Dutch Paytech Platform OPP Secures UK EMI Licence

The Dutch online payment platform OPP has successfully obtained an EMI licence in the UK, enabling enhanced services and regulatory compliance.

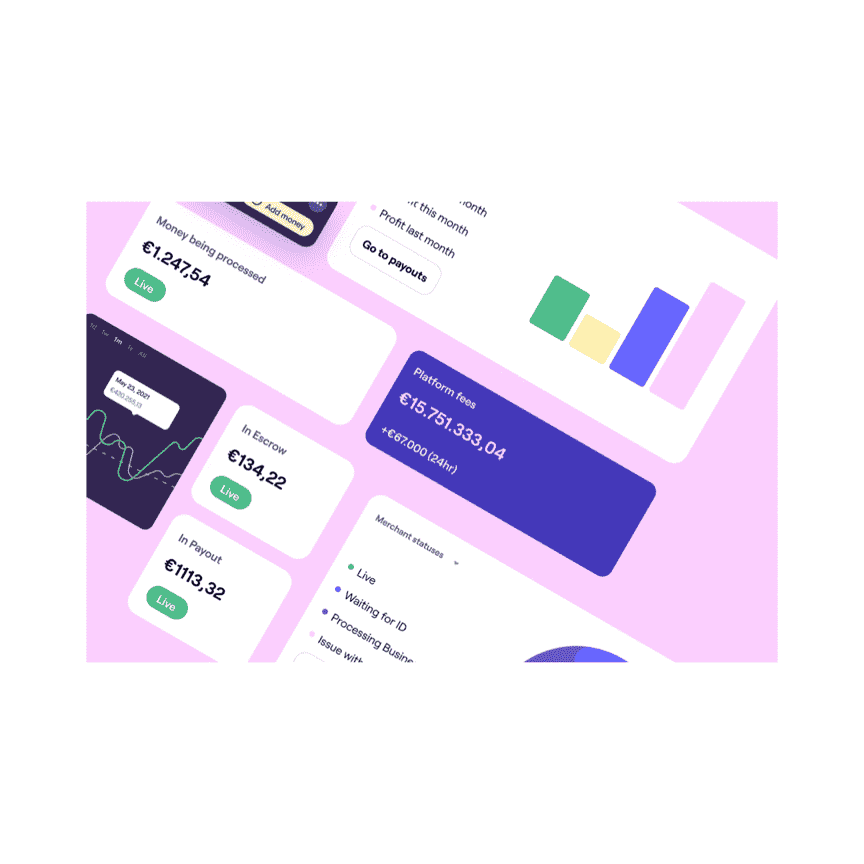

In a significant development within the European fintech landscape, Online Payment Platform (OPP), a Netherlands-based entity specializing in a comprehensive suite of payment solutions tailored for marketplaces and platforms, has successfully obtained an electronic money institution (EMI) license from the Financial Conduct Authority (FCA) in the United Kingdom. This strategic acquisition of regulatory approval is poised to enhance OPP's operational capabilities, enabling the facilitation of consumer-to-consumer (C2C), business-to-consumer (B2C), and business-to-business (B2B) transactions across the UK.

The company has articulated its intent to leverage this newly acquired license to introduce a wallet solution, a feature that is anticipated to empower businesses in both mainland Europe and the UK to augment their cross-border payment functionalities while adeptly navigating the intricate labyrinth of international expansion. Established in 2011 and subsequently launching its services in 2013, OPP's payment offerings encompass a diverse array of functionalities, including multi-split payments, dispute resolution mechanisms, automated mediation, and an escrow service.

As part of its evolving service portfolio, OPP is set to integrate what its commercial director, Steve Lavington, has characterized as a “much-demanded wallet solution.” This addition will enable clients to receive and securely store funds for future transactions, thereby enhancing the overall user experience. With a robust presence in London, where it employs a dedicated team of over 100 professionals, OPP also maintains operational offices in Berlin, Germany, and Delft, its home base in the Netherlands.

In a noteworthy collaboration earlier this month, OPP joined forces with Worldline, a company that acquired a 40% stake in the paytech firm in 2022. This partnership has culminated in the launch of an innovative embedded payments solution, which synergistically combines OPP’s cutting-edge technology with Worldline’s acquiring, acceptance, and point-of-sale (POS) capabilities. The resultant offering is touted as a “complete, turnkey solution” designed to facilitate rapid user onboarding, efficient sales processes, and expedited payment collection, all while adeptly managing transactions across multiple currencies.

In a world where financial transactions can often resemble a complex game of chess, OPP is positioning itself as a formidable player, ready to navigate the intricacies of the payment landscape with both finesse and a touch of humor.

Dutch Paytech Platform OPP Secures UK EMI Licence

Dojo Partners with YouLend for Flexible Financing in Spain

Dojo and YouLend team up to offer Spanish businesses flexible, innovative financing solutions, enhancing payment technology for local customers.

Dojo and YouLend team up to offer Spanish businesses flexible, innovative financing solutions, enhancing payment technology for local customers.

Read moreOnline Lending Market Declines in Switzerland

Explore the reasons behind the shrinking online lending market in Switzerland and its impact on borrowers and financial institutions.

Explore the reasons behind the shrinking online lending market in Switzerland and its impact on borrowers and financial institutions.

Read moreWestern Union to Acquire Dash Mobile Wallet from Singtel

Western Union has entered a conditional agreement to acquire Dash, a mobile wallet by Singtel, marking a significant move in digital finance.

Western Union has entered a conditional agreement to acquire Dash, a mobile wallet by Singtel, marking a significant move in digital finance.

Read moreDigital Banks in Spain Surpass 5 Million Customers

Explore the rise of digital banks in Spain as they reach over five million customers, reshaping the banking experience and driving innovation.

Explore the rise of digital banks in Spain as they reach over five million customers, reshaping the banking experience and driving innovation.

Read moreWealthKernel Expands into Europe with CNMV License

WealthKernel, a leading digital investing provider, secures CNMV license, becoming dual-regulated in the UK and EU.

WealthKernel, a leading digital investing provider, secures CNMV license, becoming dual-regulated in the UK and EU.

Read moreQonto Expands to Austria, Belgium, Netherlands, Portugal

Qonto, the top European finance solution for SMEs, launches in four new countries, enhancing support for freelancers and businesses.

Qonto, the top European finance solution for SMEs, launches in four new countries, enhancing support for freelancers and businesses.

Read moreLopay and YouLend: £1M in Funding for UK SMEs

Lopay and YouLend join forces to provide vital financing for UK SMEs, surpassing £1 million in funding to support business growth and innovation.

Lopay and YouLend join forces to provide vital financing for UK SMEs, surpassing £1 million in funding to support business growth and innovation.

Read moreOakNorth Offers Custom Capital Call to Paloma Capital

OakNorth provides a bespoke capital call facility to Paloma Capital, enhancing their private equity real estate investment strategies.

OakNorth provides a bespoke capital call facility to Paloma Capital, enhancing their private equity real estate investment strategies.

Read moreRapid Finance Integrates with Q2’s Digital Banking Platform for Small Business Lending

Discover how Rapid Finance's new integration with Q2 enhances small business lending solutions, streamlining access to vital financial resources.

Discover how Rapid Finance\'s new integration with Q2 enhances small business lending solutions, streamlining access to vital financial resources.

Read more