Topics: homeowners

US Real Estate Market: Starter Home Prices Surpass $1 Million Nationwide

The US real estate market is facing significant challenges as starter home prices now exceed $1 million in over 100 cities. This alarming trend underscores the ongoing affordability crisis impacting potential homebuyers across the nation.

The US real estate market is facing significant challenges as starter home prices now exceed $1 million in over 100 cities. This alarming trend underscores the ongoing affordability crisis impacting potential homebuyers across the nation.

Read moreUS Homeowners Experience Near-Record Highs in Home Equity Growth

Discover the latest CoreLogic report findings showing US homeowners gaining an average of $28,000 in home equity over the past year.

Discover the latest CoreLogic report findings showing US homeowners gaining an average of $28,000 in home equity over the past year.

Read moreFinancial Risks Loom for Homeowners: Bank Regulator in Canada Alert

The Office of the Superintendent of Financial Institutions (OSFI) issues a warning about potential financial risks for homeowners with pandemic-era mortgages.

The Office of the Superintendent of Financial Institutions (OSFI) issues a warning about potential financial risks for homeowners with pandemic-era mortgages.

Read moreAdjusted Prices and Falling Interest Rates Attract Luxembourg HomeBuyers

Learn how adjusted prices and falling interest rates are attracting buyers back to the real estate market. Stay ahead of the curve with this market update.

Learn how adjusted prices and falling interest rates are attracting buyers back to the real estate market. Stay ahead of the curve with this market update.

Read moreDutch Homeowners Face Steep Rise in Housing Costs in 2024, COELO Report Finds

COELO report from RUG shows Dutch homeowners will pay 1,670 euros on housing costs this year, up by 118 euros from 2023 due to increased municipal taxes and water board payments.

COELO report from RUG shows Dutch homeowners will pay 1,670 euros on housing costs this year, up by 118 euros from 2023 due to increased municipal taxes and water board payments.

Read moreNorway's Government Pushes for Shared Homeownership to Address Housing Challenges

Minister Erling Sande and spokesperson Siri Gåsemyr Staalesen lead the charge to make homeownership more accessible for young individuals in Norway.

Minister Erling Sande and spokesperson Siri Gåsemyr Staalesen lead the charge to make homeownership more accessible for young individuals in Norway.

Read moreStudy Reveals Britons Staying in Homes for Over a Decade Amid Cost of Living Crisis

Discover the latest findings from a study by Spring and PropAlt on the increasing trend of homeowners in Britain staying in their homes for longer periods, influenced by various factors such as the cost of living crisis and higher borrowing costs.

Discover the latest findings from a study by Spring and PropAlt on the increasing trend of homeowners in Britain staying in their homes for longer periods, influenced by various factors such as the cost of living crisis and higher borrowing costs.

Read moreCanadian Homeowners Struggle with Mortgage Payments

Find out how 69% of Canadian homeowners are finding it increasingly difficult to pay their mortgages, according to a survey by Ratehub.ca. Discover the challenges they are facing as interest rates rise.

Find out how 69% of Canadian homeowners are finding it increasingly difficult to pay their mortgages, according to a survey by Ratehub.ca. Discover the challenges they are facing as interest rates rise.

Read moreHomeowners Facing Higher Remortgage Costs Amid Property Value Decrease

Mortgage brokers report cautious surveyors slashing property values by up to £50,000, causing financial strain for many homeowners.

Mortgage brokers report cautious surveyors slashing property values by up to £50,000, causing financial strain for many homeowners.

Read moreThe Cost of Renting: A Barrier to Homeownership

Explore the challenges faced by tenants in England, who could potentially spend £150,000 on rent before purchasing a property. Learn more here.

Explore the challenges faced by tenants in England, who could potentially spend £150,000 on rent before purchasing a property. Learn more here.

Read moreU.S. Homeowner Tenure Drops to 11.9 Years, Redfin Report Finds

A recent report from Redfin reveals a significant decrease in the average length of time U.S. homeowners stay in their residences, with the shift attributed to factors such as aging baby boomers and job mobility among millennials and Gen Z.

A recent report from Redfin reveals a significant decrease in the average length of time U.S. homeowners stay in their residences, with the shift attributed to factors such as aging baby boomers and job mobility among millennials and Gen Z.

Read morePortugal's Housing Crisis: Young Homeownership Drops by Half

Discover the alarming statistics of Portugal's housing crisis, as young homeownership drops by half. Learn why only a fraction of young Portuguese citizens manage to own a home by the age of 25.

Discover the alarming statistics of Portugal\'s housing crisis, as young homeownership drops by half. Learn why only a fraction of young Portuguese citizens manage to own a home by the age of 25.

Read moreMortgage Renewal Crisis for Canadian Homeowners: Rising Interest Rates Pose Challenges

As the number of Canadian homeowners facing mortgage renewals with higher interest rates continues to grow, many are considering selling their homes. Before taking such a drastic step, financially strained homeowners should explore alternatives such as reassessing family spending habits and exploring additional income sources.

As the number of Canadian homeowners facing mortgage renewals with higher interest rates continues to grow, many are considering selling their homes. Before taking such a drastic step, financially strained homeowners should explore alternatives such as reassessing family spending habits and exploring additional income sources.

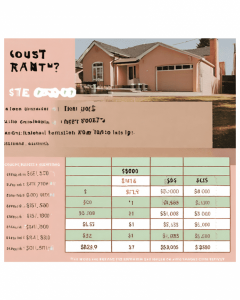

Read moreFinancial challenges for Canada homeowners: Prepare for higher mortgage payments in the coming years

Prepare for higher mortgage payments in the coming years. Canada homeowners face financial challenges as interest rates rise. Anticipate average payment increases of 14-25% next year and 20-25% in 2025-2026. Learn more.

