4 Investing Tips for Your 20s

There are investments that, as long as you are willing to put in money, time and effort, will definitely bring a worthy return. Here are 4 investments that you should make at the age of 20-30, According to Tim Denning, an Australian blogger.

The older you get, the faster time passes. Ask any adult and you will get the same answer.

1- Invest in yourself

This advice may seem cliché, but it's actually the most basic step.

Invest in your mental health, eat well, exercise hard, relax in moderation and heal yourself. This is difficult at first, but it will give long-term benefits for your future life.

2- Invest to buy back your own time

Age 40-50 will be extremely difficult if you do not learn how to invest money early.

Social status is not what makes life better. Having enough time to do whatever you want is the highest status and genuine happiness.

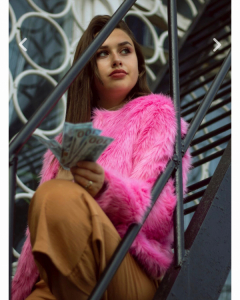

4 Investing Tips for Your 20s / ph: pexels

4 Investing Tips for Your 20s / ph: pexels

Learn how to invest in profitable assets. Then, spend at least 20% of your total income to apply price averaging technique. If you do so, you'll protect your all the time making money from inflation.

3- Invest in building relationships

Relationships are considered as potential future transactions.

Just open the message inbox, you will see that every day you are faced with countless soliciting messages with all kinds of out-of-the-box content. Everyone is just focusing on investing, instead of building a long-term professional relationship.

A relationship must start with a conversation, not a request.

Build relationships with interesting people you meet.

Try starting a chat in the elevator. Directly message the people you admire, sharing things that will most likely interest them and benefit them. Opportunity will come if you work hard to do this.

4- Invest in a second-job

Finding yourself a second job is a very good strategy. This is an opportunity that allows you to do the work you love without the pressure or financial risk. When this job begins to take up a large part of your income, you can leave your old job to fully focus on the new one.

You can do a second job from 6pm to 10pm for at least 1 year. You should also invest the time to learn about ways to make money online. Don't be afraid to try new things.

4 Investing Tips for Your 20s

Top 6 Money Habits of Self-Made Millionaires

Here are Top 6 Money Habits of Self-Made Millionaires that you should know.

Here are Top 6 Money Habits of Self-Made Millionaires that you should know.

Read more

10 Money Rules to face economic recession

Have you ever wondered what your financial situation will be like in a year, even just a few months? In the current context, it is unavoidable to worry about the risk of an economic recession. However, it is important that you start preparing now so that in the event of a recession in the next 6-12 months, you will be in the best position with the money amount you have.

Have you ever wondered what your financial situation will be like in a year, even just a few months? In the current context, it is unavoidable to worry about the risk of an economic recession. However, it is important that you start preparing now so that in the event of a recession in the next 6-12 months, you will be in the best position with the money amount you have.

Read more8 Money Saving Tips When Buying A House

Although housing prices have increased many times compared to the past time, you can still buy a house if you know how to save money smartly. Owning a dream home is no longer a far-away wish when we know how to make an effective financial plan. Below 8 Effective Money Saving Tips When Buying A House.

Although housing prices have increased many times compared to the past time, you can still buy a house if you know how to save money smartly. Owning a dream home is no longer a far-away wish when we know how to make an effective financial plan. Below 8 Effective Money Saving Tips When Buying A House.

Read more7 Billionaire Spending Habits help build Wealth

Fortune magazine published the results of a study showing that up to 54% of billionaires want to continue working at retirement age, and 60% of those with a net worth of more than $15 million don't even have a retire plan.

Fortune magazine published the results of a study showing that up to 54% of billionaires want to continue working at retirement age, and 60% of those with a net worth of more than $15 million don\'t even have a retire plan.

Read moreMost common habits of The World’s 4 Richest groups

Research "Rich Habits" by Tom Corley shows that there are 4 groups of wealthy people, including savers - investors, people who are eager to advance at work, high skilled professionals and the dreamers.

One of the common wealthy habits of the world's richest people is saving and investing their savings.

Research "Rich Habits" by Tom Corley shows that there are 4 groups of wealthy people, including savers - investors, people who are eager to advance at work, high skilled professionals and the dreamers.

One of the common wealthy habits of the world\'s richest people is saving and investing their savings.

Read more4 Financial mistakes young people often make

The path to financial independence is often not easy. For young people, focusing on retirement or saving for the future is often not a top priority.

But they can lose a lot of money if they make the wrong financial decisions. Here are 4 common financial mistakes that young people often make.

The path to financial independence is often not easy. For young people, focusing on retirement or saving for the future is often not a top priority.

But they can lose a lot of money if they make the wrong financial decisions. Here are 4 common financial mistakes that young people often make.

Read more4 Things to know when Getting a House Mortgage

A home loan is a suitable option if you need a large sum of money. To manage finances intelligently and avoid falling into a debt spiral, you should pay attention to a safe loan threshold, interest costs to pay, loan term,..

A home loan is a suitable option if you need a large sum of money. To manage finances intelligently and avoid falling into a debt spiral, you should pay attention to a safe loan threshold, interest costs to pay, loan term,..

Read moreHow to Save Money with Low Income fast: 5 Tips

If you have a low income, you need to make a concentrated effort to save money. While this is not always easy, it can be worthwhile in the long run. To help people with low income to save money, financial experts have shared 5 tips as below.

If you have a low income, you need to make a concentrated effort to save money. While this is not always easy, it can be worthwhile in the long run. To help people with low income to save money, financial experts have shared 5 tips as below.

Read more4 Personal Financial Management Tips for Gen Z

The unpredictable factors of a volatile life require Gen Z to equip themselves with personal financial management skills as well as develop a flexible plan to avoid struggling with financial problems. Here are 4 personal financial management tips for Gen Z.

The unpredictable factors of a volatile life require Gen Z to equip themselves with personal financial management skills as well as develop a flexible plan to avoid struggling with financial problems. Here are 4 personal financial management tips for Gen Z.

Read more