5 BEST WAYS TO MANAGE PERSONAL FINANCES

The problem of unreasonable spending is now quite common specially for young people and most of it comes from personal habits. Here are five ways to manage personal finances to help you make a reasonable spending decision to achieve financial freedom for yourself and your family.

5 BEST WAYS TO MANAGE PERSONAL FINANCES

1. Manage personal finances by spending less than you can afford

Reduce your spending ability a little less than it actually is. Change your lifestyle to suit your goals. This is really the key in better personal financial management.

There are many ways to live comfortably without spending your last money amount. But not everyone knows them.

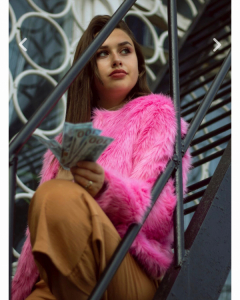

5 best ways to manage personal finances / ph: pexels

5 best ways to manage personal finances / ph: pexels

You can adjust unnecessary spending towards more savings when you have good habits. These savings will spend for later bigger goals like buying a home for yourself or traveling.

Take control of your spending on a mobile app or a small notebook and strive for achieving the set goals.

Look for suitable items instead of valuable items and satisfy your ego needs.

2. Manage personal finances through budget setting

People often think that budgeting with an excessively saving regime, sacrificing short-term comforts and denying own pleasures not only is this not good, on the contrary, it can also have bad consequences that make you decide to waste it all in just one night. Instead, set a balanced budget like you follow a healthy and balanced diet.

Personal financial management should become a habit, not an instant solution.

Establishing a safe and solid budget from day to month will keep you in good financial health.

Here are 3 types of budgets can help you deal with money disorders:

- Low budget

When you make less money or need to save up for something special like a house or a new car,..

- Average budget

Your money you earn is just enough for living costs.

- High budget

When you have extra money amounts.

Choosing the right type of budget determines your spending for that month.

3. Manage personal finances through priority choices in spending

- Choose the items or things that you think are really important before spending.

- Make sure you have a plan and this is the most important priority

- Make sure your long-term goals don't affect your short-term spending needs much

- Choose products and services with long-term using value and multi-use for cost optimization.

- Avoid buying short-term, cheap but poor quality items

- Create 2 accounts: one for necessary living expenses and one for urgent spending. Thereby, you can manage your personal finances more easily.

4. Manage personal finances by smart savings

- Set financial goals in a specific context to know how much to save and for how long

- Set a motivating goal and commit to it

- Try to pay off personal debts and bank debts

- Each month, set aside your savings first, then spend the rest and don't use your savings. If 20% is too much, try starting with 10% or at least 5%.

This will help you create a habit of saving and creating your own fund.

- You can split all your money into 2 parts:

The first part is for the need to pay for essential things on daily living. The second part is for savings, you can take it to the bank.

5. Manage personal finances by 6 financial jars method

The 6 financial jars method is a pretty simple way that everyone can apply to better manage personal finances.

- The 1st financial jar (55%): For essential spending needs

This jar spends for necessary living expenses as foods, paying electricity bills, water bills, etc.

- The 2nd financial jar (10%): Saving for long-term goals

This is an investment that needs to be fixed for the purpose of buying your own home, car, or invest in your business.

- The 3rd financial jar (10%): Education and training

Use 10% of income for the purpose of learning and developing yourself

- The 4th financial jar (10%): Entertainments

This 10% of your income is spent for entertainment and leisure purposes which will help you create more energy and be more productive at work.

- The 5th financial jar (10%): Financial Freedom Fund

This fund is for investment purposes that generate profits as financial investment, real estate,..

Financial freedom is even more improved when you invest effectively and generate a lot of profits.

- The 6th financial jar (5%): Charities & giving

Show your gratitude, life is sharing and giving to receive more values. You will get a lot of joy and happiness when you share and give or grant charities.

