UK lender Abound secures £800m in financing round

UK-based credit technology firm Abound secures £800m in new financing round, including equity and debt financing from Citi and GSR Ventures.

Abound, a UK-based credit technology firm, has recently announced the successful completion of a new financing round, raising up to £800 million in a combination of equity and debt financing. This funding round includes an asset-backed debt financing arrangement from existing investor Citi, as well as a Series B equity component led by Silicon Valley-based GSR Ventures. This latest round of financing comes on the heels of a £500 million equity and debt raise secured by Abound last year.

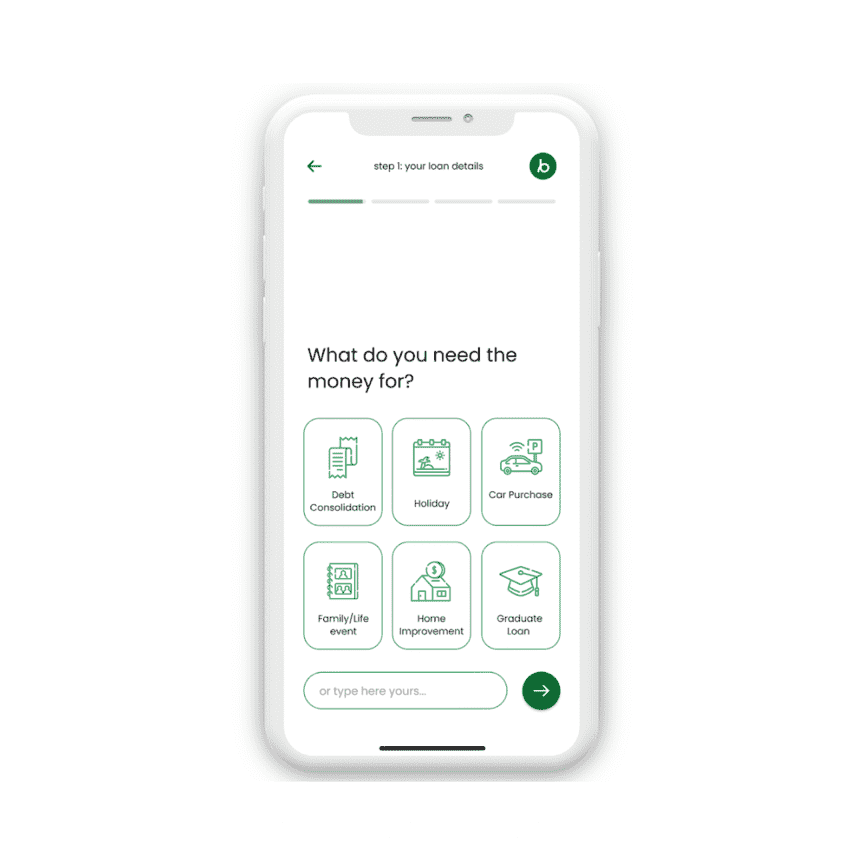

Founded in 2020 by Gerald Chappell and Dr. Michelle He, Abound prides itself on offering borrowers access to more affordable loans compared to traditional lenders. The company has already issued over £300 million in loans to date. With the new funding in place, Abound is looking to expand its presence in the UK market by venturing into prime lending. The company also aims to double its workforce from 65 to 130 employees this year.

One of the key areas where Abound plans to invest the new funds is in its proprietary AI-powered credit technology platform, Render. This platform leverages customers' open banking data to quickly assess their borrowing capacity. By using Render, Abound believes it can help enterprises make smarter credit risk decisions and extend their services to a wider range of customers, including those who may be considered "credit invisible."

Abound's latest financing round marks a significant milestone for the company as it looks to expand its reach in the UK market and enhance its technological capabilities. With a focus on providing more affordable loans and leveraging AI-powered solutions, Abound is poised for continued growth and success in the competitive credit technology sector.

UK lender Abound secures £800m in financing round

Dojo Partners with YouLend for Flexible Financing in Spain

Dojo and YouLend team up to offer Spanish businesses flexible, innovative financing solutions, enhancing payment technology for local customers.

Dojo and YouLend team up to offer Spanish businesses flexible, innovative financing solutions, enhancing payment technology for local customers.

Read moreOnline Lending Market Declines in Switzerland

Explore the reasons behind the shrinking online lending market in Switzerland and its impact on borrowers and financial institutions.

Explore the reasons behind the shrinking online lending market in Switzerland and its impact on borrowers and financial institutions.

Read moreWestern Union to Acquire Dash Mobile Wallet from Singtel

Western Union has entered a conditional agreement to acquire Dash, a mobile wallet by Singtel, marking a significant move in digital finance.

Western Union has entered a conditional agreement to acquire Dash, a mobile wallet by Singtel, marking a significant move in digital finance.

Read moreDutch Paytech Platform OPP Secures UK EMI Licence

The Dutch online payment platform OPP has successfully obtained an EMI licence in the UK, enabling enhanced services and regulatory compliance.

The Dutch online payment platform OPP has successfully obtained an EMI licence in the UK, enabling enhanced services and regulatory compliance.

Read moreDigital Banks in Spain Surpass 5 Million Customers

Explore the rise of digital banks in Spain as they reach over five million customers, reshaping the banking experience and driving innovation.

Explore the rise of digital banks in Spain as they reach over five million customers, reshaping the banking experience and driving innovation.

Read moreWealthKernel Expands into Europe with CNMV License

WealthKernel, a leading digital investing provider, secures CNMV license, becoming dual-regulated in the UK and EU.

WealthKernel, a leading digital investing provider, secures CNMV license, becoming dual-regulated in the UK and EU.

Read moreQonto Expands to Austria, Belgium, Netherlands, Portugal

Qonto, the top European finance solution for SMEs, launches in four new countries, enhancing support for freelancers and businesses.

Qonto, the top European finance solution for SMEs, launches in four new countries, enhancing support for freelancers and businesses.

Read moreLopay and YouLend: £1M in Funding for UK SMEs

Lopay and YouLend join forces to provide vital financing for UK SMEs, surpassing £1 million in funding to support business growth and innovation.

Lopay and YouLend join forces to provide vital financing for UK SMEs, surpassing £1 million in funding to support business growth and innovation.

Read moreOakNorth Offers Custom Capital Call to Paloma Capital

OakNorth provides a bespoke capital call facility to Paloma Capital, enhancing their private equity real estate investment strategies.

OakNorth provides a bespoke capital call facility to Paloma Capital, enhancing their private equity real estate investment strategies.

Read more