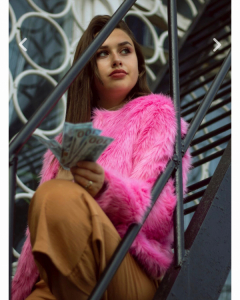

Top 6 Money Habits of Self-Made Millionaires

Here are Top 6 Money Habits of Self-Made Millionaires that you should know.

- 1- Self-Made Millionaires are always looking for ways to own a high income

- 2- Self-Made Millionaires usually save a large portion of their income

- 3- Self-Made Millionaires focus on simple investments

- 4- Self-Made Millionaires always know the basic knowledge of money and avoid big mistakes

- 5- Self-Made Millionaires have multiple income sources

- 6- Most of Self-Made Millionaires check their portfolio daily

1- Self-Made Millionaires are always looking for ways to own a high income

It is always easier to accumulate assets if you earn a lot of money. Most self-made millionaires weren't rich in the womb. They usually build an income in two or three decades by focusing and growing their careers.

2- Self-Made Millionaires usually save a large portion of their income

Saving has always been one of the important methods of accumulating wealth that anyone can do, and self-made millionaires are no exception. In the past, saving 10% was considered good. If you save that amount in 45 years, you could have a retirement amount by age 65.

As of today, people in the FIRE community are saving 50%, 75% of their income or even more.

Self-made Millionaires often maintain savings levels in between these two thresholds.

3- Self-Made Millionaires focus on simple investments

Simple investments can still make a good profit. Many millionaires have discovered this. After trying a variety of investments, they often end up falling back to the simplest investment categories such as real estate and index funds.

4- Self-Made Millionaires always know the basic knowledge of money and avoid big mistakes

Most sustainable millionaires increase their wealth using old and familiar methods like saving and investing. Thanks to that basic knowledge, they gradually became rich over time. Rarely can anyone maintain an asset thanks to a single event in a short time such as winning the lottery, inheritance, etc.

The process of getting rich of self-made millionaires is often quite boring, monotonous compared to the get-rich-quick stories often seen in the media. But it always works. Those who are slow and steady will win the race.

5- Self-Made Millionaires have multiple income sources

In addition to the main income, self-made millionaires also have many different sources of income, the most common income sources are dividends, real estate and side jobs. Passive incomes are often built over many years.

6- Most of Self-Made Millionaires check their portfolio daily

Experts often advise that the key to successful investing is not to follow the market too closely. Because that can lead to a tendency to make moves that are detrimental to their outcome.

Top 6 Money Habits of Self-Made Millionaires

10 Money Rules to face economic recession

Have you ever wondered what your financial situation will be like in a year, even just a few months? In the current context, it is unavoidable to worry about the risk of an economic recession. However, it is important that you start preparing now so that in the event of a recession in the next 6-12 months, you will be in the best position with the money amount you have.

Have you ever wondered what your financial situation will be like in a year, even just a few months? In the current context, it is unavoidable to worry about the risk of an economic recession. However, it is important that you start preparing now so that in the event of a recession in the next 6-12 months, you will be in the best position with the money amount you have.

Read more8 Money Saving Tips When Buying A House

Although housing prices have increased many times compared to the past time, you can still buy a house if you know how to save money smartly. Owning a dream home is no longer a far-away wish when we know how to make an effective financial plan. Below 8 Effective Money Saving Tips When Buying A House.

Although housing prices have increased many times compared to the past time, you can still buy a house if you know how to save money smartly. Owning a dream home is no longer a far-away wish when we know how to make an effective financial plan. Below 8 Effective Money Saving Tips When Buying A House.

Read more7 Billionaire Spending Habits help build Wealth

Fortune magazine published the results of a study showing that up to 54% of billionaires want to continue working at retirement age, and 60% of those with a net worth of more than $15 million don't even have a retire plan.

Fortune magazine published the results of a study showing that up to 54% of billionaires want to continue working at retirement age, and 60% of those with a net worth of more than $15 million don\'t even have a retire plan.

Read moreMost common habits of The World’s 4 Richest groups

Research "Rich Habits" by Tom Corley shows that there are 4 groups of wealthy people, including savers - investors, people who are eager to advance at work, high skilled professionals and the dreamers.

One of the common wealthy habits of the world's richest people is saving and investing their savings.

Research "Rich Habits" by Tom Corley shows that there are 4 groups of wealthy people, including savers - investors, people who are eager to advance at work, high skilled professionals and the dreamers.

One of the common wealthy habits of the world\'s richest people is saving and investing their savings.

Read more4 Financial mistakes young people often make

The path to financial independence is often not easy. For young people, focusing on retirement or saving for the future is often not a top priority.

But they can lose a lot of money if they make the wrong financial decisions. Here are 4 common financial mistakes that young people often make.

The path to financial independence is often not easy. For young people, focusing on retirement or saving for the future is often not a top priority.

But they can lose a lot of money if they make the wrong financial decisions. Here are 4 common financial mistakes that young people often make.

Read more4 Things to know when Getting a House Mortgage

A home loan is a suitable option if you need a large sum of money. To manage finances intelligently and avoid falling into a debt spiral, you should pay attention to a safe loan threshold, interest costs to pay, loan term,..

A home loan is a suitable option if you need a large sum of money. To manage finances intelligently and avoid falling into a debt spiral, you should pay attention to a safe loan threshold, interest costs to pay, loan term,..

Read more4 Investing Tips for Your 20s

There are investments that, as long as you are willing to put in money, time and effort, will definitely bring a worthy return. Here are 4 investments that you should make at the age of 20-30, According to Tim Denning, an Australian blogger.

There are investments that, as long as you are willing to put in money, time and effort, will definitely bring a worthy return. Here are 4 investments that you should make at the age of 20-30, According to Tim Denning, an Australian blogger.

Read moreHow to Save Money with Low Income fast: 5 Tips

If you have a low income, you need to make a concentrated effort to save money. While this is not always easy, it can be worthwhile in the long run. To help people with low income to save money, financial experts have shared 5 tips as below.

If you have a low income, you need to make a concentrated effort to save money. While this is not always easy, it can be worthwhile in the long run. To help people with low income to save money, financial experts have shared 5 tips as below.

Read more4 Personal Financial Management Tips for Gen Z

The unpredictable factors of a volatile life require Gen Z to equip themselves with personal financial management skills as well as develop a flexible plan to avoid struggling with financial problems. Here are 4 personal financial management tips for Gen Z.

The unpredictable factors of a volatile life require Gen Z to equip themselves with personal financial management skills as well as develop a flexible plan to avoid struggling with financial problems. Here are 4 personal financial management tips for Gen Z.

Read more