WHY IS FINANCIAL FREEDOM IMPORTANT TO BUSINESSES AND INDIVIDUALS?

At the core of financial freedom is freedom: freedom to plan spending, freedom to choose your own work, to refuse jobs that do not create real value for yourself, and to build sustainable values which are reasons why is financial freedom important to businesses and individuals.

For each person, the financial freedom milestone is different depending on needs. Like happiness, financial freedom is not a destination but a journey that takes time, needs right understanding and rational action.

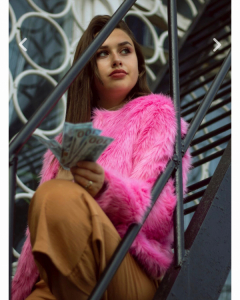

Why is financial freedom important to businesses and individuals? / ph: pexels

Why is financial freedom important to businesses and individuals? / ph: pexels

The journey to financial freedom is not only about the story of money but also the journey to change the perception to achieve freedom and happiness. Therefore, financial freedom is the act of taking care of ourselves and allowing us to spend quality time with ourselves, family, loved ones, friends and community.

Why is financial freedom important to businesses and individuals? When we achieve financial freedom, we don't need to rush to earn money to take care of basic living expenses and worry about fees that may suddenly arise. At that time, we are given the choice to do jobs that create more value than just work that makes money.

With families, at this time, parents will have more time to accompany their children in learning, playing and developing along with having money available for future education. At the same time, with aging parents, we have enough savings to spend on health problems.

With the community, when we are financially free, we have the opportunity to participate in more social works and activities to support those in need, join hands to spread interest in the community.

Below are reasons why is financial freedom important to businesses and individuals.

- Freedom to choose the job you love without worrying about salary.

- Freedom to take one (or more) annual overseas trip without worrying about the budget.

- Freedom to pay for an item you love even though it's a bit expensive.

- Freedom to respond/help others generously.

- Freedom to retire early for decades, return home to "enjoy the moment" to raise fish and grow more vegetables.

In general when you have financial freedom you have more options, the quality of each choice is also better.

Financial freedom is the state of having enough income to cover living expenses for the rest of your life without having to work or depend on others. If a person is able to generate passive income from sources other than their profession, then they have achieved financial freedom regardless of age, assets or existing salary.

In fact, the financial path of financial freedom pursuers is often better than the average seen in the other group. They have the ability to spend less, are smart and have a stable income, quickly achieve their goals in life, and easily cope with big problems. Accordingly, after being financially freedom, the quality of life is obviously improved. The family is living in adequate conditions, without having to worry about money. In addition, spiritual life will also be taken care of more. It can be said that economic independence is the freedom, without worries, without thinking, doing what you like, having enough capacity and conditions to realize your dreams which are reasons why is financial freedom important to businesses and individuals.

WHY IS FINANCIAL FREEDOM IMPORTANT TO BUSINESSES AND INDIVIDUALS?

Top 6 Money Habits of Self-Made Millionaires

Here are Top 6 Money Habits of Self-Made Millionaires that you should know.

Here are Top 6 Money Habits of Self-Made Millionaires that you should know.

Read more

10 Money Rules to face economic recession

Have you ever wondered what your financial situation will be like in a year, even just a few months? In the current context, it is unavoidable to worry about the risk of an economic recession. However, it is important that you start preparing now so that in the event of a recession in the next 6-12 months, you will be in the best position with the money amount you have.

Have you ever wondered what your financial situation will be like in a year, even just a few months? In the current context, it is unavoidable to worry about the risk of an economic recession. However, it is important that you start preparing now so that in the event of a recession in the next 6-12 months, you will be in the best position with the money amount you have.

Read more8 Money Saving Tips When Buying A House

Although housing prices have increased many times compared to the past time, you can still buy a house if you know how to save money smartly. Owning a dream home is no longer a far-away wish when we know how to make an effective financial plan. Below 8 Effective Money Saving Tips When Buying A House.

Although housing prices have increased many times compared to the past time, you can still buy a house if you know how to save money smartly. Owning a dream home is no longer a far-away wish when we know how to make an effective financial plan. Below 8 Effective Money Saving Tips When Buying A House.

Read more7 Billionaire Spending Habits help build Wealth

Fortune magazine published the results of a study showing that up to 54% of billionaires want to continue working at retirement age, and 60% of those with a net worth of more than $15 million don't even have a retire plan.

Fortune magazine published the results of a study showing that up to 54% of billionaires want to continue working at retirement age, and 60% of those with a net worth of more than $15 million don\'t even have a retire plan.

Read moreMost common habits of The World’s 4 Richest groups

Research "Rich Habits" by Tom Corley shows that there are 4 groups of wealthy people, including savers - investors, people who are eager to advance at work, high skilled professionals and the dreamers.

One of the common wealthy habits of the world's richest people is saving and investing their savings.

Research "Rich Habits" by Tom Corley shows that there are 4 groups of wealthy people, including savers - investors, people who are eager to advance at work, high skilled professionals and the dreamers.

One of the common wealthy habits of the world\'s richest people is saving and investing their savings.

Read more4 Financial mistakes young people often make

The path to financial independence is often not easy. For young people, focusing on retirement or saving for the future is often not a top priority.

But they can lose a lot of money if they make the wrong financial decisions. Here are 4 common financial mistakes that young people often make.

The path to financial independence is often not easy. For young people, focusing on retirement or saving for the future is often not a top priority.

But they can lose a lot of money if they make the wrong financial decisions. Here are 4 common financial mistakes that young people often make.

Read more4 Things to know when Getting a House Mortgage

A home loan is a suitable option if you need a large sum of money. To manage finances intelligently and avoid falling into a debt spiral, you should pay attention to a safe loan threshold, interest costs to pay, loan term,..

A home loan is a suitable option if you need a large sum of money. To manage finances intelligently and avoid falling into a debt spiral, you should pay attention to a safe loan threshold, interest costs to pay, loan term,..

Read more4 Investing Tips for Your 20s

There are investments that, as long as you are willing to put in money, time and effort, will definitely bring a worthy return. Here are 4 investments that you should make at the age of 20-30, According to Tim Denning, an Australian blogger.

There are investments that, as long as you are willing to put in money, time and effort, will definitely bring a worthy return. Here are 4 investments that you should make at the age of 20-30, According to Tim Denning, an Australian blogger.

Read moreHow to Save Money with Low Income fast: 5 Tips

If you have a low income, you need to make a concentrated effort to save money. While this is not always easy, it can be worthwhile in the long run. To help people with low income to save money, financial experts have shared 5 tips as below.

If you have a low income, you need to make a concentrated effort to save money. While this is not always easy, it can be worthwhile in the long run. To help people with low income to save money, financial experts have shared 5 tips as below.

Read more