Portugal Mortgage Rates Drop for First Time in Two Years

Portugal’s mortgage rates have fallen, leading to lower average payments for homeowners. Stay informed on the latest mortgage trends.

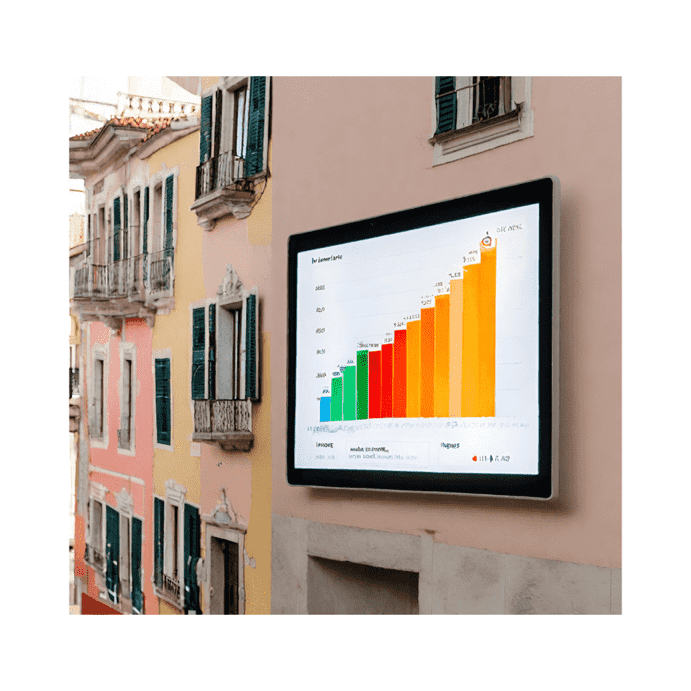

The Portugal housing market has seen a decrease in the implicit interest rate for the first time since March 2022, dropping to 4.641% in February, as reported by the National Statistics Institute (INE). Contracts signed in the past three months have also experienced a decline in interest rates for the fourth consecutive month, with rates falling from 4.315% in January to 4.197% in February.

Moreover, the average monthly instalment has seen its first reduction since February 2021, now standing at 403 euros, which is 1 euro less than in January and 81 euros more than in February 2023. This translates to a monthly decrease of 0.2%, compared to a 1.0% increase in the previous month. In February, the interest portion accounted for 62% of the average instalment, a significant increase from 41% in February 2023.

For contracts concluded in the last three months, the average instalment value has decreased by 11 euros compared to the previous month, now at 628 euros in February 2024. This represents a 10.4% increase compared to the same month in the previous year.

The Portugal housing market has seen a decrease in the implicit interest rate, along with a reduction in average instalment values for contracts signed in the last three months. These changes indicate a shift in the housing market dynamics, which may impact potential homebuyers and sellers.

Portugal Mortgage Rates Drop for First Time in Two Years

Potential Drop in Mortgage Rates in Spain Brings Good News for Homeowners

Stay informed on the latest developments as variable rate mortgage rates in Spain may soon see a decrease, offering relief to homeowners. Euribor at 3.503%.

Stay informed on the latest developments as variable rate mortgage rates in Spain may soon see a decrease, offering relief to homeowners. Euribor at 3.503%.

Read moreBarclays and HSBC Cut Fixed-Rate Mortgage Deals: Other Lenders Expected to Follow Suit

Analysts predict cuts of up to 0.31 percentage points could spark a 'summer of savings' as Barclays and HSBC lead the way in the mortgage market.

Analysts predict cuts of up to 0.31 percentage points could spark a \'summer of savings\' as Barclays and HSBC lead the way in the mortgage market.

Read moreU.S. Mortgage Rates Drop Below 7% for First Time Since April

In a historic milestone, U.S. mortgage rates have dropped below 7% for the first time since April. Stay informed on the latest developments in the housing market with this groundbreaking news.

In a historic milestone, U.S. mortgage rates have dropped below 7% for the first time since April. Stay informed on the latest developments in the housing market with this groundbreaking news.

Read moreDutch Major Lenders Raise Mortgage Rates

Stay informed on the latest developments as top financial institutions in the Netherlands increase mortgage interest rates by up to 0.10 percentage points.

Stay informed on the latest developments as top financial institutions in the Netherlands increase mortgage interest rates by up to 0.10 percentage points.

Read moreMortgage Interest Rates Surge Above 7%, Setting New 2024 High

Stay informed on the latest surge in mortgage interest rates, impacting home prices and existing home sales. No relief in sight.

Stay informed on the latest surge in mortgage interest rates, impacting home prices and existing home sales. No relief in sight.

Read moreCanadian Lenders Tackle Risk of Ultra-Long Mortgages | Financial System Alert

Discover how Canadian lenders are addressing the risk posed by ultra-long mortgages amidst the pandemic. Learn more about the measures being taken to safeguard the financial system. Take action now.

Discover how Canadian lenders are addressing the risk posed by ultra-long mortgages amidst the pandemic. Learn more about the measures being taken to safeguard the financial system. Take action now.

Read moreMortgage Rates Dip, But HomeBuyers Remain Cautious

Despite falling rates, mortgage applications declined this week. However, pending sales are starting to show signs of improvement.

Despite falling rates, mortgage applications declined this week. However, pending sales are starting to show signs of improvement.

Read moreSpring Housing Market Update: Negotiating for the Best Mortgage Rates

Stay ahead of the game as the spring housing market approaches. Learn how to secure the best mortgage rates with expert tips and insights on potential interest rate cuts by the Bank of Canada.

Stay ahead of the game as the spring housing market approaches. Learn how to secure the best mortgage rates with expert tips and insights on potential interest rate cuts by the Bank of Canada.

Read moreIreland’s New Mortgage Rates Rise, Now Seventh Highest in Eurozone

In January, Ireland's average interest rate on new mortgages increased to 4.27%, making it the seventh most expensive in the euro area. Find out more about this shift in the latest data from the Central Bank.

In January, Ireland\'s average interest rate on new mortgages increased to 4.27%, making it the seventh most expensive in the euro area. Find out more about this shift in the latest data from the Central Bank.

Read more