Lopay and YouLend: £1M in Funding for UK SMEs

Lopay and YouLend join forces to provide vital financing for UK SMEs, surpassing £1 million in funding to support business growth and innovation.

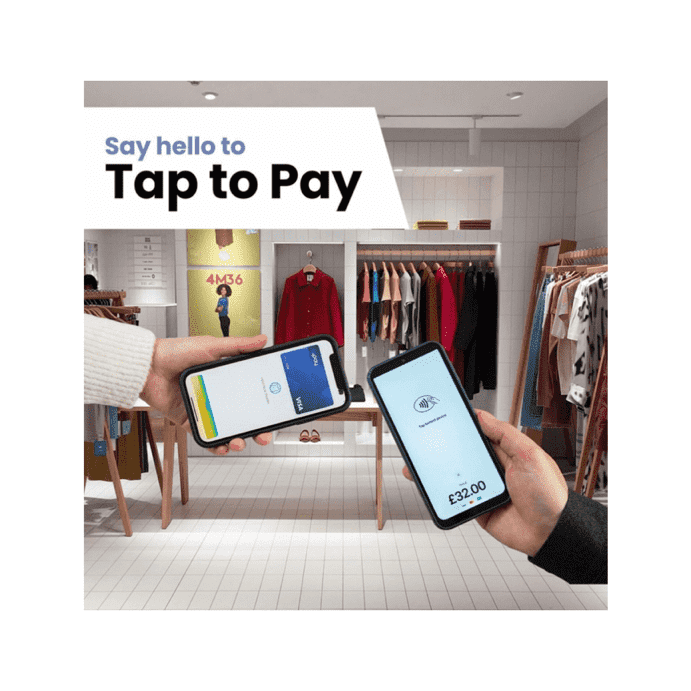

Lopay, a payment processing application headquartered in London, has recently forged a strategic alliance with YouLend, a preeminent global platform specializing in embedded financing. This collaboration aims to provide flexible and affordable financing solutions to Lopay’s extensive clientele of over 40,000 customers. By integrating access to capital directly into Lopay’s Point of Sale (PoS) system, this partnership seeks to empower small and medium-sized enterprises (SMEs) to gain a competitive advantage within the UK marketplace.

Lopay’s customers will not only continue to benefit from the app’s competitive payment processing fees but will also gain unprecedented access to capital, thereby addressing the perennial cash flow challenges that businesses encounter on a daily basis. The introduction of Lopay’s cash advance feature promises to enhance the user experience significantly, offering SMEs immediate financing options based on their sales volumes with just a few clicks. The digital application process is designed to be completed in mere minutes, a stark contrast to the protracted approval timelines typically associated with traditional financing avenues.

Since the inception of this partnership, Lopay has successfully disbursed £1 million in funding within a mere three months, highlighting the robust demand for working capital among UK enterprises. The decision to collaborate with YouLend was, in essence, a straightforward one; the emphasis on speed aligns seamlessly with Lopay’s mission to deliver reliable financial solutions that facilitate rapid business growth.

As this partnership continues to evolve, both Lopay and YouLend are committed to investing in the development of a scalable solution that meets the needs of Lopay’s expanding customer base. In a landscape where financial agility is paramount, this alliance stands as a testament to the innovative approaches being adopted to support the dynamic needs of modern businesses.

Lopay and YouLend: £1M in Funding for UK SMEs

Dojo Partners with YouLend for Flexible Financing in Spain

Dojo and YouLend team up to offer Spanish businesses flexible, innovative financing solutions, enhancing payment technology for local customers.

Dojo and YouLend team up to offer Spanish businesses flexible, innovative financing solutions, enhancing payment technology for local customers.

Read moreOnline Lending Market Declines in Switzerland

Explore the reasons behind the shrinking online lending market in Switzerland and its impact on borrowers and financial institutions.

Explore the reasons behind the shrinking online lending market in Switzerland and its impact on borrowers and financial institutions.

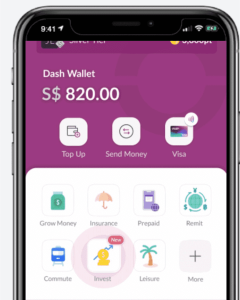

Read moreWestern Union to Acquire Dash Mobile Wallet from Singtel

Western Union has entered a conditional agreement to acquire Dash, a mobile wallet by Singtel, marking a significant move in digital finance.

Western Union has entered a conditional agreement to acquire Dash, a mobile wallet by Singtel, marking a significant move in digital finance.

Read moreDutch Paytech Platform OPP Secures UK EMI Licence

The Dutch online payment platform OPP has successfully obtained an EMI licence in the UK, enabling enhanced services and regulatory compliance.

The Dutch online payment platform OPP has successfully obtained an EMI licence in the UK, enabling enhanced services and regulatory compliance.

Read moreDigital Banks in Spain Surpass 5 Million Customers

Explore the rise of digital banks in Spain as they reach over five million customers, reshaping the banking experience and driving innovation.

Explore the rise of digital banks in Spain as they reach over five million customers, reshaping the banking experience and driving innovation.

Read moreWealthKernel Expands into Europe with CNMV License

WealthKernel, a leading digital investing provider, secures CNMV license, becoming dual-regulated in the UK and EU.

WealthKernel, a leading digital investing provider, secures CNMV license, becoming dual-regulated in the UK and EU.

Read moreQonto Expands to Austria, Belgium, Netherlands, Portugal

Qonto, the top European finance solution for SMEs, launches in four new countries, enhancing support for freelancers and businesses.

Qonto, the top European finance solution for SMEs, launches in four new countries, enhancing support for freelancers and businesses.

Read moreOakNorth Offers Custom Capital Call to Paloma Capital

OakNorth provides a bespoke capital call facility to Paloma Capital, enhancing their private equity real estate investment strategies.

OakNorth provides a bespoke capital call facility to Paloma Capital, enhancing their private equity real estate investment strategies.

Read moreRapid Finance Integrates with Q2’s Digital Banking Platform for Small Business Lending

Discover how Rapid Finance's new integration with Q2 enhances small business lending solutions, streamlining access to vital financial resources.

Discover how Rapid Finance\'s new integration with Q2 enhances small business lending solutions, streamlining access to vital financial resources.

Read more