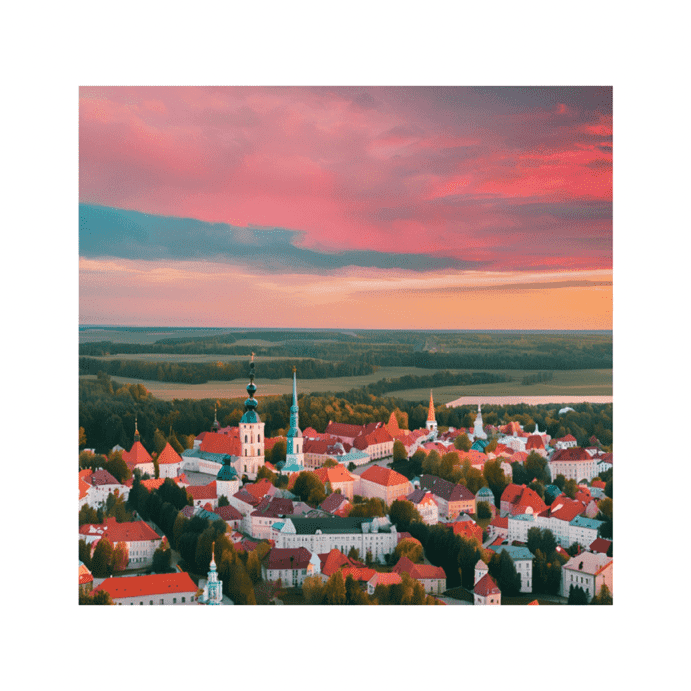

Discover Why Lithuania is the Best Real Estate Investment right now

Lithuania offers high rental yields of 6.44% and low buying costs, making it the best real estate investment right now.

Lithuania offers high rental yields of 6.44% and low buying costs, making it the best real estate investment right now.

In recent years, the landscape of overseas property investment has evolved significantly, with various countries vying for the attention of international investors. A recent study conducted by 1st Move International Removals has placed Lithuania at the forefront of this competitive arena, highlighting its attractive investment opportunities characterized by high rental yields, reasonable buying costs, and a welcoming environment for foreign investors. Let’s explore the investment potential in Lithuania and comparing it with other best European countries for real estate investment.

Lithuania: The Prime Choice for Investors

According to the study, Lithuania boasts an impressive gross rental yield of 6.44% annually, making it the best real estate investment right now for property investors looking to maximize their returns. The Baltic state has become increasingly appealing due to its moderate house price growth projections and the absence of restrictions for foreign buyers. This combination of factors positions Lithuania as one of the best European countries for real estate investment.

The study indicates that the real estate market in Lithuania is not only thriving but is also expected to continue its upward trajectory. With a growing economy and a stable political environment, the country presents a favorable backdrop for property investment. Investors can anticipate a steady increase in property values, which, coupled with high rental yields, creates a compelling case for investment.

Estonia: A Close Contender

Just north of Lithuania lies Estonia, which has secured its position as the second place of best European countries for real estate investment. One of the standout features of Estonia's property market is its non-resident purchasing policy, allowing foreign investors to buy property on the same terms as local residents. This accessibility simplifies the investment process, making it an attractive option for those looking to enter the market.

Estonia also boasts the lowest buying costs among the countries analyzed, at a mere 1.30%. With a projected growth rate of 12.30% and an annual gross rental yield of 4.51%, Estonia offers a robust rental market that promises consistent income for investors. The combination of low entry costs and high potential returns makes Estonia a noteworthy player in the overseas property investment arena.

Romania: A Hidden Gem

Ranking third in the study is Romania, a country that has garnered attention for its favorable tax environment and strong rental yields. Romania features the lowest average rental income tax rate at 10%, which is particularly appealing for investors looking to maximize their profits. The country also offers a solid gross rental yield of 6.46%, second only to the UK.

While Romania does present some challenges, such as higher selling costs at 6%, its capital, Bucharest, stands out as a hotspot for lucrative rental opportunities. The city's growing economy and increasing demand for rental properties make it an attractive option for investors seeking to diversify their portfolios.