Prepare for higher mortgage payments in the coming years. Canada homeowners face financial challenges as interest rates rise. Anticipate average payment increases of 14-25% next year and 20-25% in 2025-2026. Learn more.

Read moreCanadian Homeowners Sacrifice Affordability for a More Accessible Housing Market: Poll

Discover the significant shift in Canadian homeowners' mindset as revealed by a recent poll, showcasing their willingness to sacrifice for greater affordability in the housing market. Explore the changing perspective on Canadian home prices and the desire for a more accessible housing market.

Discover the significant shift in Canadian homeowners\' mindset as revealed by a recent poll, showcasing their willingness to sacrifice for greater affordability in the housing market. Explore the changing perspective on Canadian home prices and the desire for a more accessible housing market.

Read moreCanadian Homeowners in a Financial Dilemma: Renting vs. Owning Amid Rising Interest Rates

Delve into the financial dilemma faced by Canadian homeowners amidst the Bank of Canada's decision to maintain elevated interest rates. Explore the potential implications, such as increased rental demand and higher rents, exacerbating affordability concerns. Stay informed with our comprehensive analysis.

Delve into the financial dilemma faced by Canadian homeowners amidst the Bank of Canada\'s decision to maintain elevated interest rates. Explore the potential implications, such as increased rental demand and higher rents, exacerbating affordability concerns. Stay informed with our comprehensive analysis.

Read moreRapid Surge: US Mortgage Payments Spike 60% in Just Two Years, Alarming Homeowners

Discover the shocking rise in US mortgage payments as they skyrocket by 60% in a span of just two years, leaving homeowners stunned. Stay informed with our in-depth analysis of this alarming trend.

Discover the shocking rise in US mortgage payments as they skyrocket by 60% in a span of just two years, leaving homeowners stunned. Stay informed with our in-depth analysis of this alarming trend.

Read moreBreaking News: Expectation vs Reality - Flat Canadian Home Prices in Fall

The Canadian real estate market is bracing for a softer fall as a new report predicts average home prices to remain flat.

The Canadian real estate market is bracing for a softer fall as a new report predicts average home prices to remain flat.

Read moreThe Impact of Rising Interest Rates on Canada's Homebuyers: Detached Homes Under Pressure

A recent report by RE/MAX Canada reveals that a drop in detached home prices in certain Canadian markets attracted a surge in homebuyer activity during the second quarter of the year. However, this comeback in the detached housing market was short-lived as the Bank of Canada resumed its interest rate hikes in June, according to the report.

A recent report by RE/MAX Canada reveals that a drop in detached home prices in certain Canadian markets attracted a surge in homebuyer activity during the second quarter of the year. However, this comeback in the detached housing market was short-lived as the Bank of Canada resumed its interest rate hikes in June, according to the report.

Read moreUS: Surge in Zombie Properties Evident as Foreclosure Activity Escalates in 2023

Explore the alarming rise of zombie properties in the United States, mirroring the growing foreclosure activity in 2023. Gain a comprehensive understanding of this unsettling trend, its implications for the housing market, and the potential challenges it poses for communities nationwide. Stay informed with our in-depth analysis in this thought-provoking article.

Explore the alarming rise of zombie properties in the United States, mirroring the growing foreclosure activity in 2023. Gain a comprehensive understanding of this unsettling trend, its implications for the housing market, and the potential challenges it poses for communities nationwide. Stay informed with our in-depth analysis in this thought-provoking article.

Read moreBreaking News: UK Housing More Affordable Now, According to Halifax Report

In a welcome sign for prospective homeowners, it appears that housing in the UK has become more affordable compared to a year ago. The country's largest mortgage lender, Halifax, has revealed that a combination of falling house prices and rising wages has led to increased purchasing power for house hunters. However, with the parallel rise in mortgage rates and living costs, the financial squeeze on both buyers and renters continues to persist.

In a welcome sign for prospective homeowners, it appears that housing in the UK has become more affordable compared to a year ago. The country\'s largest mortgage lender, Halifax, has revealed that a combination of falling house prices and rising wages has led to increased purchasing power for house hunters. However, with the parallel rise in mortgage rates and living costs, the financial squeeze on both buyers and renters continues to persist.

Read moreThe Hidden Crisis: UK Homeowners Struggling to Keep Their Homes Amidst Mortgage Hikes

In recent months, there has been a noticeable increase in the number of homeowners in the UK who are compelled to sell their properties due to the soaring mortgage rates.

In recent months, there has been a noticeable increase in the number of homeowners in the UK who are compelled to sell their properties due to the soaring mortgage rates.

Read moreShocking Revelation: Nearly a quarter of US homeowners are considering selling in the next 3 years!

In recent years, the real estate market has experienced a significant surge in homeowner interest in selling their properties. According to a recent survey conducted by Zillow, nearly a quarter of homeowners are considering selling their homes in the next three years, marking a substantial increase compared to previous surveys.

In recent years, the real estate market has experienced a significant surge in homeowner interest in selling their properties. According to a recent survey conducted by Zillow, nearly a quarter of homeowners are considering selling their homes in the next three years, marking a substantial increase compared to previous surveys.

Read more1 Million UK Homeowners at Risk as Interest Rates Rise

Economist at NIESR, Mr. Max Mosley, warned that “a rise in interest rates to the 5% threshold will push millions of households with home loans to the brink of insolvency. None of the lenders have predicted that households can weather such shocks, and the government has said the same thing.”

Economist at NIESR, Mr. Max Mosley, warned that “a rise in interest rates to the 5% threshold will push millions of households with home loans to the brink of insolvency. None of the lenders have predicted that households can weather such shocks, and the government has said the same thing.”

Read more