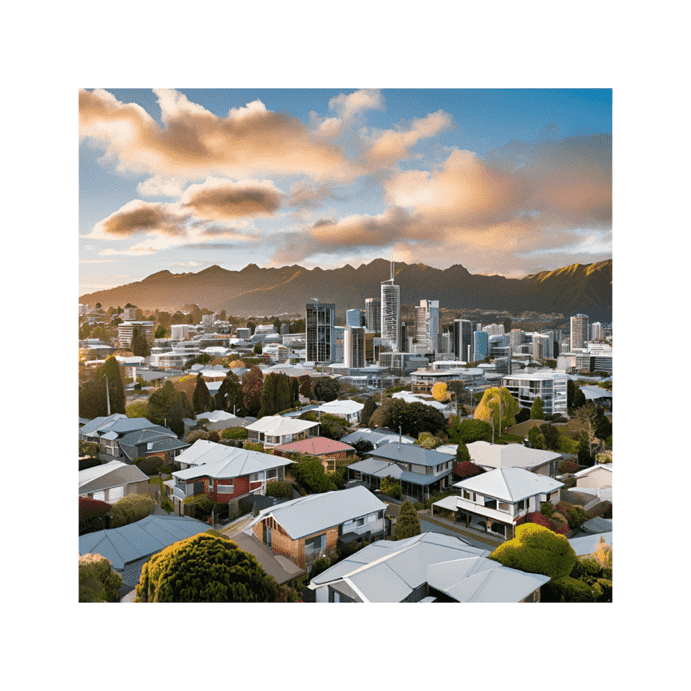

New Zealand Real Estate Market: Prices Rebound in September

After months of decline, New Zealand real estate prices rose to $823,550 in September, marking a significant shift in the real estate market.

In a surprising turn of events, the New Zealand real estate market has experienced a notable resurgence this September, following a prolonged period of consecutive declines over the past five months. According to the latest Property Price Index released by Trade Me, the national average asking price for properties has ascended to $823,550, marking a modest increase of 0.6 percent from August. This uptick signifies the first month-on-month rise since March, igniting a glimmer of hope among homeowners and prospective buyers alike.

The regional breakdown reveals that the West Coast led the charge with a commendable 3.1 percent increase month-on-month, closely followed by Northland at 2 percent and the Bay of Plenty at 1.9 percent. Auckland, which had previously witnessed its house prices dip below the million-dollar threshold in August for the first time in four years, has made a remarkable recovery, with prices bouncing back from $986,750 to $996,350 in September.

In a broader context, eleven out of the fifteen regions monitored by Trade Me Property recorded an increase in average asking prices in September, a significant rise from the mere five regions that experienced growth in August. However, not all regions basked in the glow of rising prices; Nelson/Tasman led the decline with a decrease of 2.3 percent, bringing the average asking price down to $793,850. Other regions that faced price drops included Taranaki (-2.2% to $631,550), Gisborne (-1.4% to $614,600), and Southland (-1.2% to $491,600).

Focusing on urban centers, Christchurch city has set a new benchmark for one to two-bedroom properties, reaching an impressive average asking price of $549,050 in September, reflecting a 3.4 percent increase compared to the same period last year. Ōtautahi also experienced a surge in the average asking price for units, which rose by 6.1 percent year-on-year to $471,150.

Interestingly, a stark contrast emerges when examining the New Zealand real estate market for five or more bedroom properties in Auckland and Wellington. While Auckland showcases robust growth with a 7.2 percent year-on-year increase in average asking prices for larger homes, Wellington finds itself in the opposite predicament, suffering a significant decline of 17.5 percent for properties of comparable size. The disparity in pricing is striking; in Auckland, the average asking price for a five-plus bedroom house hovers near a million dollars more than its Wellington counterpart.

On the supply side, the nation’s housing inventory remains robust, having increased by 23 percent year-on-year and 1.0 percent since August. Gisborne has emerged as the frontrunner in terms of available properties, boasting a staggering 64 percent increase compared to September 2023. Wellington and Otago also demonstrated substantial supply growth, with increases of 44 percent and 35 percent, respectively.

While interest in properties has cooled slightly between August and September, with a decrease of 2.0 percent, it still remains a remarkable 17 percent higher than the same time last year. This year-on-year demand has surged particularly in Gisborne (+35%), Auckland (+24%), and Hawke’s Bay (+22%), suggesting that despite fluctuations, the appetite for property remains insatiable.

New Zealand Real Estate Market: Prices Rebound in September

Canada Real Estate Market: Rents Drop for First Time in over 3 years

For the first time in over three years, average asking rents in Canada fell 1.2% in October, reaching $2,152, according to Rentals.ca.

For the first time in over three years, average asking rents in Canada fell 1.2% in October, reaching $2,152, according to Rentals.ca.

Read moreFewer Than 2% of Dutch Homes Sold to International Buyers

Analyze the decline in international purchases of Dutch houses, revealing key factors influencing this trend and its effects on the housing market.

Analyze the decline in international purchases of Dutch houses, revealing key factors influencing this trend and its effects on the housing market.

Read moreDonald Trump’s Victory May Boost London Property Demand

Knight Frank analyzes how Donald Trump’s election win could increase demand for prime London properties. Discover the potential market shifts.

Knight Frank analyzes how Donald Trump’s election win could increase demand for prime London properties. Discover the potential market shifts.

Read moreGerman Investors Fuel Growth in Greek Real Estate Market

Discover how German-speaking house buyers are revitalizing Greece's realty market, driving demand and investment in stunning properties.

Discover how German-speaking house buyers are revitalizing Greece\'s realty market, driving demand and investment in stunning properties.

Read moreLisbon: 11th City for Rising Luxury House Prices

Lisbon's luxury housing prices increased by 5.6%, outpacing Madrid, Seoul, and Zurich, marking it as a key player in the global real estate market.

Lisbon\'s luxury housing prices increased by 5.6%, outpacing Madrid, Seoul, and Zurich, marking it as a key player in the global real estate market.

Read moreUS Housing Market Sees Highest Inventory Since 2019

The US housing market experiences a surge in inventory as sellers flood the market, marking the highest levels since 2019. Discover the implications.

The US housing market experiences a surge in inventory as sellers flood the market, marking the highest levels since 2019. Discover the implications.

Read morePortugal’s Rental Prices Rise 5.1% in October

The prices of houses for rent in Portugal have increased by 5.1% in October, reflecting ongoing demand and market dynamics. Explore the latest rental trends.

The prices of houses for rent in Portugal have increased by 5.1% in October, reflecting ongoing demand and market dynamics. Explore the latest rental trends.

Read moreGreece Real Estate Trends: The Rise of Property Flipping

Explore how flipping old apartments in Greece is becoming a lucrative investment strategy for rental income and future profits.

Explore how flipping old apartments in Greece is becoming a lucrative investment strategy for rental income and future profits.

Read moreSpain Real Estate Market Soars 9.6%. Is It a Bubble?

Spain real estate market grows 9.6% annually, surpassing 2007 peaks. Discover the trends and data behind this remarkable surge.

Spain real estate market grows 9.6% annually, surpassing 2007 peaks. Discover the trends and data behind this remarkable surge.

Read more