Belgium: A Cautionary Tale

On the opposite end of the spectrum, Belgium has been identified as the least favorable country for property investment. The study highlights several factors contributing to this designation, including exorbitant buying costs that reach 17.50%. Additionally, Belgium imposes the highest average rental income tax rate at 36.83%, coupled with income property taxes that can soar to 50%.

These financial burdens, combined with high house prices, create a challenging environment for investors. As a result, Belgium's property market is often viewed as a less attractive option compared to its European counterparts.

Spain: A Popular Choice for Investors

Spain remains a perennial favorite among investors, consistently ranking as the most searched country for property purchases. The country's appeal lies in its relatively straightforward property ownership regulations, which allow non-residents to purchase a wide range of properties, from residential homes to commercial spaces.

Spain's vibrant culture, favorable climate, and established expat communities contribute to its allure. While the country may not offer the highest rental yields compared to Lithuania or Romania, its popularity and potential for capital appreciation make it a significant player in the overseas property market.

The findings from the 1st Move International Removals study underscore the dynamic nature of the overseas property investment landscape. Lithuania stands out as best real estate investment right now

that is the premier destination for investors seeking high yields and low buying costs, while Estonia and Romania offer compelling alternatives with their own unique advantages. Conversely, Belgium serves as a cautionary example of the challenges that can arise in property investment, while Spain continues to attract interest due to its popularity and accessibility.

As the global property market evolves, investors must remain informed about emerging trends and opportunities. By carefully considering the insights provided in this analysis, potential investors can make informed decisions that align with their financial goals and risk tolerance.

Discover Why Lithuania is the Best Real Estate Investment right now

Canada Real Estate Market: Rents Drop for First Time in over 3 years

For the first time in over three years, average asking rents in Canada fell 1.2% in October, reaching $2,152, according to Rentals.ca.

For the first time in over three years, average asking rents in Canada fell 1.2% in October, reaching $2,152, according to Rentals.ca.

Read moreFewer Than 2% of Dutch Homes Sold to International Buyers

Analyze the decline in international purchases of Dutch houses, revealing key factors influencing this trend and its effects on the housing market.

Analyze the decline in international purchases of Dutch houses, revealing key factors influencing this trend and its effects on the housing market.

Read moreDonald Trump’s Victory May Boost London Property Demand

Knight Frank analyzes how Donald Trump’s election win could increase demand for prime London properties. Discover the potential market shifts.

Knight Frank analyzes how Donald Trump’s election win could increase demand for prime London properties. Discover the potential market shifts.

Read moreGerman Investors Fuel Growth in Greek Real Estate Market

Discover how German-speaking house buyers are revitalizing Greece's realty market, driving demand and investment in stunning properties.

Discover how German-speaking house buyers are revitalizing Greece\'s realty market, driving demand and investment in stunning properties.

Read moreLisbon: 11th City for Rising Luxury House Prices

Lisbon's luxury housing prices increased by 5.6%, outpacing Madrid, Seoul, and Zurich, marking it as a key player in the global real estate market.

Lisbon\'s luxury housing prices increased by 5.6%, outpacing Madrid, Seoul, and Zurich, marking it as a key player in the global real estate market.

Read moreUS Housing Market Sees Highest Inventory Since 2019

The US housing market experiences a surge in inventory as sellers flood the market, marking the highest levels since 2019. Discover the implications.

The US housing market experiences a surge in inventory as sellers flood the market, marking the highest levels since 2019. Discover the implications.

Read morePortugal’s Rental Prices Rise 5.1% in October

The prices of houses for rent in Portugal have increased by 5.1% in October, reflecting ongoing demand and market dynamics. Explore the latest rental trends.

The prices of houses for rent in Portugal have increased by 5.1% in October, reflecting ongoing demand and market dynamics. Explore the latest rental trends.

Read moreGreece Real Estate Trends: The Rise of Property Flipping

Explore how flipping old apartments in Greece is becoming a lucrative investment strategy for rental income and future profits.

Explore how flipping old apartments in Greece is becoming a lucrative investment strategy for rental income and future profits.

Read moreSpain Real Estate Market Soars 9.6%. Is It a Bubble?

Spain real estate market grows 9.6% annually, surpassing 2007 peaks. Discover the trends and data behind this remarkable surge.

Spain real estate market grows 9.6% annually, surpassing 2007 peaks. Discover the trends and data behind this remarkable surge.

Read more