HOW TO MANAGE FINANCES WISELY?

The global pandemic caused the financial crisis take place on a large scale. These days, people understand more deeply the importance of financial management.

In fact, having the ability to make money doesn't mean you can keep your assets and make assets increase rapidly.

If you don't know how to manage money, then no matter how much money you make, one day you will be out of pocket. So how to manage finances wisely?

In fact, having the ability to make money doesn't mean you can keep your assets and make assets increase rapidly.

If you don't know how to manage money, then no matter how much money you make, one day you will be out of pocket. So how to manage finances wisely?

HOW TO MANAGE FINANCES WISELY?

1. Understand assets and liabilities

When your salary is still on the bank account, the choice to spend or manage money will determine a person's financial situation in the future.

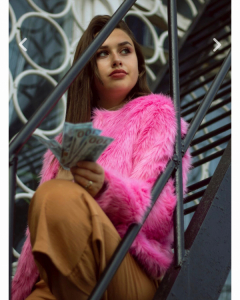

How to manage finances wisely? / ph: pexels

How to manage finances wisely? / ph: pexels

Those who prefer to spend first will often be out of pocket at the end of the month. Because they work for many years but do not know how to accumulate.

In contrast, those who know how to control desires, delay satisfaction, use money to invest and then use the income generated by old assets to use is person who are good at financial management.

It is often said that before learning how to manage finances, it is best to understand about assets and liabilities first.

Assets are things that can give us money in the present, and give us profits in the future as savings, invested real estates, stocks, funds,...

Liabilities are things that make you spend money as consumable things, car loans, mortgages, etc.

Learn to distinguish between your own reasonable and unnecessary needs, then spend wisely.

2. If you have a small capital, let’s invest in your professional skills first

Many people often learn from Buffett's investment secrets, but few people know his most important investment view.

When being asked about the most important investment view, Buffett's answer was: "Myself!"

When your investment capital is not much, instead of following the crowd, be patient to take the time to upgrade your own knowledge and skills.

If you pay close attention you will see that, for most people in the workplace, especially those with a small capital, investing in yourself will be the most effective and cost-effective approach.

3. Don't invest all your eggs in the basket

Those who dare to take risks and not hesitate to face them, often become good investors. Simply because they have a high tolerance.

There is no financial product which the returns are exceptionally high but the risks are extremely low. This is a common law.

If someone tells you how high his financial returns are without telling the truth about the risks to be paid, then don't cooperate with them.

Learn to walk slowly but surely, divide the capital into many small parts, learn to "put eggs in many baskets".

Thus, when taking risks, you will have ability to overpass difficulties.

4. Use the leverage mindset to invest in yourself

In the workplace there are two main types of people:

The first people type will get their goals based on their abilities and resources. The second people will think how to find resources and integrate resources to get their goals done. This is the leverage mindset.

Everyone understands that working hard does not guarantee success, but if you don't try, you will only fail.

The leverage mindset has great influence, even if there is the loss then It's not a big deal.

HOW TO MANAGE FINANCES WISELY?

Top 6 Money Habits of Self-Made Millionaires

Here are Top 6 Money Habits of Self-Made Millionaires that you should know.

Here are Top 6 Money Habits of Self-Made Millionaires that you should know.

Read more

10 Money Rules to face economic recession

Have you ever wondered what your financial situation will be like in a year, even just a few months? In the current context, it is unavoidable to worry about the risk of an economic recession. However, it is important that you start preparing now so that in the event of a recession in the next 6-12 months, you will be in the best position with the money amount you have.

Have you ever wondered what your financial situation will be like in a year, even just a few months? In the current context, it is unavoidable to worry about the risk of an economic recession. However, it is important that you start preparing now so that in the event of a recession in the next 6-12 months, you will be in the best position with the money amount you have.

Read more8 Money Saving Tips When Buying A House

Although housing prices have increased many times compared to the past time, you can still buy a house if you know how to save money smartly. Owning a dream home is no longer a far-away wish when we know how to make an effective financial plan. Below 8 Effective Money Saving Tips When Buying A House.

Although housing prices have increased many times compared to the past time, you can still buy a house if you know how to save money smartly. Owning a dream home is no longer a far-away wish when we know how to make an effective financial plan. Below 8 Effective Money Saving Tips When Buying A House.

Read more7 Billionaire Spending Habits help build Wealth

Fortune magazine published the results of a study showing that up to 54% of billionaires want to continue working at retirement age, and 60% of those with a net worth of more than $15 million don't even have a retire plan.

Fortune magazine published the results of a study showing that up to 54% of billionaires want to continue working at retirement age, and 60% of those with a net worth of more than $15 million don\'t even have a retire plan.

Read moreMost common habits of The World’s 4 Richest groups

Research "Rich Habits" by Tom Corley shows that there are 4 groups of wealthy people, including savers - investors, people who are eager to advance at work, high skilled professionals and the dreamers.

One of the common wealthy habits of the world's richest people is saving and investing their savings.

Research "Rich Habits" by Tom Corley shows that there are 4 groups of wealthy people, including savers - investors, people who are eager to advance at work, high skilled professionals and the dreamers.

One of the common wealthy habits of the world\'s richest people is saving and investing their savings.

Read more4 Financial mistakes young people often make

The path to financial independence is often not easy. For young people, focusing on retirement or saving for the future is often not a top priority.

But they can lose a lot of money if they make the wrong financial decisions. Here are 4 common financial mistakes that young people often make.

The path to financial independence is often not easy. For young people, focusing on retirement or saving for the future is often not a top priority.

But they can lose a lot of money if they make the wrong financial decisions. Here are 4 common financial mistakes that young people often make.

Read more4 Things to know when Getting a House Mortgage

A home loan is a suitable option if you need a large sum of money. To manage finances intelligently and avoid falling into a debt spiral, you should pay attention to a safe loan threshold, interest costs to pay, loan term,..

A home loan is a suitable option if you need a large sum of money. To manage finances intelligently and avoid falling into a debt spiral, you should pay attention to a safe loan threshold, interest costs to pay, loan term,..

Read more4 Investing Tips for Your 20s

There are investments that, as long as you are willing to put in money, time and effort, will definitely bring a worthy return. Here are 4 investments that you should make at the age of 20-30, According to Tim Denning, an Australian blogger.

There are investments that, as long as you are willing to put in money, time and effort, will definitely bring a worthy return. Here are 4 investments that you should make at the age of 20-30, According to Tim Denning, an Australian blogger.

Read moreHow to Save Money with Low Income fast: 5 Tips

If you have a low income, you need to make a concentrated effort to save money. While this is not always easy, it can be worthwhile in the long run. To help people with low income to save money, financial experts have shared 5 tips as below.

If you have a low income, you need to make a concentrated effort to save money. While this is not always easy, it can be worthwhile in the long run. To help people with low income to save money, financial experts have shared 5 tips as below.

Read more