Netherlands Sees 10-Week Decline in Mortgage Rates

Explore the sustained drop in fixed mortgage interest rates in the Netherlands, signaling fierce competition in the mortgage market.

In a surprising turn of events, fixed mortgage interest rates in the Netherlands have been on a steady decline for the past ten weeks, starting from the end of October. This significant and sustained drop in mortgage rates reflects the intense competition within the mortgage market, particularly when compared to the relatively stagnant savings account interest rates, as noted by De Hypotheekshop, a leading mortgage consultancy.

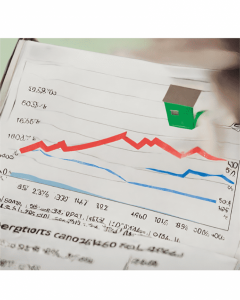

The most substantial reduction in interest rates has been observed in the case of five-year fixed rate mortgages that come with the National Mortgage Guarantee (NHG), with a remarkable decrease of 0.7 percentage points. Furthermore, the interest rates for thirty-year fixed mortgages, also with the NHG, have seen a nearly half percentage point decline. Notably, the ten-year fixed mortgage rates with NHG have experienced the most significant ten-week decline since 2004, when the organization began keeping records. As a result, the most competitive mortgage rates for various durations with NHG are now below 4 percent, with predictions that the thirty-year rates will soon follow suit.

The future trajectory of mortgage interest rates hinges on the movement of interest rates in the capital market, which dictates mid-term and long-term mortgage rates. De Hypotheekshop anticipates a decline in capital market interest rates by 2024. On the other hand, short-term mortgage interest rates, crucial for individuals in the process of moving homes, are more directly influenced by the interest rate policy of the European Central Bank (ECB). The organization foresees the ECB maintaining its current interest rates in the near future, with a gradual decrease expected in 2024 to stave off a prolonged economic downturn.

The recent downward trend in Dutch mortgage interest rates is a testament to the fierce competition in the mortgage market and the evolving economic landscape. As the market continues to adjust to external factors, such as capital market interest rates and ECB policies, it remains to be seen how this will impact mortgage rates in the coming weeks and months.

Netherlands Sees 10-Week Decline in Mortgage Rates

Potential Drop in Mortgage Rates in Spain Brings Good News for Homeowners

Stay informed on the latest developments as variable rate mortgage rates in Spain may soon see a decrease, offering relief to homeowners. Euribor at 3.503%.

Stay informed on the latest developments as variable rate mortgage rates in Spain may soon see a decrease, offering relief to homeowners. Euribor at 3.503%.

Read moreBarclays and HSBC Cut Fixed-Rate Mortgage Deals: Other Lenders Expected to Follow Suit

Analysts predict cuts of up to 0.31 percentage points could spark a 'summer of savings' as Barclays and HSBC lead the way in the mortgage market.

Analysts predict cuts of up to 0.31 percentage points could spark a \'summer of savings\' as Barclays and HSBC lead the way in the mortgage market.

Read moreU.S. Mortgage Rates Drop Below 7% for First Time Since April

In a historic milestone, U.S. mortgage rates have dropped below 7% for the first time since April. Stay informed on the latest developments in the housing market with this groundbreaking news.

In a historic milestone, U.S. mortgage rates have dropped below 7% for the first time since April. Stay informed on the latest developments in the housing market with this groundbreaking news.

Read moreDutch Major Lenders Raise Mortgage Rates

Stay informed on the latest developments as top financial institutions in the Netherlands increase mortgage interest rates by up to 0.10 percentage points.

Stay informed on the latest developments as top financial institutions in the Netherlands increase mortgage interest rates by up to 0.10 percentage points.

Read moreMortgage Interest Rates Surge Above 7%, Setting New 2024 High

Stay informed on the latest surge in mortgage interest rates, impacting home prices and existing home sales. No relief in sight.

Stay informed on the latest surge in mortgage interest rates, impacting home prices and existing home sales. No relief in sight.

Read moreCanadian Lenders Tackle Risk of Ultra-Long Mortgages | Financial System Alert

Discover how Canadian lenders are addressing the risk posed by ultra-long mortgages amidst the pandemic. Learn more about the measures being taken to safeguard the financial system. Take action now.

Discover how Canadian lenders are addressing the risk posed by ultra-long mortgages amidst the pandemic. Learn more about the measures being taken to safeguard the financial system. Take action now.

Read moreMortgage Rates Dip, But HomeBuyers Remain Cautious

Despite falling rates, mortgage applications declined this week. However, pending sales are starting to show signs of improvement.

Despite falling rates, mortgage applications declined this week. However, pending sales are starting to show signs of improvement.

Read moreSpring Housing Market Update: Negotiating for the Best Mortgage Rates

Stay ahead of the game as the spring housing market approaches. Learn how to secure the best mortgage rates with expert tips and insights on potential interest rate cuts by the Bank of Canada.

Stay ahead of the game as the spring housing market approaches. Learn how to secure the best mortgage rates with expert tips and insights on potential interest rate cuts by the Bank of Canada.

Read moreIreland’s New Mortgage Rates Rise, Now Seventh Highest in Eurozone

In January, Ireland's average interest rate on new mortgages increased to 4.27%, making it the seventh most expensive in the euro area. Find out more about this shift in the latest data from the Central Bank.

In January, Ireland\'s average interest rate on new mortgages increased to 4.27%, making it the seventh most expensive in the euro area. Find out more about this shift in the latest data from the Central Bank.

Read more