Market

Discover how German-speaking house buyers are revitalizing Greece's realty market, driving demand and investment in stunning properties.

Discover how German-speaking house buyers are revitalizing Greece\'s realty market, driving demand and investment in stunning properties.

Read moreLisbon: 11th City for Rising Luxury House Prices

Lisbon's luxury housing prices increased by 5.6%, outpacing Madrid, Seoul, and Zurich, marking it as a key player in the global real estate market.

Lisbon\'s luxury housing prices increased by 5.6%, outpacing Madrid, Seoul, and Zurich, marking it as a key player in the global real estate market.

Read more