4 Personal Financial Management Tips for Gen Z

The unpredictable factors of a volatile life require Gen Z to equip themselves with personal financial management skills as well as develop a flexible plan to avoid struggling with financial problems. Here are 4 personal financial management tips for Gen Z.

1- Develop a financial plan and strictly implement it

At present, half of Generation Z is working. Early in their careers, Gen Z often comes up with a plan that addresses short-term and long-term financial goals separately. But with the YOLO lifestyle of young people, sometimes they forget the financial goals they have set and often fall into “out of money” status before the month is over.

According to financial experts, discipline in personal finance is considered an important factor because in life, finances will change constantly. By setting up a financial plan, Gen Z can begin to take control of their life by tracking, proportioning, spending and budgeting to determine financial status and make reasonable adjustments.

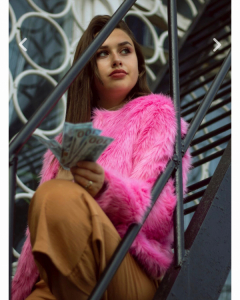

How does Gen Z manage money?

How does Gen Z manage money?

Gen Z is also advised to save for maximum financial flexibility. Gen Z should allocate savings amount to emergency fund, retirement savings and taxable investment accounts.

2- Track savings and spending continuously

According to financial experts, budgeting that incorporates technology across apps should be adopted by Gen Z to pay fewer bills, saving both time and money.

Creating a budget sometimes takes a little initial effort but over time, Gen Z won't even have to think about budgeting anymore because it has become the habit ingrained in the subconscious.

3- Set up an emergency fund

Every one of us has heard about emergency funds at least once in a while. An emergency fund is a savings account used only for emergencies such as covering expenses after a job loss or unexpected medical bills. An emergency fund is not a special type of account but a separate savings account.

Gen Z is one of the groups that currently have to adapt to many volatile situations of the world economy. With the unpredictable financial situation since the Covid-19 pandemic happened, many people have taken advantage of an emergency fund. The pandemic is a prime example of why we should set aside at least six months of savings for an emergency fund, just in case, any contingencies happen.

Experts say that in order to have an emergency fund, we should have the habit of saving early.

With an emergency fund in place, Gen Z can also confidently start entering new areas of investment which we can start putting our money to work for us to create more money.

4- Avoid sudden shopping

The explosion of e-commerce has changed consumer behaviours towards more costs. Thanks to the convenience, sudden shopping is cluttering up consumer rooms. According to Statista, in 2018, about half of all purchases made by 18- to 24-year-olds in the United States were the result of sudden shopping.

But there are still some Gen Zers who shop selectively, read reviews and make make a conscious decision before buying a product. It can be said that the habit of looking for more reference information from many websites before deciding to buy helps reduce the "bringing all cart home".

The above 4 personal financial management tips for Gen Z on building a scientific spending management plan and practicing reasonable spending habits can help Gen Z solve their financial problems and stand firm in the face of unexpected incidents in life.

4 Personal Financial Management Tips for Gen Z

Top 6 Money Habits of Self-Made Millionaires

Here are Top 6 Money Habits of Self-Made Millionaires that you should know.

Here are Top 6 Money Habits of Self-Made Millionaires that you should know.

Read more

10 Money Rules to face economic recession

Have you ever wondered what your financial situation will be like in a year, even just a few months? In the current context, it is unavoidable to worry about the risk of an economic recession. However, it is important that you start preparing now so that in the event of a recession in the next 6-12 months, you will be in the best position with the money amount you have.

Have you ever wondered what your financial situation will be like in a year, even just a few months? In the current context, it is unavoidable to worry about the risk of an economic recession. However, it is important that you start preparing now so that in the event of a recession in the next 6-12 months, you will be in the best position with the money amount you have.

Read more8 Money Saving Tips When Buying A House

Although housing prices have increased many times compared to the past time, you can still buy a house if you know how to save money smartly. Owning a dream home is no longer a far-away wish when we know how to make an effective financial plan. Below 8 Effective Money Saving Tips When Buying A House.

Although housing prices have increased many times compared to the past time, you can still buy a house if you know how to save money smartly. Owning a dream home is no longer a far-away wish when we know how to make an effective financial plan. Below 8 Effective Money Saving Tips When Buying A House.

Read more7 Billionaire Spending Habits help build Wealth

Fortune magazine published the results of a study showing that up to 54% of billionaires want to continue working at retirement age, and 60% of those with a net worth of more than $15 million don't even have a retire plan.

Fortune magazine published the results of a study showing that up to 54% of billionaires want to continue working at retirement age, and 60% of those with a net worth of more than $15 million don\'t even have a retire plan.

Read moreMost common habits of The World’s 4 Richest groups

Research "Rich Habits" by Tom Corley shows that there are 4 groups of wealthy people, including savers - investors, people who are eager to advance at work, high skilled professionals and the dreamers.

One of the common wealthy habits of the world's richest people is saving and investing their savings.

Research "Rich Habits" by Tom Corley shows that there are 4 groups of wealthy people, including savers - investors, people who are eager to advance at work, high skilled professionals and the dreamers.

One of the common wealthy habits of the world\'s richest people is saving and investing their savings.

Read more4 Financial mistakes young people often make

The path to financial independence is often not easy. For young people, focusing on retirement or saving for the future is often not a top priority.

But they can lose a lot of money if they make the wrong financial decisions. Here are 4 common financial mistakes that young people often make.

The path to financial independence is often not easy. For young people, focusing on retirement or saving for the future is often not a top priority.

But they can lose a lot of money if they make the wrong financial decisions. Here are 4 common financial mistakes that young people often make.

Read more4 Things to know when Getting a House Mortgage

A home loan is a suitable option if you need a large sum of money. To manage finances intelligently and avoid falling into a debt spiral, you should pay attention to a safe loan threshold, interest costs to pay, loan term,..

A home loan is a suitable option if you need a large sum of money. To manage finances intelligently and avoid falling into a debt spiral, you should pay attention to a safe loan threshold, interest costs to pay, loan term,..

Read more4 Investing Tips for Your 20s

There are investments that, as long as you are willing to put in money, time and effort, will definitely bring a worthy return. Here are 4 investments that you should make at the age of 20-30, According to Tim Denning, an Australian blogger.

There are investments that, as long as you are willing to put in money, time and effort, will definitely bring a worthy return. Here are 4 investments that you should make at the age of 20-30, According to Tim Denning, an Australian blogger.

Read moreHow to Save Money with Low Income fast: 5 Tips

If you have a low income, you need to make a concentrated effort to save money. While this is not always easy, it can be worthwhile in the long run. To help people with low income to save money, financial experts have shared 5 tips as below.

If you have a low income, you need to make a concentrated effort to save money. While this is not always easy, it can be worthwhile in the long run. To help people with low income to save money, financial experts have shared 5 tips as below.

Read more