Small Business Banking Platform Relay Secures $32.2M in Series B Funding

Discover how Relay, the business banking platform providing cash flow clarity to small businesses, has successfully closed its $32.2 million Series B round.

Relay, the business banking platform dedicated to providing small businesses with clarity on their cash flow, has recently announced the successful completion of its $32.2 million Series B funding round. The round was led by Bain Capital Ventures, with participation from existing investors BTV, Garage, and Tapestry, as well as new investor Industry Ventures. This latest funding brings Relay's total funding to $51.6 million.

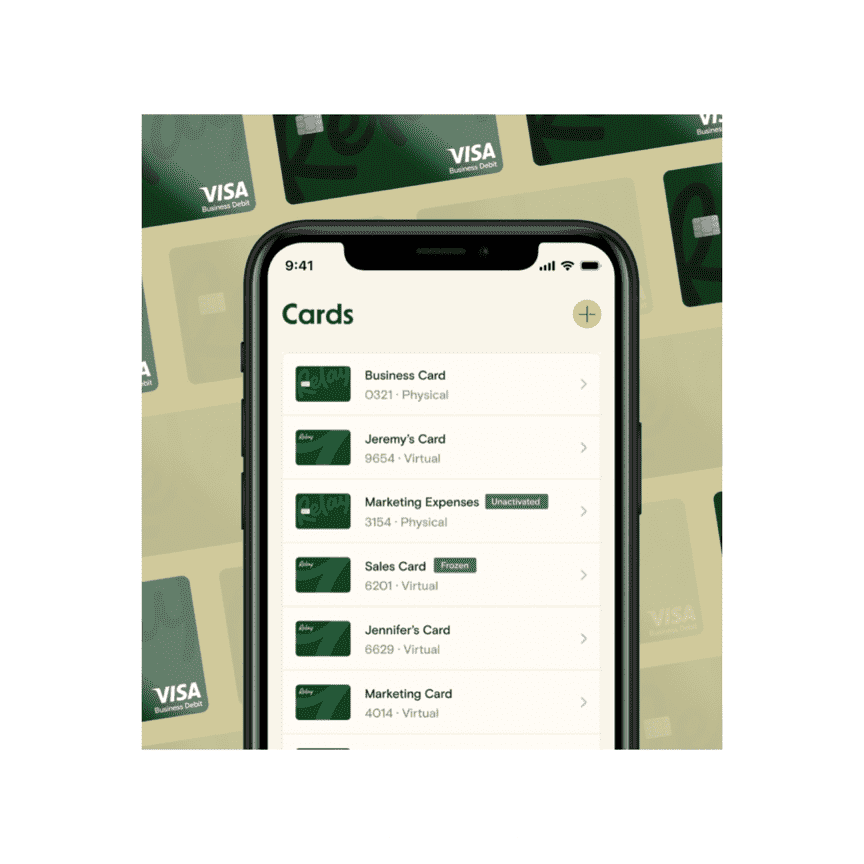

Relay's platform offers a comprehensive business banking solution tailored specifically for small and medium-sized businesses (SMBs). By focusing on tools that improve cash flow visibility and management, Relay aims to address the significant financial challenges faced by SMBs. The newly raised funds will be used to accelerate product development in key areas such as spend management, smart credit products, and the establishment of a financial API marketplace. These enhancements are designed to further Relay's mission of providing AI-powered predictive cash flow analytics to SMBs, enabling them to make better financial decisions and achieve greater stability.

The company has experienced impressive growth in recent years, with revenues tripling in 2022 and nearly sextupling in 2023. This growth underscores Relay's commitment to serving the small business market and helping SMBs overcome the common issue of cash flow management. In addition to its financial tools, Relay has partnered with the Profit First methodology, developed by entrepreneur Mike Michalowicz. This collaboration aims to assist SMBs in adopting better financial practices by utilizing a behavior-based cash management system.

Relay's latest funding round and strategic developments highlight the company's dedication to empowering small businesses with the tools and insights they need to thrive financially. With a focus on enhancing cash flow visibility and management, Relay is well-positioned to continue supporting SMBs in achieving financial success.

Small Business Banking Platform Relay Secures $32.2M in Series B Funding

Online Lending Market Declines in Switzerland

Explore the reasons behind the shrinking online lending market in Switzerland and its impact on borrowers and financial institutions.

Explore the reasons behind the shrinking online lending market in Switzerland and its impact on borrowers and financial institutions.

Read moreWestern Union to Acquire Dash Mobile Wallet from Singtel

Western Union has entered a conditional agreement to acquire Dash, a mobile wallet by Singtel, marking a significant move in digital finance.

Western Union has entered a conditional agreement to acquire Dash, a mobile wallet by Singtel, marking a significant move in digital finance.

Read moreDutch Paytech Platform OPP Secures UK EMI Licence

The Dutch online payment platform OPP has successfully obtained an EMI licence in the UK, enabling enhanced services and regulatory compliance.

The Dutch online payment platform OPP has successfully obtained an EMI licence in the UK, enabling enhanced services and regulatory compliance.

Read moreDigital Banks in Spain Surpass 5 Million Customers

Explore the rise of digital banks in Spain as they reach over five million customers, reshaping the banking experience and driving innovation.

Explore the rise of digital banks in Spain as they reach over five million customers, reshaping the banking experience and driving innovation.

Read moreWealthKernel Expands into Europe with CNMV License

WealthKernel, a leading digital investing provider, secures CNMV license, becoming dual-regulated in the UK and EU.

WealthKernel, a leading digital investing provider, secures CNMV license, becoming dual-regulated in the UK and EU.

Read moreQonto Expands to Austria, Belgium, Netherlands, Portugal

Qonto, the top European finance solution for SMEs, launches in four new countries, enhancing support for freelancers and businesses.

Qonto, the top European finance solution for SMEs, launches in four new countries, enhancing support for freelancers and businesses.

Read moreLopay and YouLend: £1M in Funding for UK SMEs

Lopay and YouLend join forces to provide vital financing for UK SMEs, surpassing £1 million in funding to support business growth and innovation.

Lopay and YouLend join forces to provide vital financing for UK SMEs, surpassing £1 million in funding to support business growth and innovation.

Read moreOakNorth Offers Custom Capital Call to Paloma Capital

OakNorth provides a bespoke capital call facility to Paloma Capital, enhancing their private equity real estate investment strategies.

OakNorth provides a bespoke capital call facility to Paloma Capital, enhancing their private equity real estate investment strategies.

Read moreRapid Finance Integrates with Q2’s Digital Banking Platform for Small Business Lending

Discover how Rapid Finance's new integration with Q2 enhances small business lending solutions, streamlining access to vital financial resources.

Discover how Rapid Finance\'s new integration with Q2 enhances small business lending solutions, streamlining access to vital financial resources.

Read more