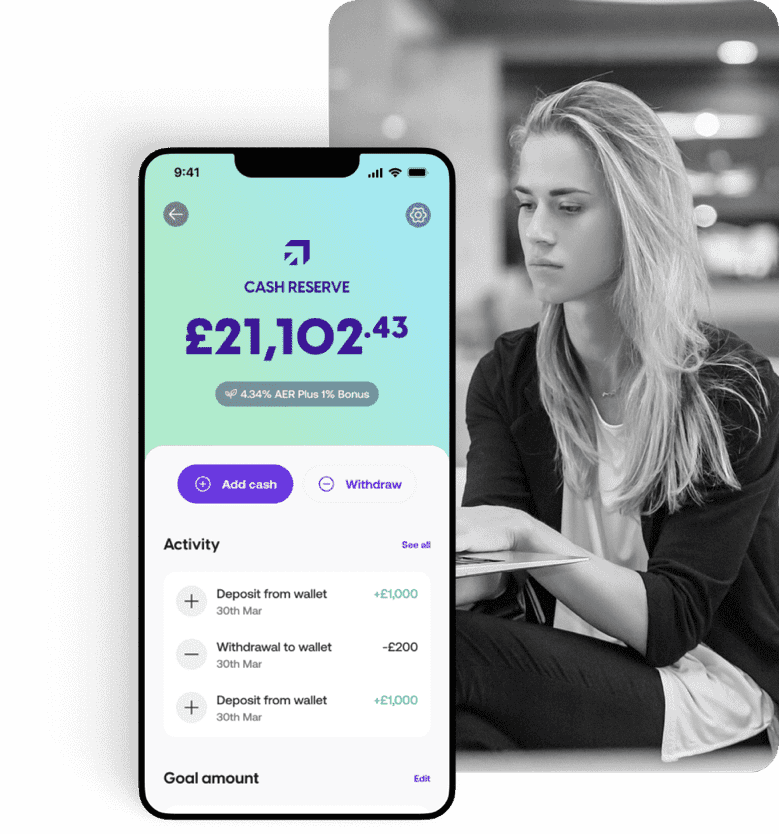

Sidekick Raises £8.5M for Wealth Management Platform

Sidekick secures £8.5M for its wealth management platform, fueling client expansion, product development, and licensing ambitions in Europe. Learn more about the investment and growth plans here.

Sidekick, a leading wealth management platform for investors, has successfully secured £4.5M in a Seed round and an additional £4M through a debt facility. The seed round was co-led by Pact VC and TheVentureCity, with support from MS&AD, Blackwood, and 1818, as well as previous investors Octopus Ventures, Seedcamp, and Semantic Ventures. The debt financing was provided by Columbia Lake Partners, known for backing successful companies like Mews, Factorial, Griffin, and Contentsquare.

Investors using Sidekick can borrow up to 40 percent of the value of their portfolio, subject to assessment, without the risk of a forced sale. This credit facility is backed by the investor's portfolio, allowing Sidekick to offer larger loan amounts, lower fees, and greater flexibility. The platform is designed to cater to investors looking for more long-term investment opportunities, rather than short-term gains through stock picking or robo-advisory services.

A recent report from the Resolution Foundation highlighted the growing wealth divide, with households in higher wealth deciles holding a larger portion of their assets in higher-returning investments. This disparity is attributed to varying liquidity needs, with lower-income households often holding more cash for unexpected expenses.

Sidekick's unique offering includes a Portfolio Line of Credit, a lombard lending product that helps investors stay invested over the long term while still having access to liquidity when needed. The company has obtained regulatory permissions from the FCA and launched its actively managed flagship equities product in January, setting itself apart as the only wealth management service in the UK to offer such a comprehensive solution.

Sidekick's innovative approach to wealth management provides investors with the tools and flexibility needed to grow their wealth over time, bridging the gap between traditional investment strategies and modern financial needs.

Sidekick Raises £8.5M for Wealth Management Platform

Dojo Partners with YouLend for Flexible Financing in Spain

Dojo and YouLend team up to offer Spanish businesses flexible, innovative financing solutions, enhancing payment technology for local customers.

Dojo and YouLend team up to offer Spanish businesses flexible, innovative financing solutions, enhancing payment technology for local customers.

Read moreOnline Lending Market Declines in Switzerland

Explore the reasons behind the shrinking online lending market in Switzerland and its impact on borrowers and financial institutions.

Explore the reasons behind the shrinking online lending market in Switzerland and its impact on borrowers and financial institutions.

Read moreWestern Union to Acquire Dash Mobile Wallet from Singtel

Western Union has entered a conditional agreement to acquire Dash, a mobile wallet by Singtel, marking a significant move in digital finance.

Western Union has entered a conditional agreement to acquire Dash, a mobile wallet by Singtel, marking a significant move in digital finance.

Read moreDutch Paytech Platform OPP Secures UK EMI Licence

The Dutch online payment platform OPP has successfully obtained an EMI licence in the UK, enabling enhanced services and regulatory compliance.

The Dutch online payment platform OPP has successfully obtained an EMI licence in the UK, enabling enhanced services and regulatory compliance.

Read moreDigital Banks in Spain Surpass 5 Million Customers

Explore the rise of digital banks in Spain as they reach over five million customers, reshaping the banking experience and driving innovation.

Explore the rise of digital banks in Spain as they reach over five million customers, reshaping the banking experience and driving innovation.

Read moreWealthKernel Expands into Europe with CNMV License

WealthKernel, a leading digital investing provider, secures CNMV license, becoming dual-regulated in the UK and EU.

WealthKernel, a leading digital investing provider, secures CNMV license, becoming dual-regulated in the UK and EU.

Read moreQonto Expands to Austria, Belgium, Netherlands, Portugal

Qonto, the top European finance solution for SMEs, launches in four new countries, enhancing support for freelancers and businesses.

Qonto, the top European finance solution for SMEs, launches in four new countries, enhancing support for freelancers and businesses.

Read moreLopay and YouLend: £1M in Funding for UK SMEs

Lopay and YouLend join forces to provide vital financing for UK SMEs, surpassing £1 million in funding to support business growth and innovation.

Lopay and YouLend join forces to provide vital financing for UK SMEs, surpassing £1 million in funding to support business growth and innovation.

Read moreOakNorth Offers Custom Capital Call to Paloma Capital

OakNorth provides a bespoke capital call facility to Paloma Capital, enhancing their private equity real estate investment strategies.

OakNorth provides a bespoke capital call facility to Paloma Capital, enhancing their private equity real estate investment strategies.

Read more