Swiss Payment App Twint Experiences Huge Increase in Usage

Discover the significant increase in the usage of the Swiss payment app Twint and how it's impacting the payment industry. Learn about the latest surge in users and the implications for the future of digital payments in Switzerland.

Twint, the digital payment app, has experienced a significant surge in traffic over the past year, with a 50% annual growth in traffic and a total of 590 million transactions. This is a substantial increase from the four million transactions recorded in the year of Twint's launch in 2017. The app has seen a substantial rise in transactions in high street shops, with an 84% increase compared to the previous year. The majority of these transactions occur at supermarket checkouts.

Twint has also made significant strides in terms of acceptance, with 77% of bricks and mortar shops and 76% of online shops in Switzerland now accepting it as a payment method. The app boasts "well over five million" active users, and 72% of payments with Twint take place in retail, while 28% are money transfers between private individuals.

Looking ahead to 2024, Twint has plans to further promote its use in physical retail, aiming to streamline the payment process and eliminate the need for physical loyalty cards. The app is set to introduce features that will allow for faster and more convenient payments at the checkout, including the ability to pay directly from the home screen or lock screen of a smartphone. However, it's worth noting that these features will initially be available only for iPhone users.

Twint's rapid growth and increasing popularity as a payment method in Switzerland indicate a promising future for the app. With plans to enhance convenience and efficiency for users, Twint is poised to become an even more integral part of the digital payment landscape.

Swiss Payment App Twint Experiences Huge Increase in Usage

Online Lending Market Declines in Switzerland

Explore the reasons behind the shrinking online lending market in Switzerland and its impact on borrowers and financial institutions.

Explore the reasons behind the shrinking online lending market in Switzerland and its impact on borrowers and financial institutions.

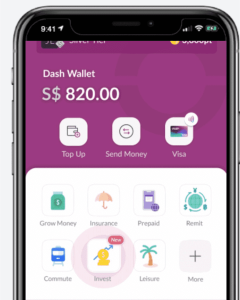

Read moreWestern Union to Acquire Dash Mobile Wallet from Singtel

Western Union has entered a conditional agreement to acquire Dash, a mobile wallet by Singtel, marking a significant move in digital finance.

Western Union has entered a conditional agreement to acquire Dash, a mobile wallet by Singtel, marking a significant move in digital finance.

Read moreDutch Paytech Platform OPP Secures UK EMI Licence

The Dutch online payment platform OPP has successfully obtained an EMI licence in the UK, enabling enhanced services and regulatory compliance.

The Dutch online payment platform OPP has successfully obtained an EMI licence in the UK, enabling enhanced services and regulatory compliance.

Read moreDigital Banks in Spain Surpass 5 Million Customers

Explore the rise of digital banks in Spain as they reach over five million customers, reshaping the banking experience and driving innovation.

Explore the rise of digital banks in Spain as they reach over five million customers, reshaping the banking experience and driving innovation.

Read moreWealthKernel Expands into Europe with CNMV License

WealthKernel, a leading digital investing provider, secures CNMV license, becoming dual-regulated in the UK and EU.

WealthKernel, a leading digital investing provider, secures CNMV license, becoming dual-regulated in the UK and EU.

Read moreQonto Expands to Austria, Belgium, Netherlands, Portugal

Qonto, the top European finance solution for SMEs, launches in four new countries, enhancing support for freelancers and businesses.

Qonto, the top European finance solution for SMEs, launches in four new countries, enhancing support for freelancers and businesses.

Read moreLopay and YouLend: £1M in Funding for UK SMEs

Lopay and YouLend join forces to provide vital financing for UK SMEs, surpassing £1 million in funding to support business growth and innovation.

Lopay and YouLend join forces to provide vital financing for UK SMEs, surpassing £1 million in funding to support business growth and innovation.

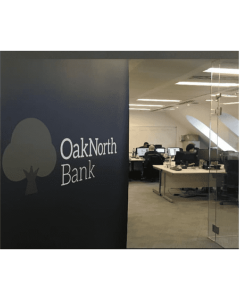

Read moreOakNorth Offers Custom Capital Call to Paloma Capital

OakNorth provides a bespoke capital call facility to Paloma Capital, enhancing their private equity real estate investment strategies.

OakNorth provides a bespoke capital call facility to Paloma Capital, enhancing their private equity real estate investment strategies.

Read moreRapid Finance Integrates with Q2’s Digital Banking Platform for Small Business Lending

Discover how Rapid Finance's new integration with Q2 enhances small business lending solutions, streamlining access to vital financial resources.

Discover how Rapid Finance\'s new integration with Q2 enhances small business lending solutions, streamlining access to vital financial resources.

Read more