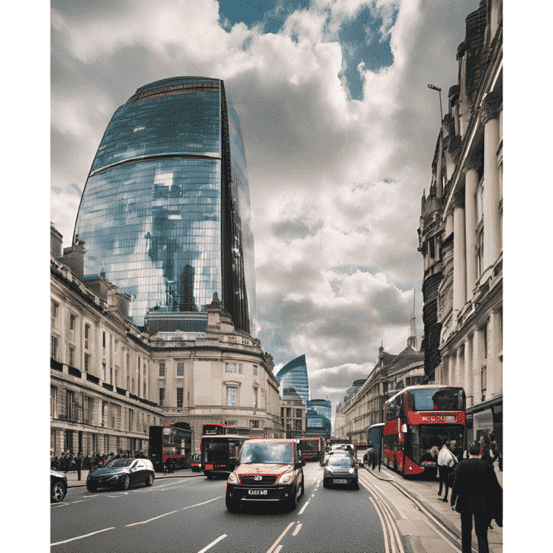

UK Real Estate Market: Buy-to-Let Decline Boosts Sales

Explore how the decline in buy-to-let properties is driving a surge in home sales within the UK real estate market. Insights and analysis await.

The UK real estate market is currently experiencing a remarkable surge in activity, with a staggering 26% increase in homes undergoing the buying process compared to the same period last year, according to research conducted by Zoopla. This translates to an impressive 306,000 properties changing hands, collectively valued at a whopping £133 billion. The driving forces behind this phenomenon appear to be a confluence of rising incomes and historically low mortgage rates.

However, an intriguing twist in this narrative is the apparent decline in confidence among buy-to-let investors, leading to a notable exodus of landlords from the market, as they offload their housing stock. As we look ahead, projections indicate a modest 2% increase in property prices for 2024, alongside an anticipated 1.1 million transactions. Notably, house prices are expected to rise by 2% over the course of the year.

In regions deemed more affordable, the upward trajectory of house prices is particularly pronounced, with the North-East, Yorkshire & Humberside, North-West, Scotland, and Northern Ireland all experiencing above-average growth rates of 2%, 2%, 2.3%, 2.4%, and a remarkable 5.6%, respectively. In stark contrast, Eastern England and the South-East are witnessing slight declines, with prices dipping by -0.3% and -0.1%, respectively.

For first-time buyers, the current landscape is somewhat favorable, as they are exempt from stamp duty on properties valued up to £425,000, and only incur partial stamp duty on homes priced up to £625,000 (applicable in England and Northern Ireland). Presently, a commendable 80% of first-time buyers are enjoying a stamp duty-free experience, while 14% are only partially liable. However, this advantageous support is set to expire in April 2025, unless the forthcoming Budget introduces a reversal. Should the previous thresholds be reinstated, an additional 20% of buyers would find themselves liable for stamp duty, with a further 14% facing partial obligations.

The UK real estate market is a dynamic and multifaceted arena, where economic factors, investor sentiment, and governmental policies intertwine to shape the experiences of buyers and sellers alike.

UK Real Estate Market: Buy-to-Let Decline Boosts Sales

Greece Real Estate Market: Rise of Serviced Apartments

Explore the growing demand for serviced apartments in central Athens, where integrated hospitality services attract savvy investors in the Greece real estate market.

Explore the growing demand for serviced apartments in central Athens, where integrated hospitality services attract savvy investors in the Greece real estate market.

Read moreHome Prices Hit by Climate Change, J.P. Morgan Warns

J.P. Morgan analysts reveal a negative link between climate risk and home price appreciation. Explore the emerging trends and their impact.

J.P. Morgan analysts reveal a negative link between climate risk and home price appreciation. Explore the emerging trends and their impact.

Read moreRenting in Spain: Prices Finally Decline

The cost of renting in Spain trends downwards, averaging €13/m². Discover insights on this shift after years of steep increases.

The cost of renting in Spain trends downwards, averaging €13/m². Discover insights on this shift after years of steep increases.

Read moreRise of Cash Purchases Outside London: A New Trend

Explore the growing trend of cash purchases outside London and its implications for the property market and economic landscape.

Explore the growing trend of cash purchases outside London and its implications for the property market and economic landscape.

Read moreCanada Real Estate Market: Rents Drop for First Time in over 3 years

For the first time in over three years, average asking rents in Canada fell 1.2% in October, reaching $2,152, according to Rentals.ca.

For the first time in over three years, average asking rents in Canada fell 1.2% in October, reaching $2,152, according to Rentals.ca.

Read moreFewer Than 2% of Dutch Homes Sold to International Buyers

Analyze the decline in international purchases of Dutch houses, revealing key factors influencing this trend and its effects on the housing market.

Analyze the decline in international purchases of Dutch houses, revealing key factors influencing this trend and its effects on the housing market.

Read moreDonald Trump’s Victory May Boost London Property Demand

Knight Frank analyzes how Donald Trump’s election win could increase demand for prime London properties. Discover the potential market shifts.

Knight Frank analyzes how Donald Trump’s election win could increase demand for prime London properties. Discover the potential market shifts.

Read moreGerman Investors Fuel Growth in Greek Real Estate Market

Discover how German-speaking house buyers are revitalizing Greece's realty market, driving demand and investment in stunning properties.

Discover how German-speaking house buyers are revitalizing Greece\'s realty market, driving demand and investment in stunning properties.

Read moreLisbon: 11th City for Rising Luxury House Prices

Lisbon's luxury housing prices increased by 5.6%, outpacing Madrid, Seoul, and Zurich, marking it as a key player in the global real estate market.

Lisbon\'s luxury housing prices increased by 5.6%, outpacing Madrid, Seoul, and Zurich, marking it as a key player in the global real estate market.

Read more