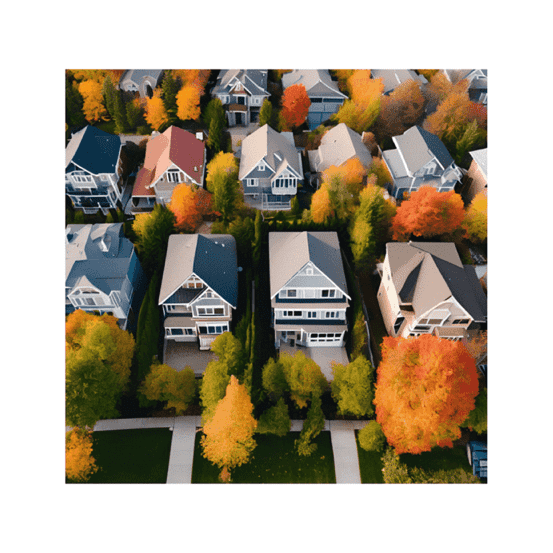

What is The Impact of Seasonality on Real Estate Investing?

Discover how timing your real estate purchase right in relation to the seasons can lead to significant savings for both buyers and sellers.

Property buyers and sellers can potentially save significant amounts of money by strategically timing their property transactions according to the seasons. Seasonality is often overlooked as a crucial factor when considering purchasing an investment property. However, understanding how seasonal changes impact buyer and seller sentiment can help real estate investors maximize their returns by capitalizing on seasonal trends.

During the spring and summer months, the Australian real estate market tends to be more active and vibrant. Warmer weather encourages more open house inspections, auctions, and overall property activities. The positive and optimistic mindset of buyers during this time can lead to higher sales prices for sellers. Additionally, the longer daylight hours and favorable weather conditions result in more properties being listed for sale, more open homes, and increased sales through auction campaigns.

Conversely, the cooler months of autumn and winter typically see a decline in market activity. Colder temperatures and shorter days may deter potential buyers from attending open houses and auctions, leading to fewer property listings. Regions with harsher winter climates, such as Victoria, may experience a more pronounced seasonal effect compared to warmer areas like Queensland.

However, areas known for their cold climates, such as those close to snowfields and snowy mountains, may see heightened activity during the winter months. Properties in these regions can attract more buyers due to their unique selling points, such as views over snowcapped mountains or proximity to popular ski resorts.

It is important to note that there are exceptions to these seasonal trends, and real estate investors should consider the specific market dynamics of the area they are interested in. For example, Queensland's warm climate means that winter does not significantly impact real estate markets, making it a more consistent investment option year-round.

Real estate investors looking to make strategic property decisions should consider timing the market based on seasonal trends, focusing on specific regions that align with their investment goals, and exploring specialty investments in areas with unique seasonal opportunities. Staying informed about local market trends and climatic conditions can enhance investment outcomes and lead to greater success in the real estate market.

Understanding how seasonality impacts real estate markets can help investors make informed decisions and maximize their returns. By strategically timing property transactions and adapting to seasonal trends, real estate investors can take advantage of market fluctuations and achieve greater success in their investments.

What is The Impact of Seasonality on Real Estate Investing?

Greece Real Estate Market: Rise of Serviced Apartments

Explore the growing demand for serviced apartments in central Athens, where integrated hospitality services attract savvy investors in the Greece real estate market.

Explore the growing demand for serviced apartments in central Athens, where integrated hospitality services attract savvy investors in the Greece real estate market.

Read moreHome Prices Hit by Climate Change, J.P. Morgan Warns

J.P. Morgan analysts reveal a negative link between climate risk and home price appreciation. Explore the emerging trends and their impact.

J.P. Morgan analysts reveal a negative link between climate risk and home price appreciation. Explore the emerging trends and their impact.

Read moreRenting in Spain: Prices Finally Decline

The cost of renting in Spain trends downwards, averaging €13/m². Discover insights on this shift after years of steep increases.

The cost of renting in Spain trends downwards, averaging €13/m². Discover insights on this shift after years of steep increases.

Read moreRise of Cash Purchases Outside London: A New Trend

Explore the growing trend of cash purchases outside London and its implications for the property market and economic landscape.

Explore the growing trend of cash purchases outside London and its implications for the property market and economic landscape.

Read moreCanada Real Estate Market: Rents Drop for First Time in over 3 years

For the first time in over three years, average asking rents in Canada fell 1.2% in October, reaching $2,152, according to Rentals.ca.

For the first time in over three years, average asking rents in Canada fell 1.2% in October, reaching $2,152, according to Rentals.ca.

Read moreFewer Than 2% of Dutch Homes Sold to International Buyers

Analyze the decline in international purchases of Dutch houses, revealing key factors influencing this trend and its effects on the housing market.

Analyze the decline in international purchases of Dutch houses, revealing key factors influencing this trend and its effects on the housing market.

Read moreDonald Trump’s Victory May Boost London Property Demand

Knight Frank analyzes how Donald Trump’s election win could increase demand for prime London properties. Discover the potential market shifts.

Knight Frank analyzes how Donald Trump’s election win could increase demand for prime London properties. Discover the potential market shifts.

Read moreGerman Investors Fuel Growth in Greek Real Estate Market

Discover how German-speaking house buyers are revitalizing Greece's realty market, driving demand and investment in stunning properties.

Discover how German-speaking house buyers are revitalizing Greece\'s realty market, driving demand and investment in stunning properties.

Read moreLisbon: 11th City for Rising Luxury House Prices

Lisbon's luxury housing prices increased by 5.6%, outpacing Madrid, Seoul, and Zurich, marking it as a key player in the global real estate market.

Lisbon\'s luxury housing prices increased by 5.6%, outpacing Madrid, Seoul, and Zurich, marking it as a key player in the global real estate market.

Read more