3 BEST MONEY SAVING TIPS FOR YOUNG ADULTS

The reality today shows that after a few years of working, many young people still have not had a good savings amount. The problem of spending always makes young people struggling so they don't know how to save money effectively. Many of them often fall into a passive financial status, making it difficult to achieve long-term financial goals such as buying a house, buying a car, setting up a business, traveling... for themselves. So what are best money saving tips for young adults?

Setting up a spending diary, limiting purchases, setting up savings and investments are ways to help young people secure their financial future.

1- Set up a spending diary

Setting up a spending diary is something very few young people do. Therefore, most young people over-spend their money that leads to out of money at the end of the month. To solve this problem, right from the moment of making money, young people need to record the amount of money they earn in a month, the amount of money spent by day and week. After each week or month, you need to review so that the next months consider income - spending as well as spend a small amount of money to save. This diary will help young people approach the daily habit of using money in the most detail.

2- Control shopping

Shopping is an essential need to maintain a stable life and today has become a habit and hobby of young people. Many people choose it as a way to relieve stress and pressure in life. Even many young people are addicted to shopping that leads to excessive spending and even debt.

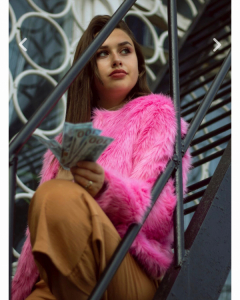

3 best money saving tips for young adults / ph: pexels

3 best money saving tips for young adults / ph: pexels

In order not to waste money, young people need to make a list of the items they will buy and consider whether it is a necessity or simply a hobby. For items that are not really necessary, you can wait for discounts to buy cheap. However, young people do not fall into the trap of buying too much because of the desire to buy cheap which make you buy items that can only be used once.

3- Set up a savings plan

If you want to finish early retirement quickly, you should also create a financial and savings plan as soon as possible.

The earlier you start, the better your chances of taking advantage of the potential for compound growth in your savings. Compound interest will help your assets grow faster over time, by continuously re-saving.

Grow estimates that over time, you could see an increase in average annual costs of 5% to 10%, adjusted for inflation. According to experts at Grow, you should save at least 8% a month from your income. This is the safest number for most people.

Using hypothetical numbers is a great way to create goals for the future, but not a guarantee. These calculations do not include future market volatility, fees or other fluctuations that may affect the value of any of your accounts.

Remember that saving for the future is a marathon, not a sprint. Wherever you are on your path, it can be helpful to apply a realistic budgeting approach. Living suitable with your abilities and following a savings plan can help you make money effectively.

Because everyone's income and expenditure levels are different, there can be no common minimum saving level.

However, according to the analysis of experts, each person usually spends about 50% of monthly income on mandatory expenses, about 30% of other income is used to spend on discretionary expenses. Thus, the remaining 20% of income is for savings.

Experts recommend that you should save about 15-20% of your income every month and start from the age of 25.

3 BEST MONEY SAVING TIPS FOR YOUNG ADULTS

Top 6 Money Habits of Self-Made Millionaires

Here are Top 6 Money Habits of Self-Made Millionaires that you should know.

Here are Top 6 Money Habits of Self-Made Millionaires that you should know.

Read more

10 Money Rules to face economic recession

Have you ever wondered what your financial situation will be like in a year, even just a few months? In the current context, it is unavoidable to worry about the risk of an economic recession. However, it is important that you start preparing now so that in the event of a recession in the next 6-12 months, you will be in the best position with the money amount you have.

Have you ever wondered what your financial situation will be like in a year, even just a few months? In the current context, it is unavoidable to worry about the risk of an economic recession. However, it is important that you start preparing now so that in the event of a recession in the next 6-12 months, you will be in the best position with the money amount you have.

Read more8 Money Saving Tips When Buying A House

Although housing prices have increased many times compared to the past time, you can still buy a house if you know how to save money smartly. Owning a dream home is no longer a far-away wish when we know how to make an effective financial plan. Below 8 Effective Money Saving Tips When Buying A House.

Although housing prices have increased many times compared to the past time, you can still buy a house if you know how to save money smartly. Owning a dream home is no longer a far-away wish when we know how to make an effective financial plan. Below 8 Effective Money Saving Tips When Buying A House.

Read more7 Billionaire Spending Habits help build Wealth

Fortune magazine published the results of a study showing that up to 54% of billionaires want to continue working at retirement age, and 60% of those with a net worth of more than $15 million don't even have a retire plan.

Fortune magazine published the results of a study showing that up to 54% of billionaires want to continue working at retirement age, and 60% of those with a net worth of more than $15 million don\'t even have a retire plan.

Read moreMost common habits of The World’s 4 Richest groups

Research "Rich Habits" by Tom Corley shows that there are 4 groups of wealthy people, including savers - investors, people who are eager to advance at work, high skilled professionals and the dreamers.

One of the common wealthy habits of the world's richest people is saving and investing their savings.

Research "Rich Habits" by Tom Corley shows that there are 4 groups of wealthy people, including savers - investors, people who are eager to advance at work, high skilled professionals and the dreamers.

One of the common wealthy habits of the world\'s richest people is saving and investing their savings.

Read more4 Financial mistakes young people often make

The path to financial independence is often not easy. For young people, focusing on retirement or saving for the future is often not a top priority.

But they can lose a lot of money if they make the wrong financial decisions. Here are 4 common financial mistakes that young people often make.

The path to financial independence is often not easy. For young people, focusing on retirement or saving for the future is often not a top priority.

But they can lose a lot of money if they make the wrong financial decisions. Here are 4 common financial mistakes that young people often make.

Read more4 Things to know when Getting a House Mortgage

A home loan is a suitable option if you need a large sum of money. To manage finances intelligently and avoid falling into a debt spiral, you should pay attention to a safe loan threshold, interest costs to pay, loan term,..

A home loan is a suitable option if you need a large sum of money. To manage finances intelligently and avoid falling into a debt spiral, you should pay attention to a safe loan threshold, interest costs to pay, loan term,..

Read more4 Investing Tips for Your 20s

There are investments that, as long as you are willing to put in money, time and effort, will definitely bring a worthy return. Here are 4 investments that you should make at the age of 20-30, According to Tim Denning, an Australian blogger.

There are investments that, as long as you are willing to put in money, time and effort, will definitely bring a worthy return. Here are 4 investments that you should make at the age of 20-30, According to Tim Denning, an Australian blogger.

Read moreHow to Save Money with Low Income fast: 5 Tips

If you have a low income, you need to make a concentrated effort to save money. While this is not always easy, it can be worthwhile in the long run. To help people with low income to save money, financial experts have shared 5 tips as below.

If you have a low income, you need to make a concentrated effort to save money. While this is not always easy, it can be worthwhile in the long run. To help people with low income to save money, financial experts have shared 5 tips as below.

Read more