5 BEST WAYS TO MANAGE PERSONAL FINANCES

Top 6 Money Habits of Self-Made Millionaires

Here are Top 6 Money Habits of Self-Made Millionaires that you should know.

Here are Top 6 Money Habits of Self-Made Millionaires that you should know.

Read more

10 Money Rules to face economic recession

Have you ever wondered what your financial situation will be like in a year, even just a few months? In the current context, it is unavoidable to worry about the risk of an economic recession. However, it is important that you start preparing now so that in the event of a recession in the next 6-12 months, you will be in the best position with the money amount you have.

Have you ever wondered what your financial situation will be like in a year, even just a few months? In the current context, it is unavoidable to worry about the risk of an economic recession. However, it is important that you start preparing now so that in the event of a recession in the next 6-12 months, you will be in the best position with the money amount you have.

Read more8 Money Saving Tips When Buying A House

Although housing prices have increased many times compared to the past time, you can still buy a house if you know how to save money smartly. Owning a dream home is no longer a far-away wish when we know how to make an effective financial plan. Below 8 Effective Money Saving Tips When Buying A House.

Although housing prices have increased many times compared to the past time, you can still buy a house if you know how to save money smartly. Owning a dream home is no longer a far-away wish when we know how to make an effective financial plan. Below 8 Effective Money Saving Tips When Buying A House.

Read more7 Billionaire Spending Habits help build Wealth

Fortune magazine published the results of a study showing that up to 54% of billionaires want to continue working at retirement age, and 60% of those with a net worth of more than $15 million don't even have a retire plan.

Fortune magazine published the results of a study showing that up to 54% of billionaires want to continue working at retirement age, and 60% of those with a net worth of more than $15 million don\'t even have a retire plan.

Read moreMost common habits of The World’s 4 Richest groups

Research "Rich Habits" by Tom Corley shows that there are 4 groups of wealthy people, including savers - investors, people who are eager to advance at work, high skilled professionals and the dreamers.

One of the common wealthy habits of the world's richest people is saving and investing their savings.

Research "Rich Habits" by Tom Corley shows that there are 4 groups of wealthy people, including savers - investors, people who are eager to advance at work, high skilled professionals and the dreamers.

One of the common wealthy habits of the world\'s richest people is saving and investing their savings.

Read more4 Financial mistakes young people often make

The path to financial independence is often not easy. For young people, focusing on retirement or saving for the future is often not a top priority.

But they can lose a lot of money if they make the wrong financial decisions. Here are 4 common financial mistakes that young people often make.

The path to financial independence is often not easy. For young people, focusing on retirement or saving for the future is often not a top priority.

But they can lose a lot of money if they make the wrong financial decisions. Here are 4 common financial mistakes that young people often make.

Read more4 Things to know when Getting a House Mortgage

A home loan is a suitable option if you need a large sum of money. To manage finances intelligently and avoid falling into a debt spiral, you should pay attention to a safe loan threshold, interest costs to pay, loan term,..

A home loan is a suitable option if you need a large sum of money. To manage finances intelligently and avoid falling into a debt spiral, you should pay attention to a safe loan threshold, interest costs to pay, loan term,..

Read more4 Investing Tips for Your 20s

There are investments that, as long as you are willing to put in money, time and effort, will definitely bring a worthy return. Here are 4 investments that you should make at the age of 20-30, According to Tim Denning, an Australian blogger.

There are investments that, as long as you are willing to put in money, time and effort, will definitely bring a worthy return. Here are 4 investments that you should make at the age of 20-30, According to Tim Denning, an Australian blogger.

Read moreHow to Save Money with Low Income fast: 5 Tips

If you have a low income, you need to make a concentrated effort to save money. While this is not always easy, it can be worthwhile in the long run. To help people with low income to save money, financial experts have shared 5 tips as below.

If you have a low income, you need to make a concentrated effort to save money. While this is not always easy, it can be worthwhile in the long run. To help people with low income to save money, financial experts have shared 5 tips as below.

Read more