Revolutionizing Shopping with New Biometric Technology Checkout

Discover how Bold Commerce's latest innovation, biometric checkout powered by Wink, revolutionizes the shopping experience for omnichannel retailers and DTC brands. Say goodbye to manual login and payment details with this groundbreaking technology.

Bold Commerce, a leading provider of headless checkout solutions for omnichannel retailers and direct-to-consumer (DTC) brands, has unveiled its latest innovation: the introduction of biometric checkout powered by Wink. This groundbreaking technology allows shoppers to use their face and voice to automatically fill in login credentials, delivery details, loyalty accounts, and payment preferences, streamlining the checkout process across all shopping channels and in-store.

The new Bold Checkout with Wink is set to revolutionize the shopping experience by significantly reducing the time it takes for shoppers to complete their purchases. With checkout times accelerated by 3X, the risk of abandonment and fraud associated with traditional password-based systems is effectively eliminated. This move comes in response to the growing demand for faster, more secure checkout experiences, with over half of shoppers already using biometrics to complete their purchases.

Unlike existing biometric solutions that are limited to specific devices and only apply to the payment stage of checkout, Bold Commerce's new offering extends biometrics to every aspect of the checkout process. By removing the need for passwords and PINs, shoppers can seamlessly transition from adding items to their cart to finalizing their purchase using just their face.

Retailers can seamlessly integrate Bold Checkout with Wink into any mobile, desktop, or in-store shopping environment, empowering shoppers to expedite their checkout process regardless of their location or the nature of their purchase. Through the use of voice and face recognition, customers can be swiftly authenticated, with their account details and preferred payment methods automatically pre-filled to facilitate a smooth and personalized transaction.

In addition to enhancing the convenience and efficiency of the checkout process, Bold Checkout with Wink also provides an added layer of security, safeguarding both retailers and shoppers against fraudulent activity and unauthorized access. By incorporating biometric authentication into their checkout systems, retailers can ensure a secure and seamless shopping experience across all touchpoints.

This latest innovation from Bold Commerce is part of the company's Build with Bold program, which aims to empower retailers with cutting-edge solutions to enhance their customer experiences and drive business growth.

Revolutionizing Shopping with New Biometric Technology Checkout

Online Lending Market Declines in Switzerland

Explore the reasons behind the shrinking online lending market in Switzerland and its impact on borrowers and financial institutions.

Explore the reasons behind the shrinking online lending market in Switzerland and its impact on borrowers and financial institutions.

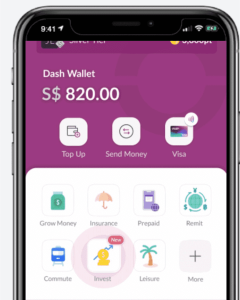

Read moreWestern Union to Acquire Dash Mobile Wallet from Singtel

Western Union has entered a conditional agreement to acquire Dash, a mobile wallet by Singtel, marking a significant move in digital finance.

Western Union has entered a conditional agreement to acquire Dash, a mobile wallet by Singtel, marking a significant move in digital finance.

Read moreDutch Paytech Platform OPP Secures UK EMI Licence

The Dutch online payment platform OPP has successfully obtained an EMI licence in the UK, enabling enhanced services and regulatory compliance.

The Dutch online payment platform OPP has successfully obtained an EMI licence in the UK, enabling enhanced services and regulatory compliance.

Read moreDigital Banks in Spain Surpass 5 Million Customers

Explore the rise of digital banks in Spain as they reach over five million customers, reshaping the banking experience and driving innovation.

Explore the rise of digital banks in Spain as they reach over five million customers, reshaping the banking experience and driving innovation.

Read moreWealthKernel Expands into Europe with CNMV License

WealthKernel, a leading digital investing provider, secures CNMV license, becoming dual-regulated in the UK and EU.

WealthKernel, a leading digital investing provider, secures CNMV license, becoming dual-regulated in the UK and EU.

Read moreQonto Expands to Austria, Belgium, Netherlands, Portugal

Qonto, the top European finance solution for SMEs, launches in four new countries, enhancing support for freelancers and businesses.

Qonto, the top European finance solution for SMEs, launches in four new countries, enhancing support for freelancers and businesses.

Read moreLopay and YouLend: £1M in Funding for UK SMEs

Lopay and YouLend join forces to provide vital financing for UK SMEs, surpassing £1 million in funding to support business growth and innovation.

Lopay and YouLend join forces to provide vital financing for UK SMEs, surpassing £1 million in funding to support business growth and innovation.

Read moreOakNorth Offers Custom Capital Call to Paloma Capital

OakNorth provides a bespoke capital call facility to Paloma Capital, enhancing their private equity real estate investment strategies.

OakNorth provides a bespoke capital call facility to Paloma Capital, enhancing their private equity real estate investment strategies.

Read moreRapid Finance Integrates with Q2’s Digital Banking Platform for Small Business Lending

Discover how Rapid Finance's new integration with Q2 enhances small business lending solutions, streamlining access to vital financial resources.

Discover how Rapid Finance\'s new integration with Q2 enhances small business lending solutions, streamlining access to vital financial resources.

Read more